58 smallcaps give double digit gains as broader indices hit fresh highs

Broader indices touched record highs in this week.

Market extended the winning streak in the sixth consecutive week ended December 8 and also tested fresh record high levels amid positive global cues, strong GDP data, BJP’s massive victory in 3 states and inline RBI policy with keeping key rates unchanged for the fifth time in a row and upgraded GDP growth boosted investor confidence.

In this week, BSE Sensex rose 3.47 percent or 2344.41 points to close at 69,825.60, while Nifty50 surged 701.5 points or 3.46 percent to finish at 20,969.40. On Friday, the Nifty went past the 21,000 mark for the first time when it hit 21,006.10 and the BSE Sensex also touched a new high of 69,893.80.

Among the broader indices BSE Small-cap, BSE Mid-cap, BSE Large-cap indices rose 3.8 percent, 2 percent and 1.3 percent, respectively and also touched record highs.

“The market achieved an all-time high, driven by robust domestic GDP growth. Despite the RBI maintaining policy status quo, an upgraded GDP growth forecast for FY24 (6.5% to 7%) boosted investor confidence. Measures to address the liquidity deficit, including the reversal of SDF & MDF facilities, positively impacted financials, leading to a 5% gain in Nifty Bank for the week,” said Vinod Nair, Head of Research at Geojit Financial Services.

“IT, consumer, auto, and realty sectors performed well due to valuation comfort, festive momentum, and a strong uptick in residential sales. Mid & small caps continued to outperform, driven by a healthy economic outlook, strong Q2 earnings, and corrections in oil prices.”

“Investors should be mindful that achieving the RBI’s 4% CPI inflation target may take time. Concerns arise from reduced rabi sowing and declining reservoir levels, signalling a potential rise in foodgrain prices. This impacted FMCG stocks negatively, contrasting with positive performances in most other sectors. In the upcoming data-centric week, focus will be on crucial releases, including inflation data from India and the US.”

“Indian inflation is expected to rise, while US inflation will remain steady. Indian industrial and manufacturing production is also expected, while consensus expects expansion. However, the outcome of the awaited Fed policy meeting will be pivotal in shaping market sentiments,” he added.

Among sectors, BSE Power index rose 13 percent, BSE Oil & GAs index added 7.6 percent, and BSE Bank index rose 5.3 percent and BSE Energy index up 5.2 percent. However, BSE FMCG index fell 0.3 percent.

Story continues below Advertisement

In this week, Foreign Institutional Investors (FIIs) extended their support, as they bought equities worth Rs 9,285.11 crore, while Domestic Institutional Investors (DIIs) bought equities worth Rs 4326.47 crore.

