F&O Manual | Sideways momentum in Nifty, straddles pile up in 19,350-19,450 range

Sensex was down 0.17 percent at 64,722.79, and Nifty was down 0.14 percent at 19,367.60

The equity benchmarks traded flat for the third day on November 10, with range-bound activity in both Nifty and Bank Nifty. Adani Ports, ONGC, HDFC Life, Tech Mahindra and NTPC were among the top gainers on the Nifty, while losers were M&M, Hero MotoCorp, Asian Paints, Bajaj Auto and Titan Company.

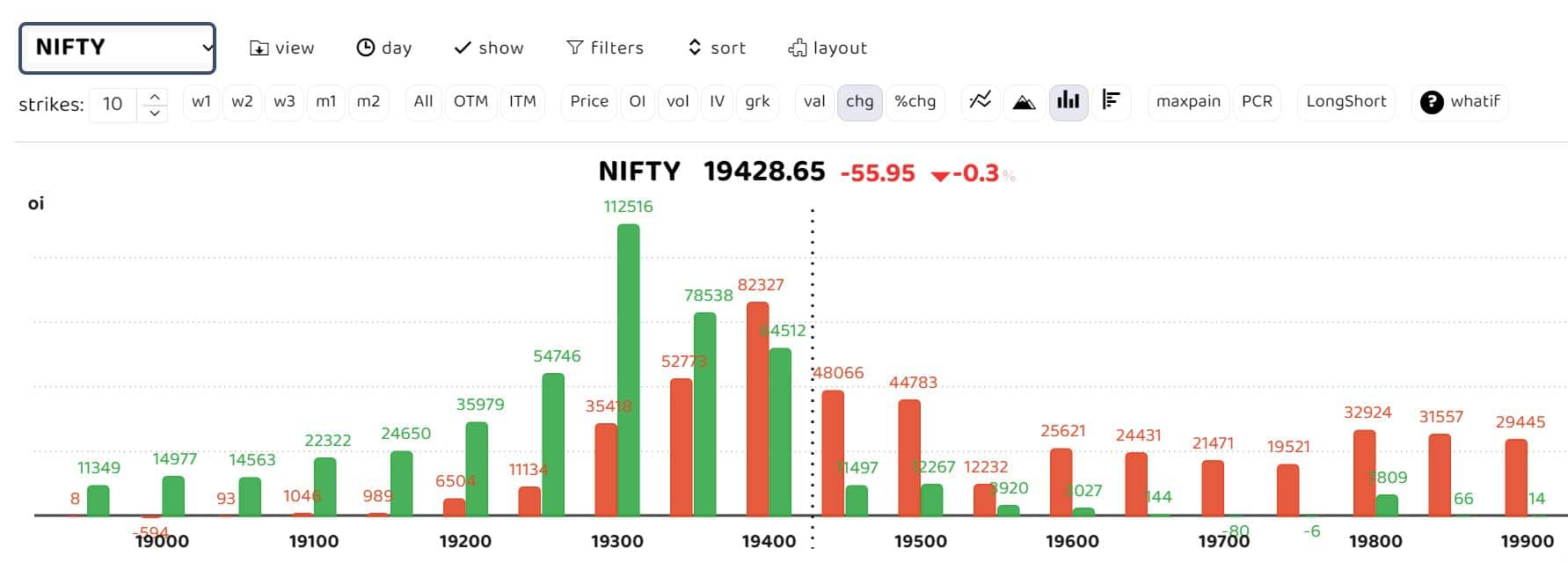

The options data suggest sideways momentum with key straddle positions at 19,400 and 19,350 levels.

According to Sudeep Shah, the head of technical and derivatives at SBI Securities, “Post a negative opening below the 20-EMA zone, the next important support zone would be the 19,230-19,250 zone, which is the 38.2 percent Fibonacci retracement of the rebound from 18,837 to 19,450.”

Crucial resistance is developing around the 19,420-19,440 zone, above which the index can witness an upmove to 19,525-19,540, representing the 50 percent retracement of the entire downswing from 20,222 to 18,837, he said.

Only if the Nifty surpasses and sustains above 19,550, a fresh rally up to 19,730-19,780 is possible . Conversely, below 19,230, the index can slip to 19,160, followed by 19,110, Shah said.

Bank Nifty

In the last three sessions, the Bank Nifty has faced resistance in the 43,850-43,900 range, marking a pivotal support level below which a breakdown occurred in October.

“Above 43,900, we anticipate a further short-covering rally towards the 44,200 zone. This level signifies the 50 percent retracement of the entire downswing from 46,300 to 42,105,” Shah said.

The immediate support for Bank Nifty is likely 43,250-43,300, where the 38.2 percent retracement of the current rebound from 42,105 to 43,876 is positioned. If Bank Nifty falls below 43,250, it can retest the 43,000-42,900 zone, he said.

Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox, said, “Despite the market opening on a negative note, Bank Nifty is demonstrating a positive recovery, with 43,600 PE and 43,500 PE witnessing robust writing post the early hour session.”

A sustained move over 43,600 would trigger more short covering, propelling the index towards 43,800. “The PCR stands at 1.03, implying volatile activity in the derivatives trading,” Bagkar added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.