F&O Manual | Benchmarks shed early gains, trade in a range as more consolidation looks likely

At 12 PM, he Sensex was up 64.50 points or 0.09 percent at 69,890.10, and the Nifty was up 17.00 points or 0.08 percent at 20,986.40.

The benchmark indices opened in the green as the bullish momentum continued to persist in the market, fuelled by rising purchases by Foreign Institutional Investor (FII) and positive global cues indicating stability. Bur, by noon, the markets erased the initial gains and traded flat.

Among sectors, all indices, barring pharma, were trading in the green with the oil and gas index up 1 percent by 12noon.

The Sensex was up 64.50 points or 0.09 percent at 69,890.10, and the Nifty was up 17.00 points or 0.08 percent at 20,986.40. About 2071 shares advanced, 1181 shares declined, and 114 traded unchanged around 12pm.

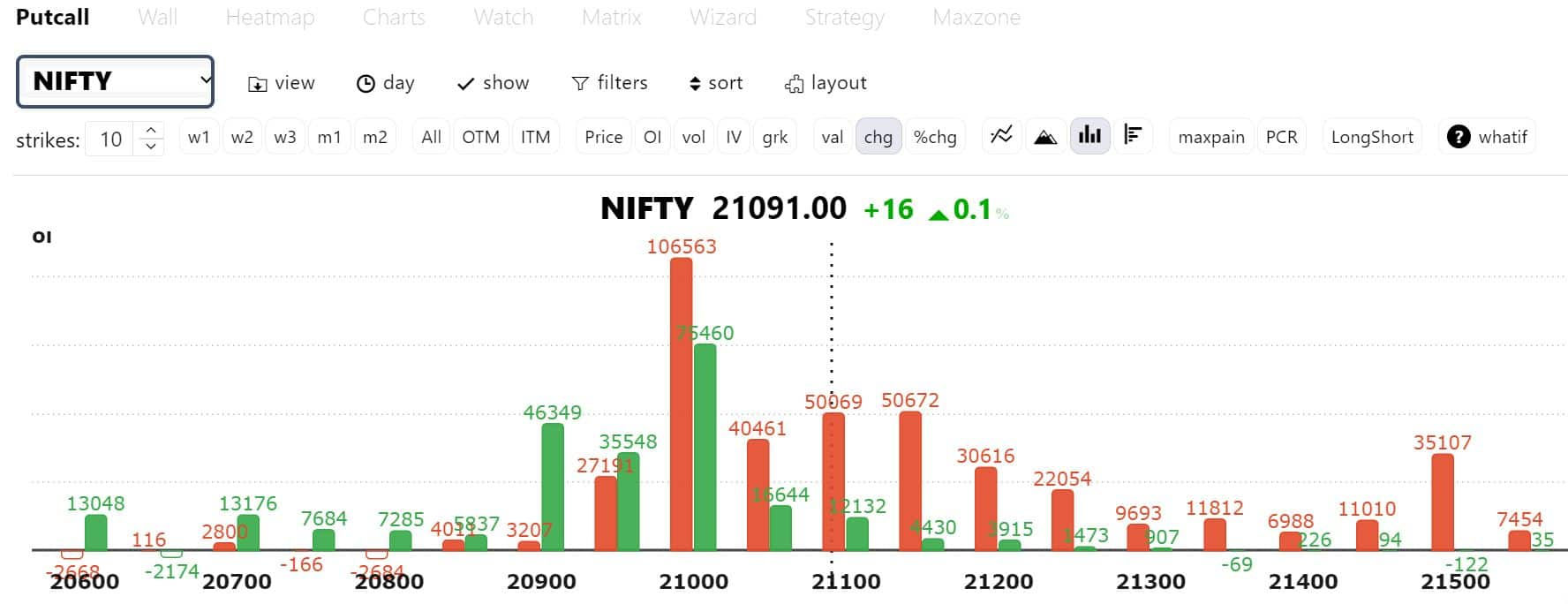

Options data suggests heavy put writing at the 20,900 strike, while the 21,000 mark formed the key straddle positions. “Despite a slowdown in momentum over the last three sessions, minor dips are consistently met with buying interest, leading to week-ending prices near the peak. Observing the last three candles, prices seem to have entered a time-wise correction,” Sameet Chavan, head of research for technical and derivatives at Angel One Ltd, said.

“This week, 20850 is viewed as immediate support, and sustained trading below this level could trigger a price correction, potentially bringing prices toward the next support at 20700. The primary support zone remains the bullish gap created this week, ranging from 20,500 to 20,300, and as long as it holds, the secular bull run is expected to persist, and any type of correction would be considered healthy for the primary uptrend,” he said.

Bank Nifty View

“The banking index is exhibiting a positive tilt for today, as 47,600 CE and 47,600 PE are showing a tight struggle, standing among the highest OI. Once the spot index stabilises over 47,600, the traders may expect a sharp upside on Monday,” Avdhut Bagkar, derivatives and technical analyst at Stoxbox, said.

Story continues below Advertisement

“Among the highest OI, 47,500 PE, 47,400 PE and 47,300 PE see writing, implying support for the index. Thus, any downside move in the 47,500 – 47,400 region should comprehend accumulation, and a reversal cannot be neglected, “he added.

On the daily chart, as per Bagkar, the overall trend in the Bank Nifty remains highly optimistic. The current trend exhibits a sideways movement in the range of 47,300 to 46,500, and any closing breakout of this rectangular range could trigger the next rally. On the upside, the banking index may travel in the direction of 48,000, while a breach may lead to a dip toward 45,800 level.

He believes the trendline breakout on the RSI favours bulls as the market demonstrates its ability to absorb sell-off as it enters uncharted territories.

Among individual stocks, there is a long build-up observed in Adani Enterprises, Tata Power, Hindustan Copper, and India Cements. Conversely, short covering is seen in BHEL, PFC, and HAL.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1296348323-44c7aca2cbb14d2f84b65b393fec649a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-171349083-062edb8f4c13435797d038746c27422f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-21669937071-728bfabe684b4c8aa17fc9c47255a740.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1338457868-a84a285627f64532a38b290e15fc48ea.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1440361960-8ba9445e90a74d6d9177d1c88bd6608b.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-527648748-e21f967435564d7ca7d86ebb94225e62.jpg)