F&O | Expiry trading strategies for Fin Nifty options today

.

The Fin Nifty index opened marginally lower and is trading in a narrow range. In the Muharat trading session on November 12, it gave a range breakout on the daily chart and managed to close above it which, according to experts, has bullish implications.

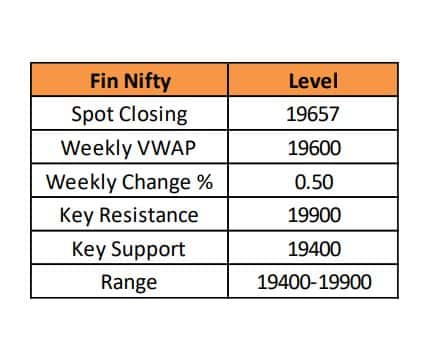

Weekly Change: The Fin Nifty is trading up by 0.50 percent at 19,657 on a weekly expiry basis (from Tuesday’s close to Sunday’s close). The Fin Nifty VWAP of the week is near the 19,600 levels, and it is trading around 50 points above the same, indicating an overall positive bias for the expiry day.

At 11:41am, the Fin Nifty index was trading 0.45 percent lower at Rs 19,568 on the National Stock Exchange.

.

.

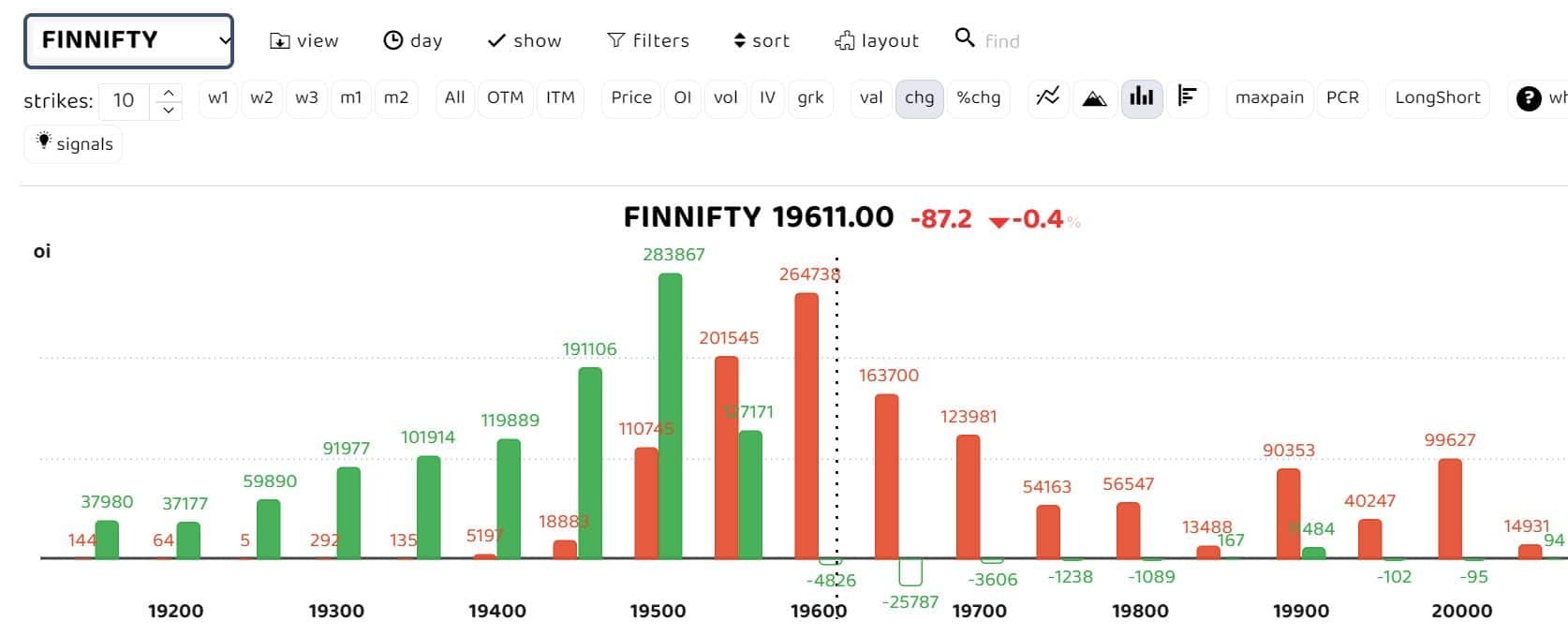

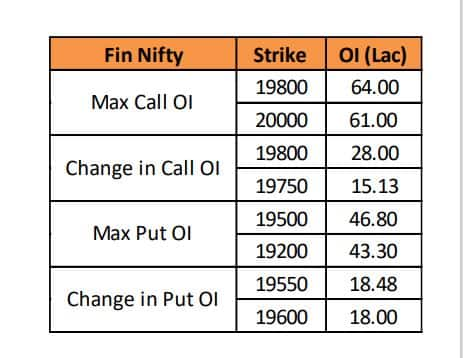

Option Data highlights writing in 19,600 CE and 19,550 CE, with 19,600 CE witnessing the highest OI.

“It formed a small-bodied candle on the daily and a bullish candle on the weekly scale, implying that bulls have the upper hand in the market. Now it needs to hold above 19,500 zones to extend the momentum towards 19,780, then 19,900 zones, while on the downside, support is seen at 19,500, then 19,400 levels,” Motilal Oswal Financial Services said.

“The current scenario negates a sharp upside in Fin Nifty as 19,600 continues to remain a key hurdle for today. On the downside, the 19,550 PE is acting as a support base, standing as the second-highest in the OI activity. Thus, until 19,600 is taken out with substantial OI, we expect Fin Nifty to expire within the range of 19,600 to 19,550 levels,” Avdhut Bagkar, derivatives and technical analyst at Stoxbox, stated.

“A sustained move over 19,600 could propel the 19,550 PE to address more write-offs, leading the 19,600 CE to see attractive opportunities,” added Bagkar.

Trading Range: Expected wider trading range: 19,400/19,500 to 19,780/19,900 zones.

Option Strategy: Option traders can initiate a Bull Call Spread (Buy 19,550 CE and Sell 19,600 CE) to play the upside move.

Option Writing: Option writers are suggested to write 19,800 Call and 19,450 Put in pairs with double the Stop loss.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.