Howzzat! Nifty sticks to script after India’s World Cup heartbreak

The equity market benchmark has periodically transformed into a barometer to gauge the mood of the nation, at least when it comes to the unofficial religion of the country

For those unaccustomed to the ways of love, this is what heartbreak feels like. As an entire nation woke up to a mournful Monday, trying hard to suppress the memories of last night’s wretched loss in the World Cup finals, a familiar script played out on Dalal Street.

The NSE Nifty, despite valiant efforts at the start of the session to keep its head above water, closed 0.19 percent lower at 19,694.

This was not an isolated incident.

The equity market benchmark has periodically transformed into a barometer to gauge the mood of the nation, at least when it comes to the unofficial religion of the country.

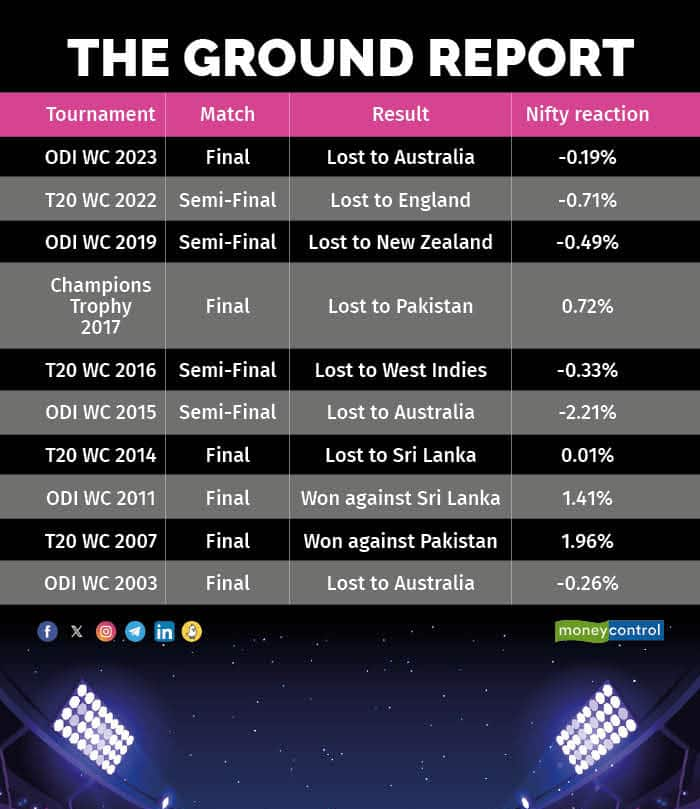

The following table shows the curious interrelationship between the performance of the Indian men’s cricket team in ICC tournaments and trend in the equity markets.

Almost every time India has crashed out of a major ICC competition, Nifty has closed in the red in the next session.

Not only that, sometimes the market has even purportedly priced in the cricket team’s loss in a knockout match.

Case in point – the Twenty20 World Cup semi-final on November 10, 2022.

The match against England started at 1.30 pm, but within an hour, it was clear the Indian batting line-up was struggling to get things going. The Nifty closed 0.71 percent lower that day, perhaps reflecting the collective anguish over the inadequate score.

Later that evening, England cantered over the finish line without losing a single wicket.

An even more curious case was the ODI World Cup semi-final of 2019.

The rain-interrupted match was played over two days. The market benchmark closed lower on both the sessions.

In fact, in the past two decades, there have been only two instances when the Nifty managed to shrug off India’s loss in an ICC tournament – the Champions Trophy final of 2017 and the T20 World Cup final of 2014.

So is there a strong statistical correlation, or are we just reading too much into coincidences?

“Well, the market can have a knee-jerk sentiment-driven reaction post a disappointing loss. Traders’ sentiment is low, most are digesting the match results and many are also travelling the day after a major match, which often leads to low volumes and sideways movement in the market,” Rajesh Palviya, Head of Technical & Derivative Research at Axis Securities, told Moneycontrol.

“However, definitely there’s no major long-term impact and we can see the market getting back to its normal rhythm from the next session,” he added.

While that may be true, for most cricket fans, the road to healing is a long and difficult one.

“Oh my mind is not on the screen right now. We win or lose in the market every day, but a World Cup loss stings as it is a once-in-four-years kind of event,” a Mumbai-based trader said, requesting anonymity.

This, after all, is what heartbreak feels like.