Dalal Street Week Ahead | Exit polls, manufacturing PMI, US, India GDP among 10 factors to watch

Market to focus on Exit polls, manufacturing PMI, Powell speech, US, India GDP data

The market had a lacklustre week ended November 24 due to the absence of any major global and domestic cues, yet ended higher for the fourth consecutive week. The coming truncated week (Monday being a market holiday on account of Guru Nanak Jayanti) will be full of news including exit polls after five State elections, September FY24 quarter economic growth, and second estimates for Q3-CY23 US GDP numbers, which seem to be eagerly awaited by the participants.

Overall, the market is likely to get into some momentum after the rangebound trade seen in the previous seven trading sessions, by taking cues from several global and domestic factors, though there may be a bit of volatility due to the expiry of monthly derivative contracts, experts said.

The Nifty50 climbed 63 points to 19,795, and the BSE Sensex rose 175 points to 65,970, supported by auto, banking & financial services, energy, metal and pharma stocks.

The broader markets had a mixed trend as the Nifty Midcap 100 index advanced 0.6 percent and Nifty Smallcap 100 index was down 0.4 percent.

“Next week we expect some momentum in market to return as investors will take cues from various economic data including GDP numbers for US, & India,” Siddhartha Khemka, Head – Retail Research at Motilal Oswal Financial Services said.

Apart from exit polls and macro numbers, Santosh Meena, Head of Research at Swastika Investmart said the market participants would closely monitor movements in crude oil prices, US bond yields, and the dollar index, too.

The market will be shut on November 27 for Gurunanak Jayanti.

Here are 10 key factors to watch next week:

Exit Polls

One of the most important factors on the domestic front will be the much-awaited exit poll predictions for five states namely Mizoram, Madhya Pradesh, Chhattisgarh, Rajasthan and Telangana on November 30, which will be released in the evening on November 30 after the voting in Telangana. The voting in the other four states was completed last week.

This is generally an immediate poll taken from voters after their voting at polling stations.

Also read: T+0 settlement by March 2024, instantaneous settlement in 2025, both to co exist: SEBI Chief

Q3CY23 GDP Growth (2nd Estimates), Powell Speech

Globally, investors will keep an eye on the second estimates for the third quarter US GDP growth releasing on November 29, which is an important data for the Federal Reserve, apart from inflation and jobs numbers. As per the advance estimates (released in October), the US economy grew at a 4.9 percent annual pace for the third quarter, against the actual growth of 2.1 percent recorded for the second quarter of CY23.

Also, the next estimates for real consumer spending will be announced on the same day.

Meanwhile, the participants will also take cues from the speech by Federal Reserve Chair Jerome Powell on December 1, while other Fed officials namely Waller, Goolsbee, Bowman, Barr, Mester, and Williams will also deliver speeches next week. In the minutes of the last policy meeting released on November 22, Fed officials did not give any indication about rate cuts, but they still looked worried about inflation which is still above the 2 percent target set by the Federal Open Market Committee, while the markets seem to be convinced that there may not be any hike henceforth.

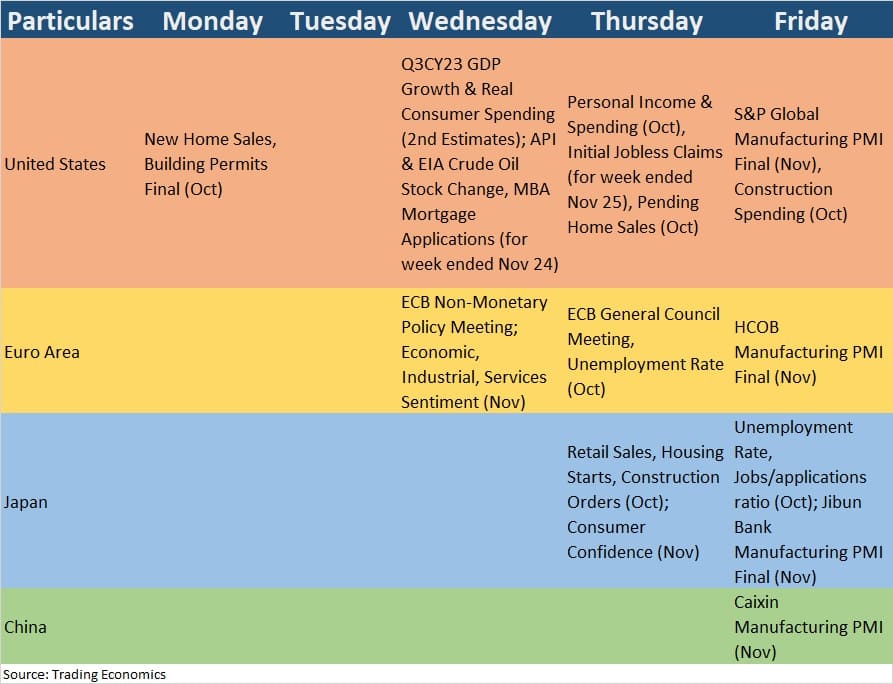

Global Economic Data

The manufacturing PMI numbers for November by several countries including the top three global economies and Europe will also be released next week. Apart from that, US new home sales, building permits, crude oil inventories, and pending home sales data will also be watched.

