F&O Buzzer |Torrent Power displays bullish trend, analyst recommends ‘buy’

In Q2FY24, Torrent Power recorded a 9.2 percent year-on-year increase in net profit.

Technical charts of Torrent Power indicated a bullish trend on November 10 morning, a day after the company shared its September quarter numbers after market hours. The power utility company posted a 9.2 percent year-on-year rise in net profit.

At 9:51 am, the stock was trading at Rs 780.80 on the National Stock Exchange, up 2.72 percent from the previous close.

Torrent power monthly chart | Source: Emkay Global

Torrent power monthly chart | Source: Emkay Global

“The stock has formed a strong base for 11 years, from 2009 to 2021, followed by a breakout. The strong rise has been digested by time-wise correction for two years. The stock has given a fresh breakout, indicating a bullish continuation sign,” Kapil Shah, a technical analyst at Emkay Global, said.

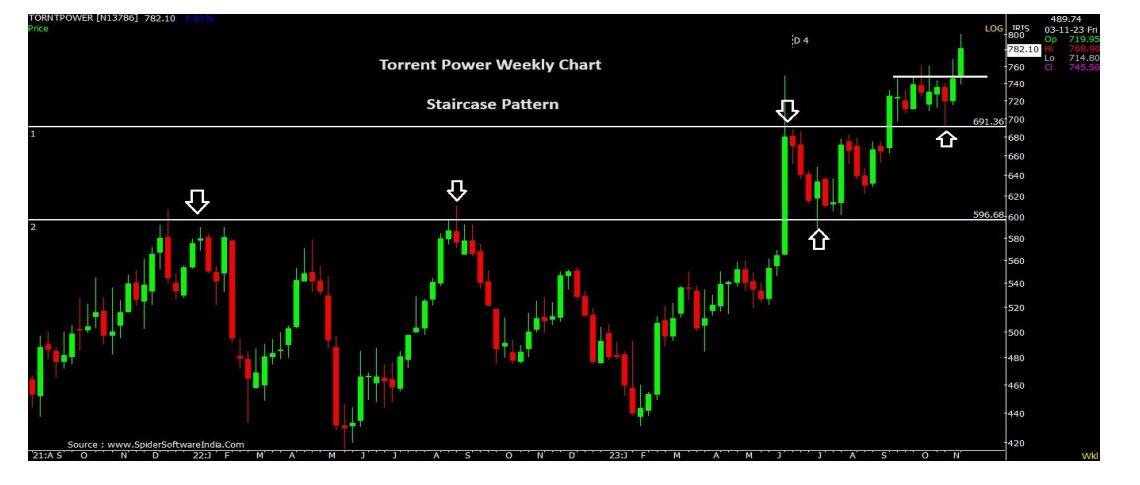

Torrent power weekly chart | Source: Emkay Global

Torrent power weekly chart | Source: Emkay Global

“The stock is forming a staircase pattern wherein the earlier resistance level turns out to be a support level. Technically, this is known as role reversal, and it is considered a bullish continuation sign,” Shah said of Torrent Power’s weekly chart.

Torrent power daily chart | Source: Emkay Global

Torrent power daily chart | Source: Emkay Global

Analysing the daily chart, Shah said, “Every intermediate decline in stocks finds its feet at the 54-period moving average. The 45-degree rising slope of the moving average shows a decent positive trend.”

Torrent power daily chart: intensity of fall | Source: Emkay Global

Torrent power daily chart: intensity of fall | Source: Emkay Global

The stock exhibits a pattern in correction, a decline of around 8 percent followed by an upward movement. The recent rise is occurring after an 8 percent fall, Shah said.

He recommended accumulating the stock in the range of Rs 780-765 with a stop loss of Rs 735 on a closing basis. The stock has the potential to rise to Rs 860.

Fundamental highlights

In Q2FY24, Torrent Power recorded a 9.2 percent year-on-year increase in net profit at Rs 526 crore. Revenue was up 3.8 percent at Rs 6,960.9 crore. EBITDA for the quarter rose 4.9 percent to Rs 1,221.4 crore for, up from Rs 1,164.2 crore in the year-ago fiscal.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decision.