Is Novo Nordisk a buy? Wall Street banks weigh in — and one gives it 36% downside

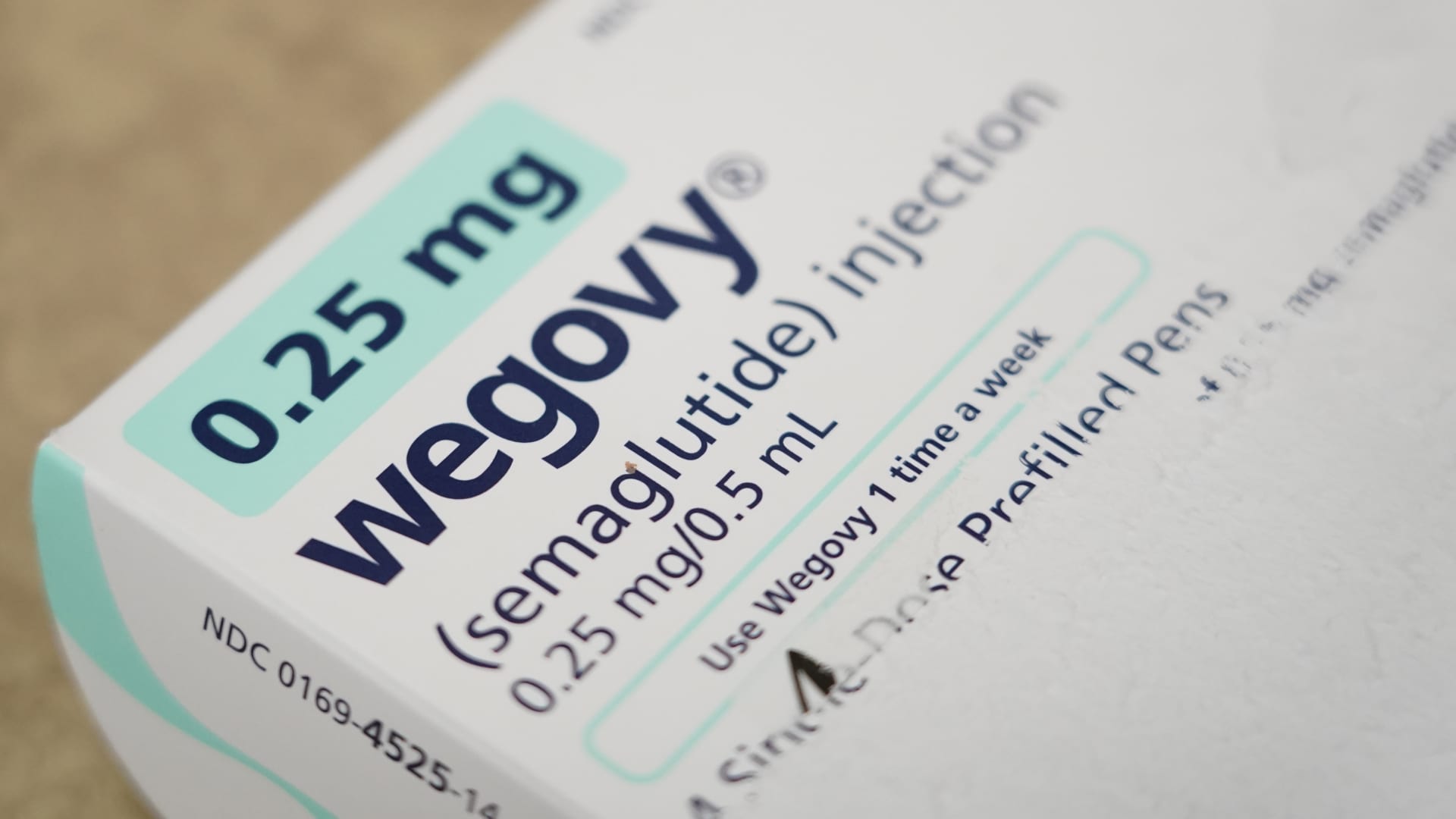

For many investors, the weight loss drug boom has boosted Danish pharmaceutical giant Novo Nordisk ‘s appeal this year — but one investment bank has reservations. “Over the coming year, we envisage sentiment to change, perhaps initially as a result of the launch of competitor Eli Lilly ‘s anti-obesity drug Zepbound and the risk of disappointment from slower than anticipated Wegovy supply ramp-up,” Jefferies’ analysts led by Peter Welford wrote in a Dec. 7 equity research note. Eli Lilly’s Zepbound, its tirzepatide weight-loss drug, received approval from the U.S. Food and Administration (FDA) for weight loss in early November. Novo Nordisk, for its part, announced in the same month that its Wegovy weight-loss drug could receive expanded approval from the FDA within six months . Other pharmaceutical companies like AstraZeneca and Pfizer are also developing weight-loss drugs. Jefferies believes the focus could shift from Novo Nordisk “to other anti-obesity drugs in the competitive landscape, with early/mid-stage data in 2024 expected from [over] 10 competing drugs in development.” Year-to-date shares in Novo Nordisk were up around 40% to 661 Danish krone ($95.58) on Dec. 12. NOVOB-CH YTD mountain Year-to-date shares in Novo Nordisk Jefferies is underweight on the stock — naming it as one of the “underperformers” of 2024. The investment bank has a target price of 430 Danish krone on the drug manufacturer— giving it around 36% downside. “We argue current multiples already reflect impressive growth, profit beats and significant claim on market share. Shorter term, we envisage material risk of sentiment change around the stock as focus shifts to competitor readouts and drug launches,” the analysts wrote. Bullish calls Investment bank BofA, however, is bullish on Novo Nordisk, giving it a buy rating at a price target of 875 Danish krone in its Dec. 6 note, representing 32.4% upside potential. The bank’s analysts like the stock thanks to the strong sales compound annual growth rate of around 11% between 2025 and 2028, driven in part by the launch of Wegovy. BofA expects the company’s “earnings upgrades cycle to continue” in 2024, following its “share price outperformance in the last 18 months.” Citi is also positive on the stock, giving it a target price of 815 Danish krone, or around 24% upside. “Novo continues to offer materially higher growth and returns ( > 3x pharma peers) and provides earnings visibility beyond 2035. We see the GLP-1 market continuing to be dominated by [Novo/Eli Lilly],” the investment bank’s analysts wrote in a Dec. 8 flash note. “Wegovy commands a 92% share of the GLP-1 obesity market. Over 80% of business comes from patients paying a $25 monthly co-pay, with cash-pay representing 5-10% Rx (medical prescriptions),” they added. Some 500,000 people in the U.S. currently take Wegovy and the company stands to gain from an addressable patient population of more than 100 million in the U.S. and 700 million globally, the analysts noted. Of the 28 analysts covering the stock, 16 have a buy or overweight rating with an average price target of 729.49 Danish krone, according to FactSet. — CNBC’s Michael Bloom contributed to this report.