Nifty breaks 7-day winning streak, needs to surpass 20,940-mark for upward trend on expiry

.

The Indian benchmark indices on December 7 ended a 7-day winning streak after opening with a gap down. At 12 pm,the Sensex was down 88.10 points or 0.13 percent at 69,565.63, and the Nifty was down 19.10 points or 0.09 percent at 20,918.60. About 1880 shares advanced, 1260 shares declined, and 97 shares unchanged.

On this expiry day, the Nifty spot must surpass the 20,940-mark to encourage bulls to ride the upward trend. This hurdle represents a crucial level for today, given that it is the expiry day.

Catch all LIVE updates on stock market action here

According to Sudeep Shah, Head of Derivative and Technical Research at SBI Securities, “FIIs’ Long-Short Ratio for Index Futures has further improved to 53 percent, as they squared off 14,600 index futures net shorts and added 12,000 contracts on the long side. On the stock futures front, FIIs have sold to the tune of 5,500 contracts, while on the Options Front, FIIs added 2 lakh call contracts and sold 1.68 lakh Put Option contracts.”

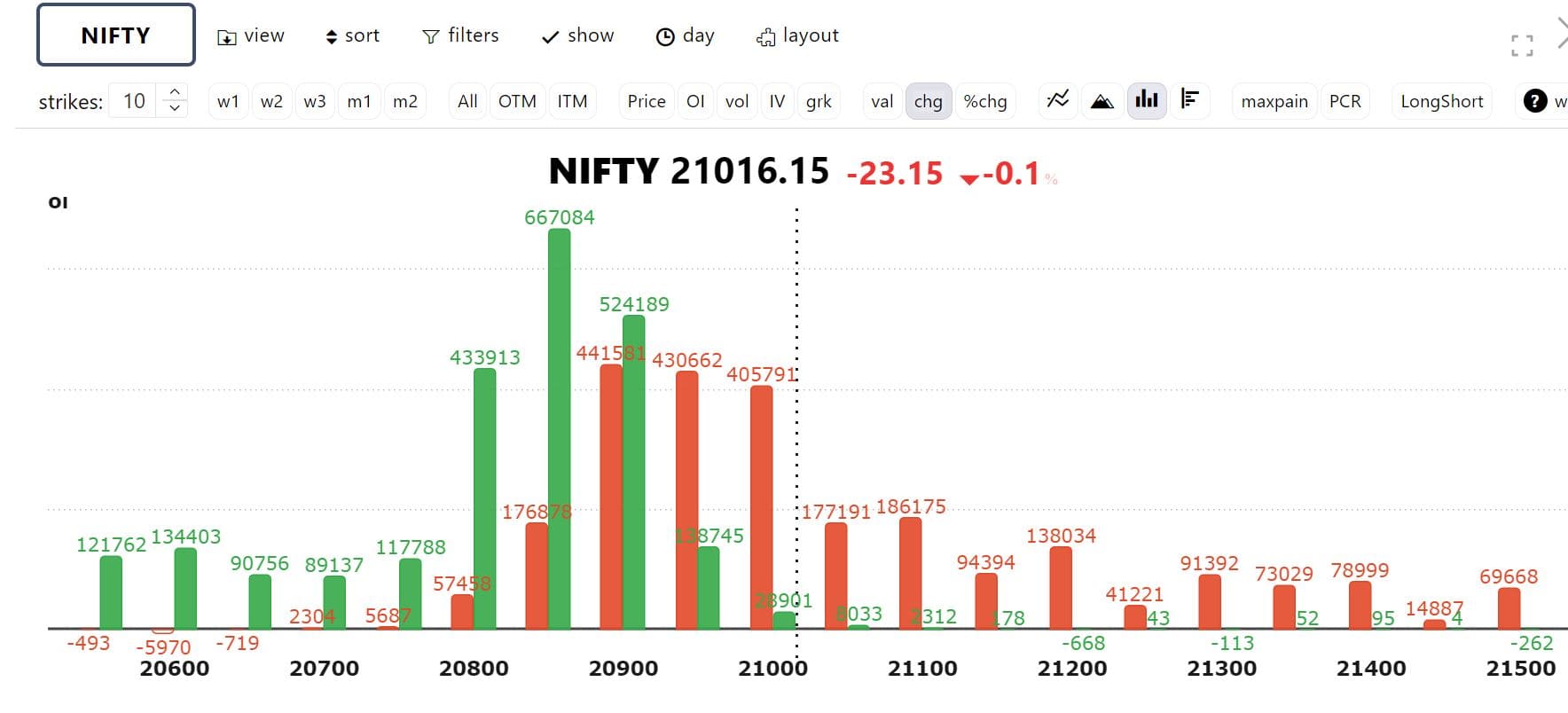

Options data indicates a tussle between options call and put writers at the 20,900 strike. Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox, states, “The Spot Nifty needs to cross the 20,940 mark to instigate bulls to ride the upward trend. This hurdle remains a crucial level for today, its expiry day. Only a sustained move enduring 5-10 minutes over the hurdle could assist Nifty to expire close to 21,000.”

“Option data favors a positive bias for today, as the 20,900 PE and 20,850 are observing writing on an extensive note. Despite the data remaining in favor of bulls, a rally over the spot 20,940 needs to be examined. Likewise, the 21,000 CE is also gaining heavy traction, which could derail the move if the index fails to cross 20,940,” added Bagkar.

Among individual stocks, long build up can be seen Tata power, BPCL, Hindcopper, Oberio Realty.

Story continues below Advertisement

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Get ₹100 cashback on checking your free Credit Score on Moneycontrol. Gain valuable financial insights in just two clicks! Click here