Foreign Institutions’ net long in stock futures scales a 4-month high

Representative image

Bulls of Dalal Street have been charging at full throttle, driving the markets to record highs, for six weeks in a row. This rally stems from a noteworthy recovery led by short-covering, with Foreign Institutional Investors (FIIs) substantially lowering their net shorts from over 1,80,000 contracts in early days of November to 47,000 contracts. This turnaround marked a positive change in market sentiment.

Market participants are actively writing Put strikes, indicating a consensus on limited downsides in the market. On the upside, expectations of positive election results are likely to drive fresh funds flow into equities, potentially propelling the Nifty to even higher levels.

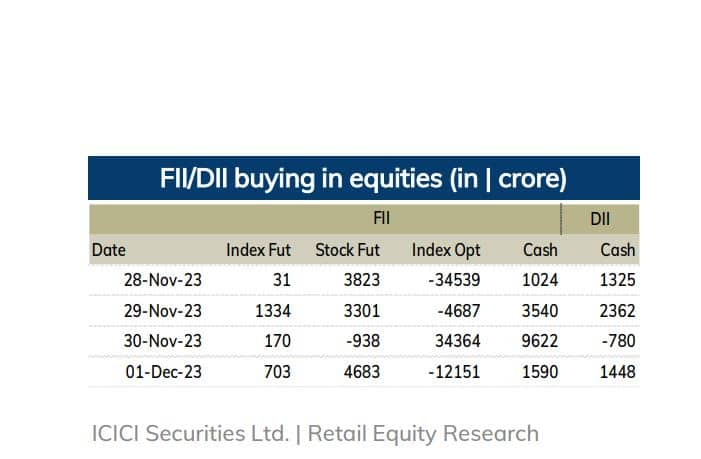

According to an ICICI Direct research report, foreign institutional investors (FIIs) have engaged in substantial buying over the last few days, with a weekly purchase of nearly Rs 16,000 crore. “We anticipate the current buying momentum to persist, focusing primarily on heavyweight stocks, thereby providing further impetus to the indices. Additionally, domestic institutions continued with their net buying trend last week, acquiring equities valued at around Rs 4,355 crore,” it said.

In the Futures and Options (F&O) space, FIIs have drastically reduced their net shorts in index futures, with the current week’s net short position standing at a mere 47,000 contracts, compared to the previous week’s high of 1.3 lakh contracts. Simultaneously, there has been a notable shift in stock futures, with net longs rising to approximately 1,34,000 contracts from 90,000 contracts recorded in the penultimate week of November.

“Given the aggressive long position, we anticipate the current positive momentum in the Nifty to continue,” ICICI Securities said.

At noon on December 5, the Nifty was up 73.60 points or 0.36 percent to 20,760.40.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here