Nifty hits new milestone; 38 smallcaps gain upto 33%

In the month of November, the BSE Sensex rose nearly 5 percent and Nifty50 rose 5.5 percent.

In the truncated week, the Indian equity market posted solid gains and extended the winning run for the fifth consecutive week, helping Nifty50 to test fresh record high of 20,291.55 in the final session of the week led by positive global as well as domestic data print and extended FIIs support amid fading concerns of further interest rate hike by Fed and ECB going ahead.

In this week, BSE Sensex added 2.29 percent or 1,511.15 points to finish at 67,481.19, while Nifty50 gained 473.2 points or 2.39 percent to end at 20,267.90.

In the month of November, the BSE Sensex rose nearly 5 percent and Nifty50 rose 5.5 percent.

Broader indices outperformed the main indices with BSE Mid-cap, Large-cap and BSE Small-cap indices added 3 percent, 2.6 percent and 2 percent, respectively.

“The market soared to new heights this week, decisively breaching the key resistance level and closing strongly above 20,000 levels. Global markets witnessed a bullish trend, buoyed by expectations that the ECB has concluded its rate-hiking cycle amid a backdrop of easing inflation. The Indian economy received a substantial boost from strong Q2FY24 GDP figures and a notable surge in manufacturing activity, significantly enhancing the growth outlook. The IPO market maintained its vibrancy, highlighted by Tata Technology’s monumental listing, fostering increased investor confidence in riskier assets,” said Vinod Nair, Head of Research at Geojit Financial Services.

“The broader market outperformed, with mid and small caps displaying resilience and no signs of fatigue. Investors remain optimistic about government spending and heightened consumption, driven by easing inflation, propelling growth in H2FY24. Oil prices continued to move on the downside despite the OPEC+ supply cut. The eagerly awaited exit polls also contributed positively, boosting investor sentiments towards the current union government.”

“In the upcoming week, investors’ attention will mostly be directed towards the release of service PMI data from the U.S., India, and China. RBI policy meeting next week; anticipate the status quo; however, the growth outlook might be positively tweaked. The gradual return of FIIs in November signals positive momentum to continue,” he added.

All the sectoral indices ended in the green with BSE Oil & Gas and Power indices added 5.7 percent each, BSE Capital Goods index up 3.6 percent, and BSE Metal index up 3 percent.

In this week market witnessed resurgence in FII buying, as they bought Rs 10,593.19 crore, while Domestic institutional investors (DIIs) bought equities worth Rs 4,353.55 crore.

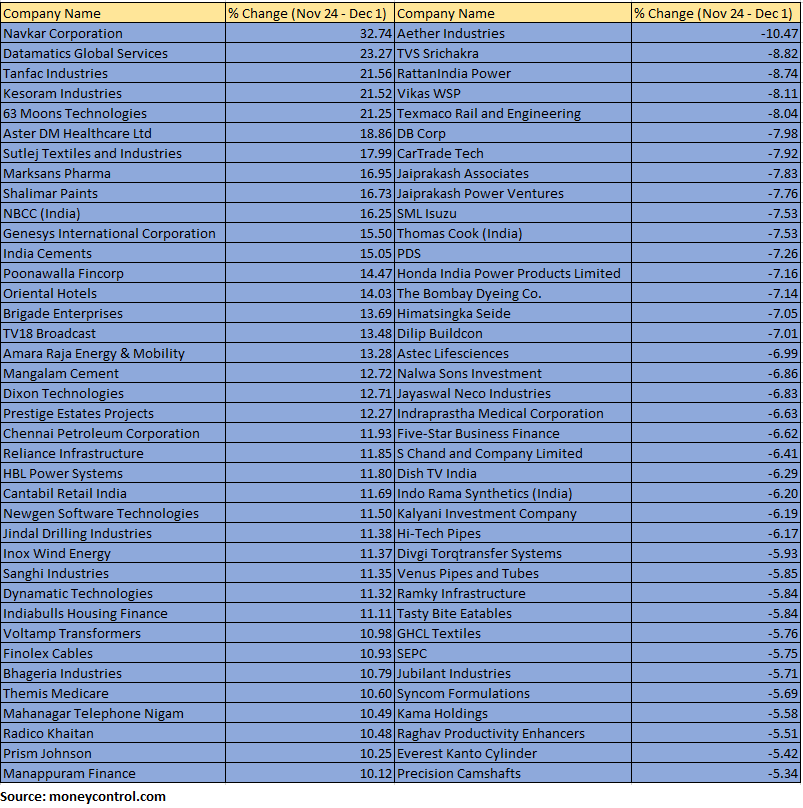

The BSE Small-cap index rose 2 percent with Navkar Corporation, Datamatics Global Services, Tanfac Industries, Kesoram Industries, 63 Moons Technologies, Aster DM Healthcare, Sutlej Textiles and Industries, Marksans Pharma, Shalimar Paints, NBCC (India), Genesys International Corporation and India Cements rising 15-32 percent.

On the other hand, Aether Industries, TVS Srichakra, RattanIndia Power, Vikas WSP, Texmaco Rail and Engineering, DB Corp, CarTrade Tech, Jaiprakash Associates, Jaiprakash Power Ventures, SML Isuzu, Thomas Cook (India), PDS, Honda India Power Products, The Bombay Dyeing, Himatsingka Seide and Dilip Buildcon lost 7-10 percent.

Where is Nifty50 headed?

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty continues to ascend as the bulls maintain control. A consolidation breakout on the weekly time frame seems probable, paving the way for a further rally in the index.

The sentiment remains upbeat, marked by a bullish crossover in the weekly RSI. At the lower end, support stands firm at 20,200; any declines could be seen as buying opportunities as long as it holds above this level. On the higher end, resistance is anticipated around 20,450-20,500

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Frenzied buying on the back of renewed optimism from the FIIs and positive European market cues lifted benchmark Nifty to a fresh record high. India remains a bright spot in an uncertain global economy as the recent data indicators such as strong GDP and manufacturing numbers along with external factors like falling US bond yields are keeping markets in good stead.

The good news is that the short-term technical outlook for Nifty continues to be in favor of the bulls, with support seen at 20089-19909 and resistance at 20500-20751.

Ajit Mishra, SVP – Technical Research, Religare Broking:

The rotational buying across the key sectors is helping the index to inch higher and we are now eyeing 20,500 in Nifty ahead. Apart from the domestic factors, upbeat global cues, especially the performance of the US markets, are further adding to the positivity. We thus recommend continuing with a “buy on dips” approach with a focus on stock selection.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.