F&O Manual | Nifty trades in positive territory, straddles pile up at 19,800 strike

From the Large-caps, Reliance, Bajaj Auto, Eicher Motors & Hero-Moto showed signs of strong momentum on the upside.

The equity markets opened on a positive note, buoyed by favourable global indicators. The US Dollar index found stability at a 12-week low of 103.70, and the US 10-year bond yields remained subdued at 4.40 percent. These developments bode well for risk-on assets, particularly in global and Indian equity markets.

The BSE MidCap and SmallCap indices were trading in the green around 10am on November 24. Among sectors, the pharma index was up 1 percent, while selling was seen in IT and oil and gas stocks.

At 10am, the Sensex was down 50.34 points or 0.08 percent at 65,967.47, and the Nifty was down 8.70 points or 0.04 percent at 19,793.30. About 1,704 shares advanced, 1,143 declined, and 122 traded unchanged.

Nifty Levels

The index once again experienced a price rejection in the 19,850-19,900 zone on November 23, which is a gap zone that the Nifty had created in September. Surpassing this zone is crucial for instilling confidence in investor sentiment.

Despite the resistance zone not being breached, the India VIX has dropped below the 11.50 levels, indicating that options participants are not panicking.

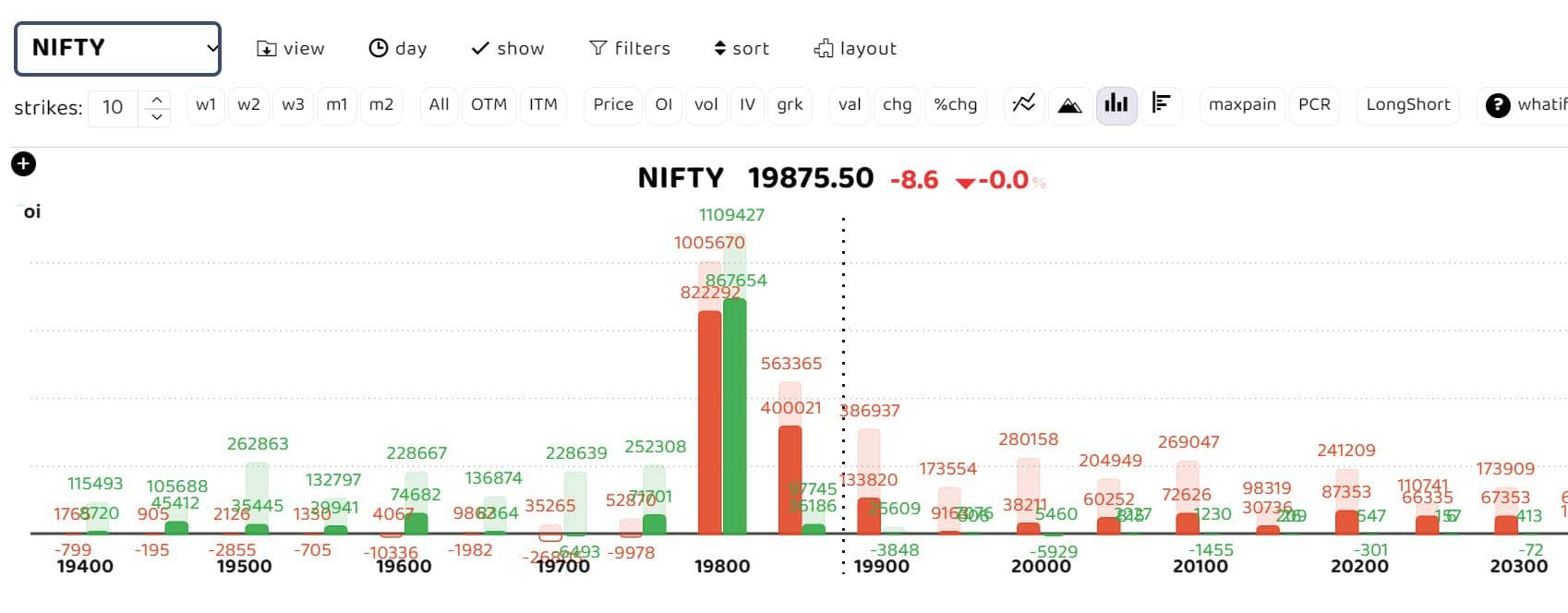

Options data reveals a key straddle position forming at the 19,800 strike. Significant call writing is observed at 20,000 and 19,900 strikes, while notable open interest additions are seen on the puts front at 19,800 and 19,700.

“Above 19,900, the index could sustain its rebound rally up to 20,050-20,100. On the downside for the day, key support is seen at the 19,705-19,720 zone, with positional supports deeper around 19,575-19,600, where the 20-day EMA is positioned. The overall range for the day is anticipated to be 19,735-19,750 on the downside and 19,870-19,900 on the upside,” Sudeep Shah, head of technical and derivative research at SBI Securities, said.

Bank Nifty Levels

Turning to Bank Nifty, Shah said that it displayed a shift in momentum by outperforming Nifty and the broader market after four sessions. The daily ADX is at its lowest point in over four months, and the 100-day EMA has flattened, signalling a lack of a strong trend currently. The contracting bollinger bands suggest diminishing volatility.

“Crucial support for Bank Nifty rests at 43,350, where the 200-DMA is located. Resistance on the upside is expected at the 43,700 zone, where the 20 Day EMA is positioned. A move above 43,700 could lead to a recovery in Bank Nifty up to 43,890-44,050. Conversely, a drop below 43,350 could result in a correction down to 43,080-43,000,” he noted.

Among individual stocks in the large-cap segment, Reliance Industries Limited (RIL), Bajaj Auto Limited, Eicher Motors Limited, and Hero MotoCorp Limited displayed indications of robust upward momentum. In the broader market, bullish setups were identified in Bharat Petroleum Corporation (BPCL), Bharti Airtel (BHARTIARTL), Deepak Nitrite (DEEPAKNTR), Oberoi Realty Limited (OBEROIRLTY), Cummins India (CUMMINSIND), Jubilant Foodworks (JUBLFOOD), Praj Industries (PRAJIND), Central Depository Services (CDSL), and Bharat Heavy Electricals (BHEL).

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.