F&O Manual | Bulls stage a year-end comeback with short covering and long rollovers strengthening bullish sentiment

At 12 pm, the Sensex was up 525.21 points or 0.78 percent at 67,513.65, and the Nifty was up 148.60 points or 0.74 percent at 20,281.80

The indices are trading positively as bulls return to uplift sentiments towards the year-end. Notably, sectors such as bank capital goods, FMCG, power, and realty are experiencing gains of 1-2 percent. The BSE Midcap and Smallcap indices are both up by 0.5 percent. Active shares on the NSE include Tata Tech, Power Finance, REC, Reliance Industries, and HDFC Bank.

At 12 pm, the Sensex was up 525.21 points or 0.78 percent at 67,513.65, and the Nifty was up 148.60 points or 0.74 percent at 20,281.80. About 2081 shares advanced, 1052 shares declined, and 106 shares unchanged.

Nifty rollover data and outlook

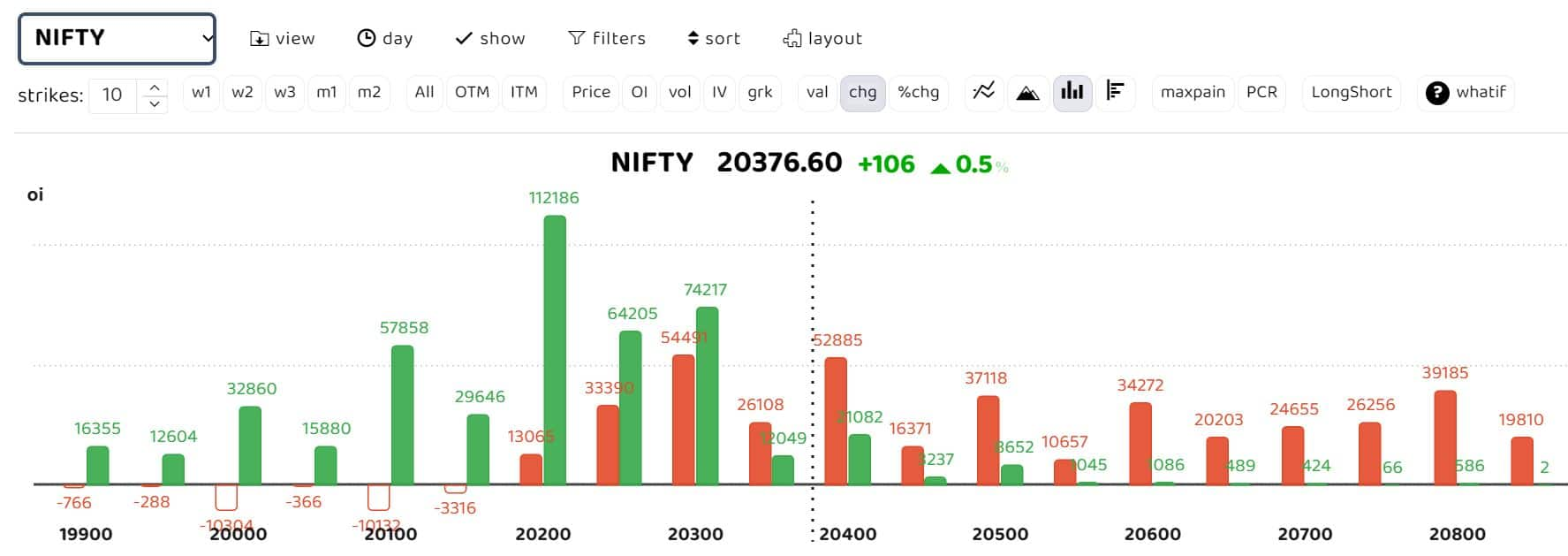

Discussing rollover positions, Chandan Taparia, Head of Derivative Research at Motilal Oswal Financial Services, remarks, “Nifty formed a strong bullish candle on an expiry-to-expiry basis, signifying a powerful comeback of the bulls. The November series saw a reduction in open interest by 7.8 percent with a simultaneous rise in price by 6.8 percent on an expiry-to-expiry basis, indicating some short covering towards the end of the series. The rollover of Nifty stands at 73.1 percent, lower than its quarterly average of 77.5 percent. Rollover data suggests short covering and some longs being rolled over with sentiments growing stronger.”

Options data suggests heavy put writing can be seen in Nifty at 20,100 and 20,000 levels forming strong support. “Considering overall derivatives activity, we expect strength to continue in Nifty as we enter the December series. It now has to hold above 20,000 zones for an upward move towards 20,350 and then 20,500 zones, while supports are placed at 19,950 and 19,800 zones. Overall, we anticipate Nifty to be in a broader range between 19,800 to 20,500 zones at the start of the December series, with stock-specific action and bulls driving the upside in the market,” added Taparia.

Among individual stocks, long rollovers were witnessed in Persistent, Lupin, ONGC, Powergrid, Colpal, IOC, NTPC, BEL, Auropharma, Hindalco, MCX, Granules, TVS Motor, Cipla, BPCL, Tatapower, Gail, Divislabs, L&T, Exide Ind, Lichsgfin while short rollover in Petronet, Bajaj Finance, SBI Card, India Mart, PEL.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here