Of polls and punters: Decoding the D-St dynamics in a year of elections

The BJP returning to power in 2024 is seen to be positive for policy continuity and long-term growth, analysts said

After the BJP sweep in the heartland India that drove the markets to record highs, the focus is now more on the general election that’s just months away, than anything else.

Many investors are now pondering on how to position themselves in the market as we head into 2024.

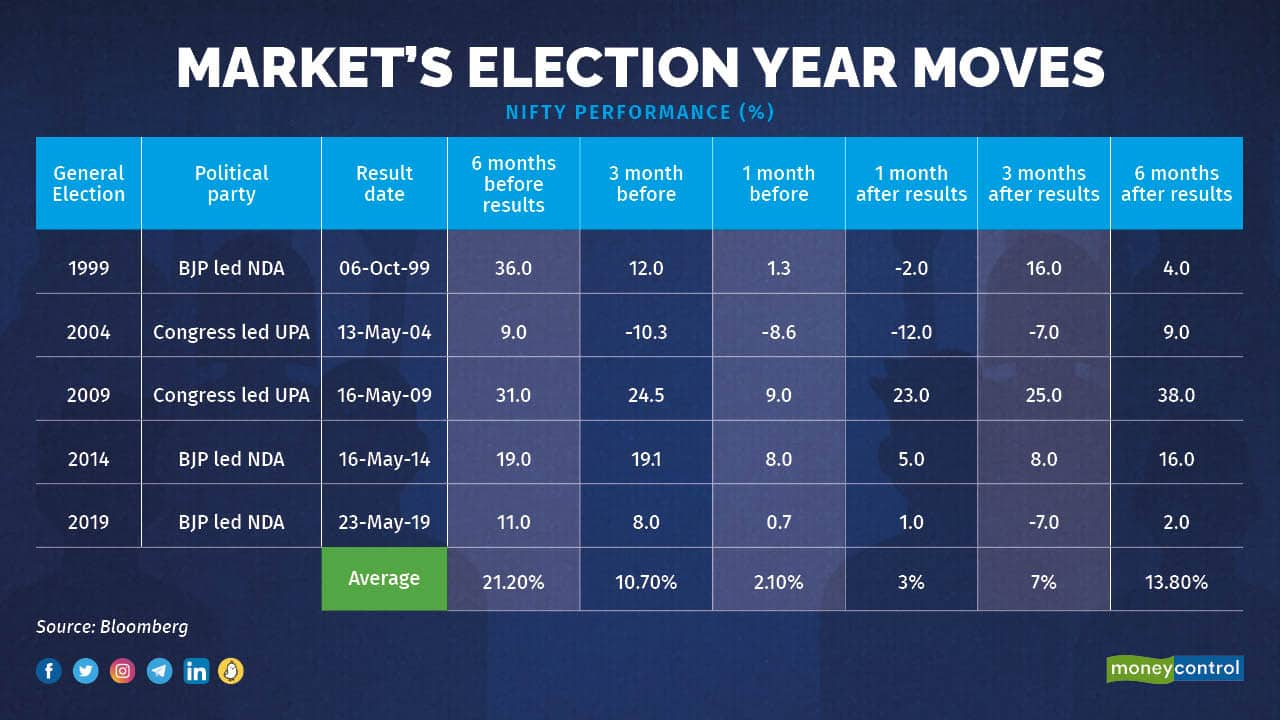

As per a Moneycontrol analysis of the trend during the previous five general elections, the best time to enter the market in an election year is roughly six months before the date of the result announcement.

Since the elections of 1999, when the BJP-led NDA swept into power, the Nifty has returned an average of 21.2 percent during the six months before the results.

The figure drops to 10.7 percent for the three-month period before the results, and further to 2.1 percent in the month before the D-Day.

Analysts say this can be explained by the fact that the markets have largely priced in the election outcome over the preceding months, and there is very little upside left as we approach the actual event.