Q2FY24 GDP Growth

On the domestic front, the participants will focus on the economic growth numbers for July-September quarter scheduled to be released on November 30, which economists expect around 6.8-7.0 percent. This is lower than the 7.8 percent growth recorded in April-June quarter of FY24.

Barclays India estimates that India’s GDP in Q2FY24 expanded by 6.8 percent YoY. “Underlying growth trends continue to look robust in India, with activity underpinned by domestic consumption, high levels of state-led capex, and strong growth in the utilities sectors.”

According to SBI Research, the growth rate may be around 7 percent for the quarter.

Also read: SEBI cuts minimum issue size on Social Stock Exchanges by 50% to Rs 50 lakh

Apart from this, fiscal deficit and infrastructure output numbers for October will also be announced on November 30, while bank loan & deposit growth for fortnight ended November 17, and foreign exchange reserves for week ended November 24 will be released on December 1.

S&P Global Manufacturing PMI will also be released on December 1.

Auto Sales

The participants will also focus on the monthly auto sales for November scheduled from December 1, with particular attention on Diwali sales figures. The Nifty Auto index was one of the biggest gainers among sectors, rising 7 percent in the current month, outperforming the benchmark Nifty50 which gained 3.5 percent during the month.

The focus will also be on FII flow as foreign institutional buyers turned net buyers after several weeks. The indication that Federal Reserve may be done with the rate hikes after further all in US inflation and a fall in US bond yields from 5 percent to around 4.4 percent seem to be key reasons behind the FII inflow.

They have net bought Rs 1,473 crore worth of shares in the cash segment, cutting down the net monthly outflow to around Rs 5,100 crore now, from Rs 6,500 crore in previous week, while domestic institutional investors’ buying was higher (at Rs 2,112 crore) than FII inflow, taking monthly inflow to Rs 9,800 crore.

The primary market will remain in action next week too, with key focus on the five listings – Tata Technologies, IREDA, Fedbank Financial Services, Flair Writing Industries, and Gandhar Oil Refinery – in the mainboard segment, while there will be no new public issue launch in the segment. All will be listing in T+3 timeline after closing their issues. IREDA is likely to list shares on November 29, and other four may be on November 30. These are tentative dates.

Also read: Here is how to check share allotment status, know listing date, grey market premium

Meanwhile, the action will also be seen in the SME segment with two public issues (by Deepak Chemtex, and AMIC Forging) will be opening on November 29, and other three (Net Avenue Technologies, Graphisads, and Marinetrans India) on November 30, while Swashthik Plascon will be closing on November 29.

Further, Arrowhead Seperation Engineering will be listing on the BSE SME on November 28 and Rocking Deals Circular Economy on the NSE Emerge on November 30.

Technical View

The Nifty50 maintained upward journey for fourth straight week with making higher lows for four days in a row and faced strong hurdle at 19,850-19,900 area on the higher side, while taking strong support at 19,600, which coincides with the 20-day EMA. Further, it sustained above 20-week EMA (exponential moving average – 19,408) for three weeks in a row. Hence, if it decisively breaks the hurdle on the higher side, then 20,000-20,200 can be the possibility with support at 19,700, experts said.

The 20-day EMA crossed above the 50-day EMA (19,533) in previous week and remained above the same last week, which is a positive sign, according to some experts.

“A decisive move above 19,850-19,900 levels is expected to open a sharp upside towards new all-time highs. Any weakness below 19,700 could find support at around 19,600 levels,” Arvinder Singh Nanda, Senior Vice President of Master Capital Services said.

He feels the sentiment is anticipated to stay sideways as long as it holds above 19,700. However, a drop below 19,600 might exert downward pressure on the Nifty, he said.

F&O Cues

Options data indicated that 19,900-20,000 is expected to be key resistance area for the Nifty50 now, with immediate support at 19,700 levels.

As per the monthly options data front, the maximum Call open interest was seen at 19,900 strike, followed by 20,000 & 19,800 strikes, with meaningful Call writing at 19,800 strike, then 19,900 & 20,000 strikes, while on the Put side, 19,800 strike witnessed the maximum open interest, followed by 19,000 & 19,500 strikes, with Put writing at 19,000 strike, then 19,400 strike and 19,600 strike.

“Foreign institutional investors’ (FIIs) short exposure in index futures remains elevated at 77 percent, and the put-call ratio (PCR) stands at 0.99, suggesting the potential for a short covering rally,” Santosh Meena of Swastika Investmart said.

The fear index, India VIX corrected by 4.2 percent during the week to 11.33 levels, after rising in the previous two weeks, also supported bulls.

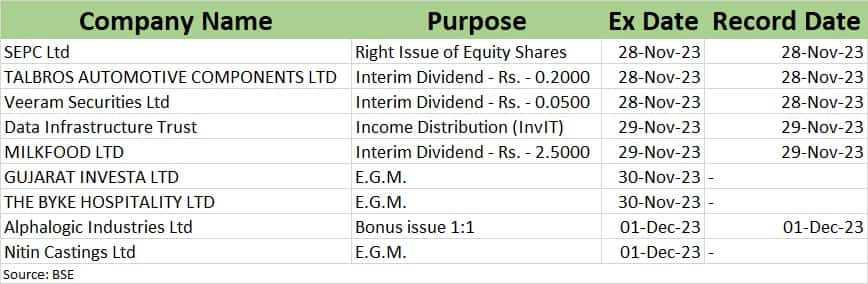

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.