More than 40 smallcaps give double digit gain in volatile week

Broader indices outperformed the main indices with BSE Mid-cap and BSE Small-cap indices added 0.7 percent and 0.5 percent, respectively.

The Indian market ended the volatile week with marginal gains and extended the winning run for the fourth consecutive week after minutes from Fed revealed that the interest rates are likely to remain high, rising crude oil imports by India, while falling bond yield and crude oil prices gave some respite.

In this week, BSE Sensex gained 0.26 percent or 175.31 points to ends at 65,970.04, while Nifty50 rose 62.9 points or 0.31 percent to close at 19,794.7.

Broader indices outperformed the main indices with BSE Mid-cap and BSE Small-cap indices added 0.7 percent and 0.5 percent, respectively. BSE Large-cap index ended on a flat note.

“Domestic indices traded within a range throughout the week with a positive bias. The Fed reserve adopted a cautious stance and the muted trend in European and German markets was also echoed in domestic markets. Declining inflation and recent cooling job data in the US, along with easing US bond yields, attracted foreign funds to the emerging market,” said Vinod Nair, Head of Research at Geojit Financial Services.

“The broader Indian market experienced some profit booking as investor attention shifted to the primary market, marked by a set of IPOs scheduled for the week. Sectors such as consumer durables and realty took the lead, driven by a strong rebound in festive demand. However, the IT sector showed subdued performance in response to weak global data. Despite the RBI’s scrutiny of unsecured lending by NBFCs, the banking index demonstrated resilience this week,” he added.

Among sectors, Nifty Realty index rose 1.5 percent, Nifty Metal, Nifty Oil & Gas, Pharma indices up 1 percent each. On the other hand, Nifty PSU Bank index down 1.7 percent and Nifty Information Technology index down 0.4 percent.

Domestic institutional investors (DIIs) continued their buying as they bought equities worth Rs 2,112.38 crore in this week, on the other hand Foreign institutional investors (FIIs) also bought equities worth of Rs 1,472.87 crore. In the month of November so far, FIIs sold equities worth Rs 5,101.72 crore, while DIIs bought equities worth Rs 9,814.84 crore.

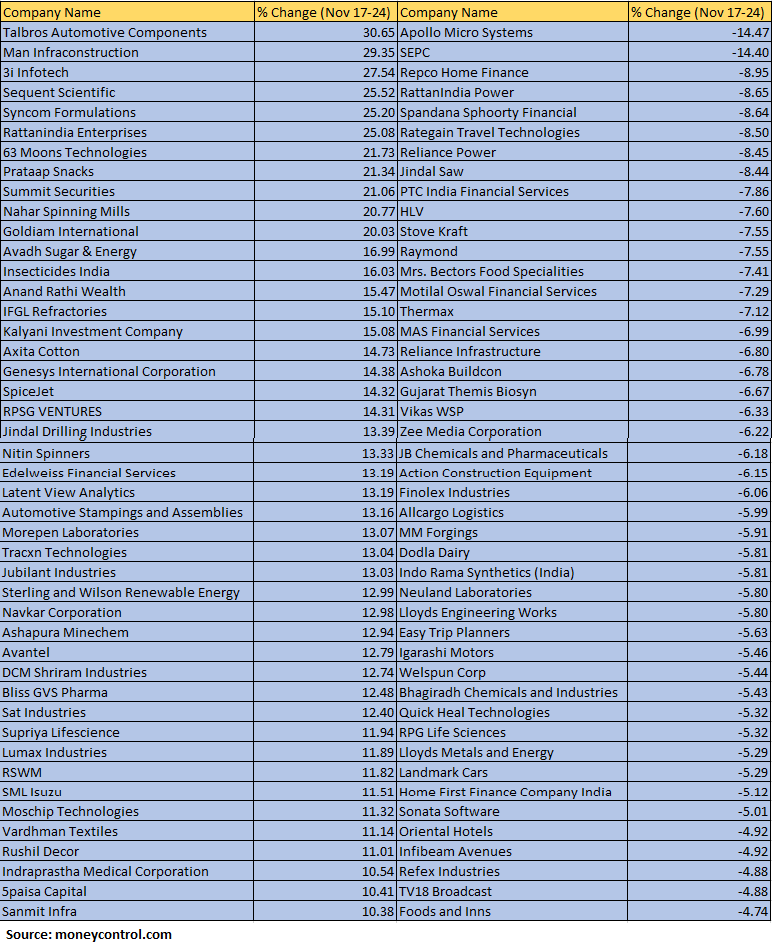

The BSE Small-cap index added 0.5 percent with Talbros Automotive Components, Man Infraconstruction, 3i Infotech, Sequent Scientific, Syncom Formulations, Rattanindia Enterprises, 63 Moons Technologies, Prataap Snacks, Summit Securities, Nahar Spinning Mills and Goldiam International adding more than 20 percent.

On the other hand, Apollo Micro Systems, SEPC, Repco Home Finance, RattanIndia Power, Spandana Sphoorty Financial, Rategain Travel Technologies, Reliance Power and Jindal Saw lost 8-14 percent.

Where is Nifty50 headed?

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty has encountered difficulty surpassing the resistance range of 19850-19900. On the downside, 19700 has held as a near-term support level. As long as there’s no breakout, the index is expected to continue moving sideways.

A decline below 19700 could potentially trigger a market correction. Conversely, a clear move above 19900 might prompt a significant rally, potentially driving the index towards a new all-time high.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

On the daily charts, we can observe that the consolidation between 19620 – 19875 has been going on for the past seven trading sessions. The daily momentum indicator has a positive crossover and thus this consolidation should be used as a buying opportunity.

On the downside, until the zone of 19630 – 19600 is held, we can expect the upside momentum to resume over the next few trading sessions which can take the Nifty towards 19900 – 19930 zone.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.