Mission 2024

Story continues below Advertisement

The Assembly elections in Rajasthan, Madhya Pradesh, Chhattisgarh, Telangana and Mizoram were the last round of state polls ahead of the general election, scheduled for May 2024, and are being seen as a curtain raiser for the national polls.

As per political analysts, BJP’s thumping win in the Hindi heartland states of Rajasthan, Madhya Pradesh and Chhattisgarh has reinforced its position as the dominant party in North India with consistent gain in vote share, irrespective of the seat share.

Also Read: Forget elections, India growth story will carry equity markets over the next decade

“It is now near-certain that the BJP would be re-elected to power in the Parliamentary elections of 2024,” analysts at Emkay Global said.

The election results are a tailwind for the market as the BJP returning to power in 2024 is seen to be positive for policy continuity and long-term growth.

“Other headwinds are also dissipating. Geopolitical uncertainty is fading and crude prices are off their September-October peaks. Fears of a hard landing in the US have also faded in the last few weeks,” they added.

Some others have highlighted the low correlation between state and national elections, pointing out that the BJP had lost these three states in December 2018 but won the 2019 Lok Sabha elections with a better majority than 2014.

However, the consensus view remains that the BJP is set to retain power in 2024.

According to Barclays Research, the big issues ahead of the general election include swings in food prices, demands for a caste census, temptations for a tilt towards fiscal populism with some state governments opting to go back to a previous pension system, and cultural issues.

“While factors such as the continued popularity of the PM work in the BJP’s favour, it will still have to counter anti-incumbency and fatigue from being in national power for a decade,” it added.

Fiscal path

A key monitorable for market watchers is whether political parties succumb to the temptation of offering ‘freebies’ to the electorate, which can put a strain on the country’s fiscal deficit.

“Both BJP and Congress tried to woo the voters by providing freebies particularly to below poverty line (BPL) people,” global brokerage firm Jefferies pointed out.

Also Read: BJP’s election sweep calms populism fears, allays market concerns about political risks

Some common promises include income transfer to married women (Rs10,000/annum in Rajasthan by Congress, Rs 1,250 per month in MP by BJP) and landless-farmers, farm loan waivers, subsidy on cooking-fuel, among others.

“BJP’s strong performance in state polls notwithstanding, we believe that the tilt to welfare policies should gain momentum in run up to Apr-May24 polls. The upcoming budget may have some large new welfare scheme announcements, similar to the farmers direct income transfer announced before 2019 polls,” it added.

Other analysts, however, maintain that the election results are unlikely to lead to the announcement of any major schemes that could materially alter the government’s fiscal position.

“We think the Union budget‘s fiscal deficit target for FY23-24 of 5.9% of GDP is likely to be met, despite higher subsidy costs (across food, fertiliser, LPG), given strong growth in tax receipts so far,” Barclays said.

Sectoral picks

The reduced election ‘risk’ and growing expectations of an imminent rate cut cycle in the US may sustain the Indian market’s rich valuations, Kotak Institutional Equities said.

“Most consumption, investment and outsourcing-linked stocks are trading at ‘rich’ valuations, while financials continue to trade at attractive/reasonable valuations. Meanwhile, mega-caps have underperformed other large-caps, mid-caps and small-caps,” it noted.

Kotak further said it is possible that mega-caps may now see more interest from the market (specifically FPIs), given their reasonable valuations and lower worries about a sub-optimal outcome (no decisive mandate) in the general elections.

Jefferies, which had recently deployed the cash in its model portfolio, partly on our expectations of BJP’s strong performance in state polls, said welfare announcements should help the “Bottom of Pyramid” demand recovery, where it prefers telecom and two-wheelers over consumer staples.

“Our clear preference remains to play the cyclical story via power, industrials, property, banks and select mid-caps – as we believe the unfolding private capex cycle (corporate + housing) is strong and durable turnaround, not impacted by potential government capex slowdown,” it added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.