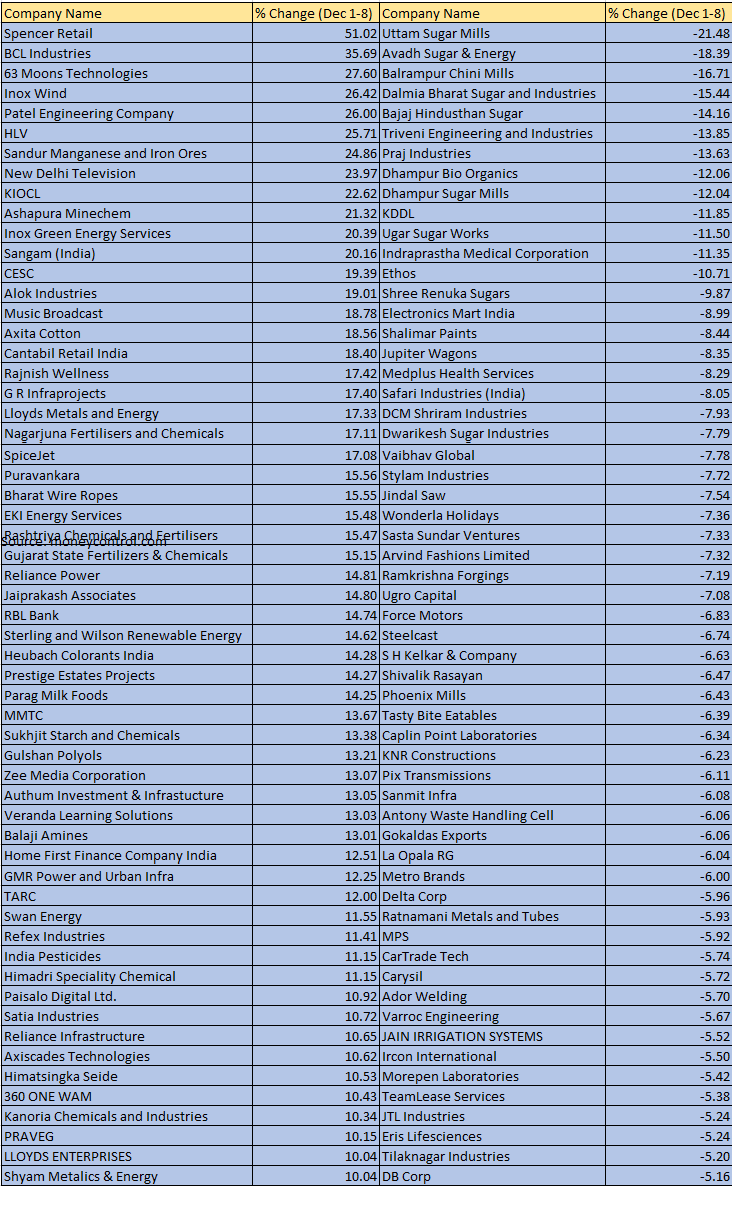

The BSE Small-cap index added 1.3 percent. Spencer Retail, BCL Industries, 63 Moons Technologies, Inox Wind, Patel Engineering Company, HLV, Sandur Manganese and Iron Ores, New Delhi Television, KIOCL, Ashapura Minechem, Inox Green Energy Services, Sangam (India) added between 20-51 percent.

On the other hand, Uttam Sugar Mills, Avadh Sugar & Energy, Balrampur Chini Mills, Dalmia Bharat Sugar and Industries, Bajaj Hindusthan Sugar, Triveni Engineering and Industries, Praj Industries, Dhampur Bio Organics, Dhampur Sugar Mills, KDDL, Ugar Sugar Works, Indraprastha Medical Corporation and Ethos lost between 10-21 percent.

Where is Nifty50 headed?

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Buying resumed after a day’s break on Thursday as benchmark indices notched up fresh highs on the back of positive global cues and RBI raising FY24 GDP forecast to 7% in its monetary policy announcement. While the central bank is positive about the country’s strong growth prospects going ahead, it remains wary of inflation and indicates that higher interest rate regime may not reverse in a hurry, which triggered a sharp volatility in intra-day trades.

Despite overbought technical conditions, the short-term technical outlook for markets continues to be in favor of the bulls, with support for Nifty placed at 20777-20521 levels and resistance at 21121-21331 range.

Rupak De, Senior Technical Analyst at LKP Securities:

During the week, the Nifty witnessed a spectacular rally following a swing high breakout on the daily chart. This suggests a rise in optimism among market participants. However, the Nifty consolidated in the later part of the week.

Going forward, 21000 is likely to act as a crucial level for the Nifty as call writers have built their maximum positions at that strike price. A resumption of the current uptrend might be seen above 21000, with the potential to reach towards 21550. On the lower end, put writers have built significant positions at 20900 and 20800; below these levels, profit booking might increase.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

On the charts, we can observe that after the two-day consolidation, the Nifty has resumed its up move. The momentum indicator though is still not in sync which suggests caution at higher levels. The ideal strategy to trade is to hold on to long positions with a trailing stop loss mechanism. On the downside crucial support is placed at 20860 – 20800 and a dip towards this zone should be used as a buying opportunity as the overall trend is still positive. On the upside immediate hurdle is placed at 21060 – 21100.

Bank Nifty also witnessed a sharp pullback from the intraday lows and closed at an all-time high. We expect the positive momentum to continue during the next week as well. On the upside, the next immediate hurdle is placed at 47800 – 48000 from a short-term perspective. Crucial support is placed at 46800 – 46700.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.