Singapore to pilot use of wholesale central bank digital currencies in 2024

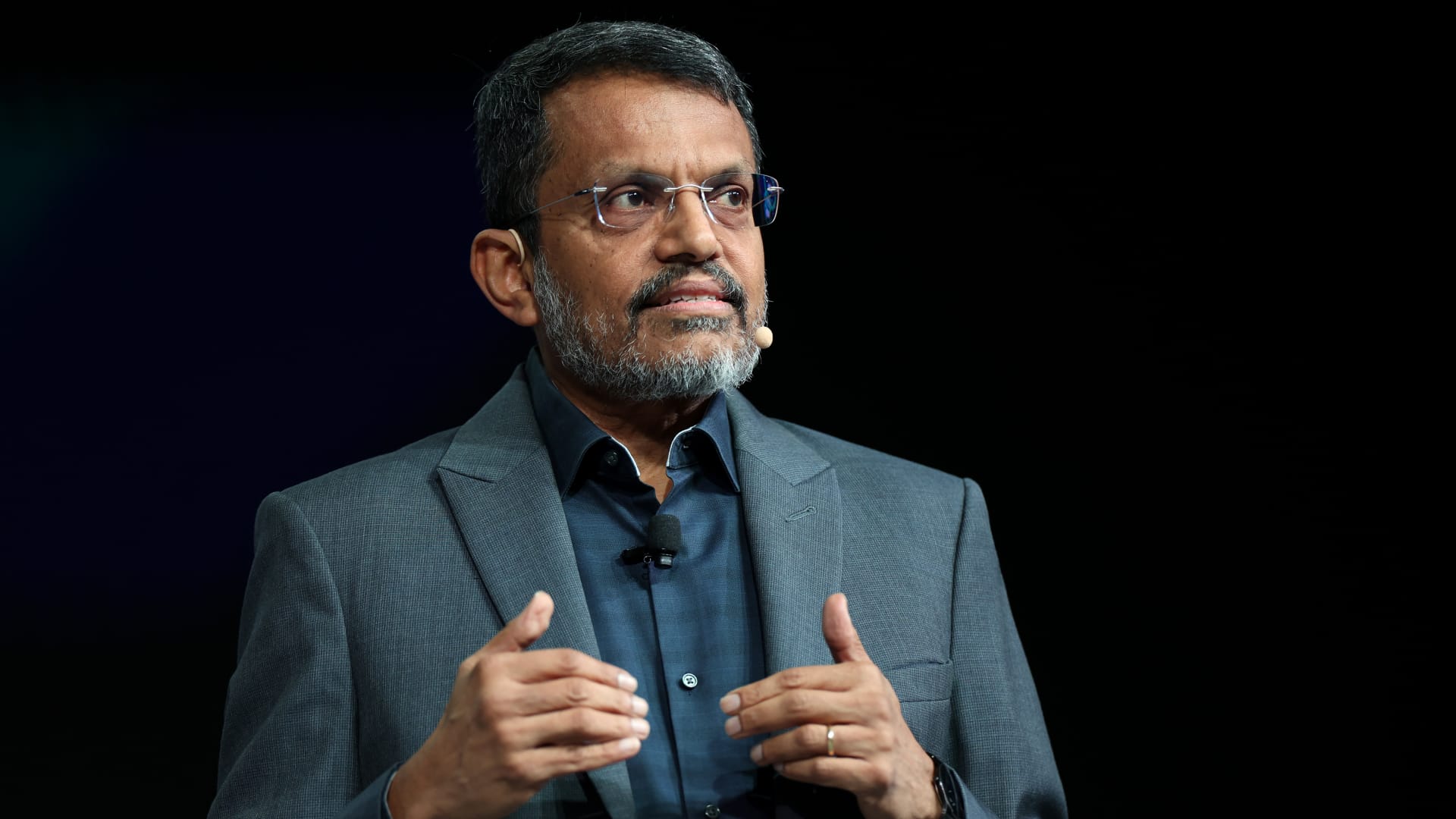

Ravi Menon, managing director of Monetary Authority of Singapore, speaks during the Singapore FinTech Festival in Singapore, on Thursday, Nov. 16, 2023. The festival runs through Nov. 17.

Lionel Ng | Bloomberg | Getty Images

SINGAPORE — Come 2024, Singapore will pilot the live issuance and use of wholesale central bank digital currencies, said Ravi Menon, managing director of the Monetary Authority of Singapore.

“We will take our experiments a step further next year,” said Menon at Singapore FinTech Festival 2023 on Thursday, without specifying more details on the timeframe.

“I’m pleased to announce that MAS will pilot the live issuance of wholesale CBDCs to instantaneously support payments across commercial banks here,” Menon said. MAS is the city-state’s central bank and financial regulator.

Wholesale CBDC is a digital currency issued by a central bank, that’s used exclusively by central banks, commercial banks or other financial institutions to settle large-value interbank transactions. It’s unlike retail CBDCs which cater to individuals and businesses, facilitating everyday transactions.

“Since 2016, the MAS has conducted many experiments with other central banks and the financial industry to explore the use of wholesale CBDCs on distributed ledgers to facilitate real time cross border payments and settlements,” said Menon, referring to the database spread across a network that is accessible from several geographical locations.

One such pilot project is Project Ubin, which was started in 2016 to explore the use of blockchain and digital ledger technology for the clearing and settlement of payments and securities.

Project Ubin was successfully completed in 2021 after five phases of experimentation. Some of the partners included Singapore’s largest bank DBS and sovereign wealth fund Temasek.

MAS announced Ubin+ in November last year to advance cross-border connectivity with wholesale CBDCs through collaborations with international partners.

During the pilot, Singapore’s central bank will partner with local banks to test the use of wholesale CBDCs to facilitate domestic payments, said Menon.

Banks will issue tokenized bank liabilities in the form of claims in balance sheets. Retail customers can then use the tokenized bank liabilities in transactions with merchants, who will then credit these bank liabilities with their respective banks. Tokenization refers to the process of issuing a digital form of an asset on a blockchain.

The CBDC will then be automatically transferred to the merchant as a form of payment during the transaction.

“So clearing and settlement occurs in a single step on the same infrastructure, unlike the current system in which clearing and settlement take place on different systems and settlement occurs with a lag,” said Menon.

On Wednesday, the International Monetary Fund’s managing director urged the public sector to keep preparing to deploy CBDCs and related payment platforms in the future.

“We have not yet reached land. There is so much more space for innovation and so much uncertainty over use-cases,” said Kristalina Georgieva.

Menon is set to retire from public service and step down as managing director of MAS on Dec. 31 since being appointed to the position in 2011. He will be succeeded by Chia Der Jiun who previously spent 18 years at MAS.