F&O Manual | Nifty retests 20,800 levels as market consolidates on profit-booking

Among individual stocks, REC Ltd, PFC, and Hindpetro witnessed short build-up, while short covering was observed in NMDC, Alkem, and SAIL.

The frontline Indian indices opened flat and faced profit-booking from higher levels, leading the Nifty to retest 20,800 levels and Bank Nifty 47,000 levels.

Traders chose to take money off the table ahead of the FOMC outcome and maintained lighter positions. Broad-based profit-booking signalled an early sign of caution for aggressive buyers. From a technical standpoint, there has been a mere alteration in price chart for the Nifty, but the recent candlestick formations clearly showcase the exhaustion of bullish strength and might attract a price-wise correction after the rally.

Among sectors, information technology, oil and gas, metal, realty, bank indices down 0.4-1 percent.

At 11am, the Sensex was down 224.34 points or 0.32 percent to 69,326.69, and the Nifty was down 71.50 points or 0.34 percent to 20,834.90. About 1,669 shares advanced, 1,407 declined, and 87 shares were unchanged.

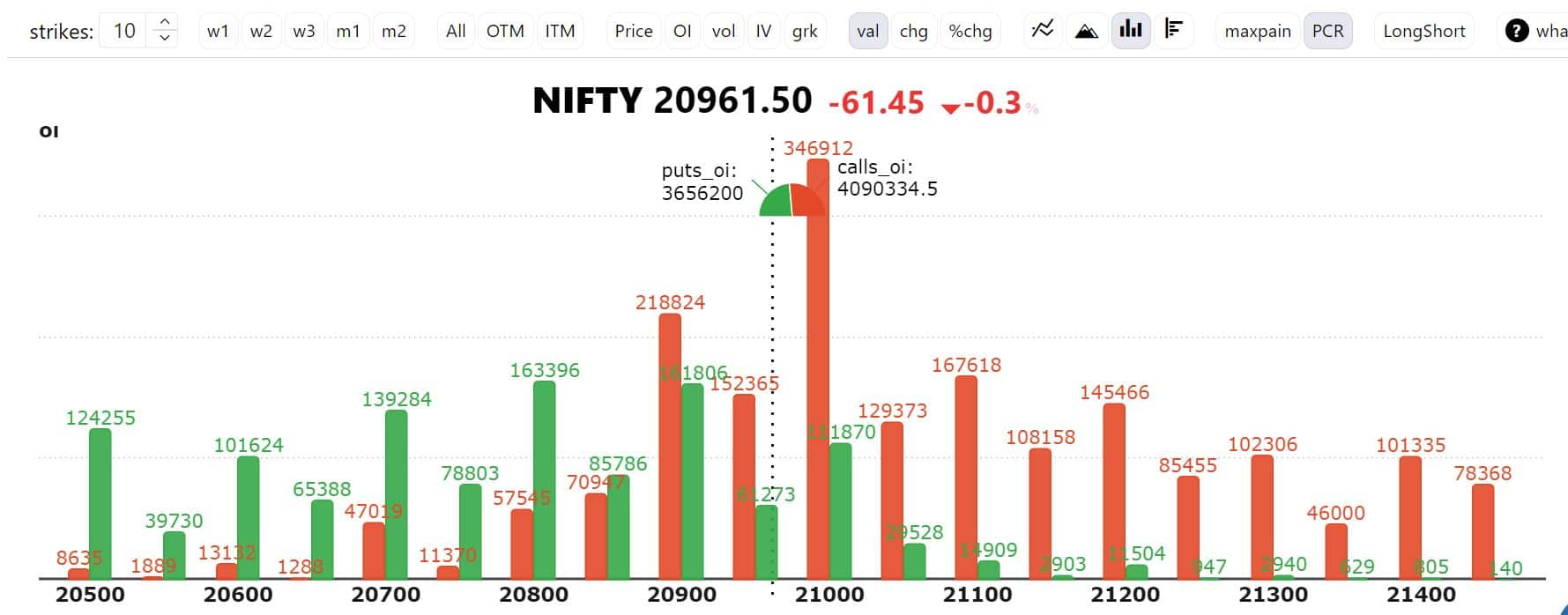

Bars in red show the change in open interest (OI) of call writers and in green show the change in OI of put writers.

Bars in red show the change in open interest (OI) of call writers and in green show the change in OI of put writers.

“Regarding levels, 20,850-20,800 is likely to be seen as an immediate support, followed by a bullish gap around 20,700. On the flip side, 21,000-21,040 holds a significant hurdle, followed by the 21,100 zone,” Sameer Chavan, research head for technicals and derivatives at Angel One Ltd, said.

Options data suggests call writers dominate for the day. “Yesterday, the Nifty ended the day with a cut of 0.5 percent. In the last few days, we had cautioned about the overbought nature of the RSI indicator and the deteriorating Advance Decline Ratio over the past few sessions. This is not a shorting signal in an otherwise bullish market, but it is definitely a sign of consolidation for the coming few sessions from a short-term perspective,” Sudeep Shah, head of derivatives and technical research at SBI Securities, said.

“Significant call writing build-up is seen in 20,950 and 21,000 strikes, while on the put front, 20,900-20,850-20,800 were seen as considerable Open Interest additions. Overall, the range for the day could be 20,750 on the downside and 21,017 on the upside,” he added.

Story continues below Advertisement

Among individual stocks, REC Ltd, PFC, and Hindpetro witnessed short build-up, while short covering was observed in NMDC, Alkem, and SAIL.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.