F&O Manual |Bullish momentum prevails; Nifty advances towards 21000

the Sensex was up 290.26 points or 0.42 percent at 69,155.38, and the Nifty was up 95.80 points or 0.46 percent at 20,782.60.

The Indian equity benchmark were trading higher for the sixth consecutive session on December 5 as bullish momentum continues. For the Nifty, immediate support is at 20,500 and 20,300 zones, while resistance is at 20,800 and then 21,000 zones. Now, it needs to hold above 20,500 for an upmove towards 20,800 and then 21,000.

While bank, oil & gas and power up a percent each, the information technology index was down 0.5 percent. BSE midcap and smallcap indices up 0.5 percent each.

About 2,007 shares advanced, 988 declined and 90 were unchanged.

Nifty highlights

– Nifty futures open interest (OI) increased by 9.03 percent to 1.18 crore.

– The Nifty put/call ratio (OI) increased from 1.30 to the 1.39 level.

– India VIX was up by 4.95 percent, rising from 12.38 to 12.99 levels. Volatility has slightly increased, creating momentum for the bulls to show strength in the new price territory.

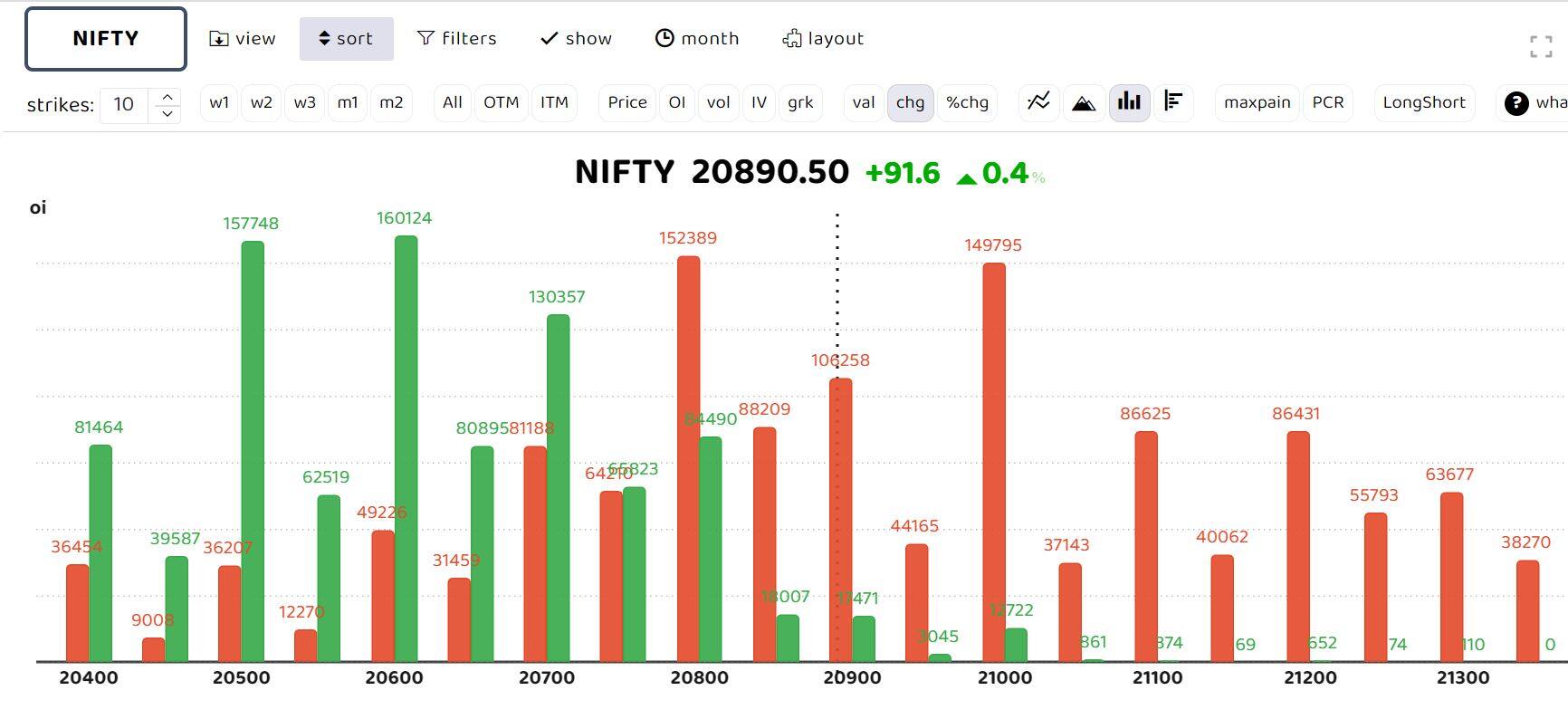

– As it is the beginning of a new expiry, the option data is scattered at various strike prices.

According to Anand James, Chief Market Strategist, Geojit Financial Services, “While oscillators are at upper extremes, calling for corrections, momentum has worked in favour of the upside so far, allowing the Nifty to persist with the prevailing uptrend.

“But with VIX also rising, en route to a 20 percent gain, which we are eyeing, our bets are on corrections finding buying interest again, at least initially.”

Early trades in the vicinity of 20,720 are likely to see buyers withdrawing and the favored point for such a turnaround on the lower side is 20590 or 20500. Alternatively, a close above 20660 could call for 20880.”

Nifty derivatives data

On the weekly front, the Maximum Call OI is at 21,000 and 20,700 strikes, while the Maximum Put OI is at 20,500 and 20,600 strikes. Call writing was observed at 21,500 and 21,200 strikes, while meaningful Put writing was seen at 20,500 and 20,600 strikes.

The Option data suggests a broader trading range between 20,200 and 2,1200, with an immediate trading range between 20400 to 21000 zones. “Nifty has immediate support at 20500 and then 20300 zones, while resistance is at 20800 and then 21000 zones. Now it has to hold above 20500 zones for an upmove towards 20800 and then 21000 zones, whereas supports are placed at 20500 and then 20300 zones,” stated brokerage house Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here