F&O Manual | Indices face selling pressure, Nifty finds support at 19,400 points

: Except Nifty Metal and Nifty Energy, all sectors are trading in red.

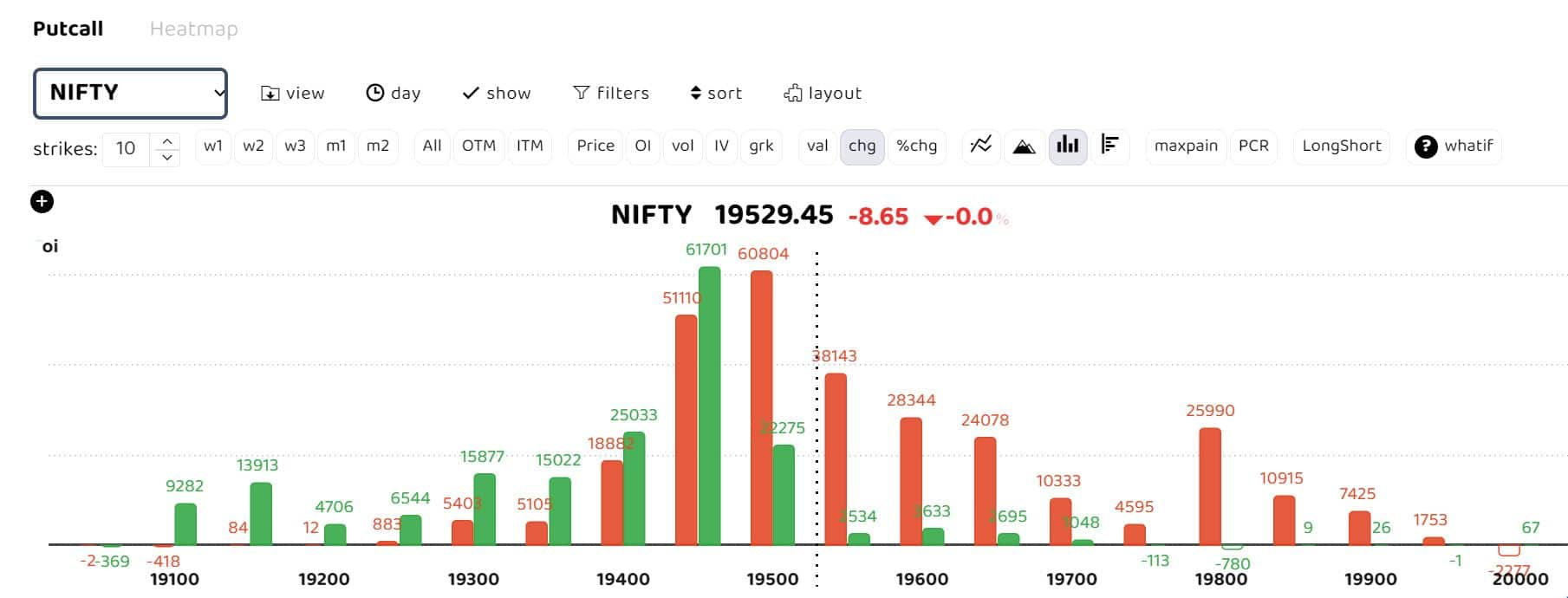

The benchmark Indian indices opened marginally lower on November 13 amid mixed global cues. A tussle between Nifty options call and put writers can be seen at the 19,450 level. As per analysts, the Nifty is to extend the gains, whereas lower levels of 19,400 are likely to act as immediate support in the holiday-shortened week.

“The good beginning for Samvat 2080 with a 100-point rally in Nifty is indicative of the bullish sentiment in the market. The market is climbing walls of worries posed by two wars and a slowing global economy. This happens in a bull market. The investment strategy should be based on this basic understanding of the market behaviour. An important feature of the market is that it is up-trending despite sustained FPI selling. This means that even if FPIs continue to sell, the market will remain resilient if the selling is in small quantities. Of course, big selling by FPIs will negatively impact markets,” Dr VK Vijayakumar, chief investment strategist at Geojit Financial Services, said.

Selling was observed in the auto, IT, and oil and gas sectors, while buying was witnessed in the metal, capital goods, and power sectors. BSE Midcap and Smallcap indices settled largely flat.

Options data suggests a tussle between call and put writers at the 19,450 strike. “The Nifty extended its recovery from October lows last week and moved towards the 19,500 levels. Continued selling pressure among banking and technology heavyweights restricted the gains in Nifty as FPI remained net negative throughout the week. Going ahead, we expect Nifty to extend the gains, whereas lower levels of 19,400 are likely to act as immediate support in the shortened week,” Raj Deepak Singh, Head Derivatives Research at ICICI Securities, said.

“From the data perspective, despite the up-move and positive global cues, FIIs remained aggressive net shorts in index futures, and only marginal covering was experienced during the week. The net shorts from FIIs are still significantly higher, over 1.5 lakh contracts. We were expecting short-covering considering such aggressive short positions and expect the Nifty to move towards the 19,600 levels in the coming sessions. However, they have been net sellers in the cash segment throughout the series so far. Hence, failure to sustain 19,200 may put pressure once again,” Singh said.

“Aggressive writing is visible in both Call and Put ATM strikes from 19,300 to 19,500 for the coming weekly expiry. Considering a shortened trading week, a narrow range-bound move cannot be ruled out in the headline indices.”

Bank Nifty

“We expect that recovery may find momentum if Bank Nifty is able to move above 44,000 levels while immediate support can be expected near 43,500 levels. Open interest in Bank Nifty has risen once again last week as the Banking index failed to move beyond its major hurdle of 44,000 levels. Moreover, due to continued range-bound move below 44,000 levels, Call writing at the 44,000 strike was evident for the coming weekly settlement. However, aggressive Put writing is visible at ATM 43,500 and 43,600 Put strikes. Thus, we expect Bank Nifty to hold recovery at 43,500 and find fresh momentum towards 44,800 levels amid short covering,” ICICI Securities said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1383931917-16f7e81b08344140b4041462de226112.jpg)