F&O Manual | Market extends gains, Nifty’s immediate support is at 21,000

Among individual stocks, long build up can be seen in NationAlum, Coforge, Persistent and Bandhan Bank. While short build up can be witnessed in REC ltd, HAL and PFC.

The Indian benchmark indices extending the previous session’s gains to hit new highs on December 15 morning. All the sectoral indices were trading in the green, with metal, oil & gas and information technology indices up a percent each.

At 11 am, the Sensex was up 461.24 points, or 0.65 percent, at 70,975.44 and the Nifty was up 136.60 points, or 0.64 percent, at 21,319.30. About 1,845 shares advanced, 1,238 declined and 95 were unchanged.

Nifty highlights:

>> Nifty futures open interest (OI) increased by 18.09 percent to 1.50 crore, while Bank Nifty futures OI decreased 3.86 percent to 23.21 lakh.

>> The Nifty Put/Call Ratio (OI) rose from 0.96 to 1.37.

>> India VIX went up 2.16 percent, moving from 12.06 to 12.32 levels. Though there was a slight uptick in volatility, it cooled steadily in the last few sessions, providing comfort to the bulls.

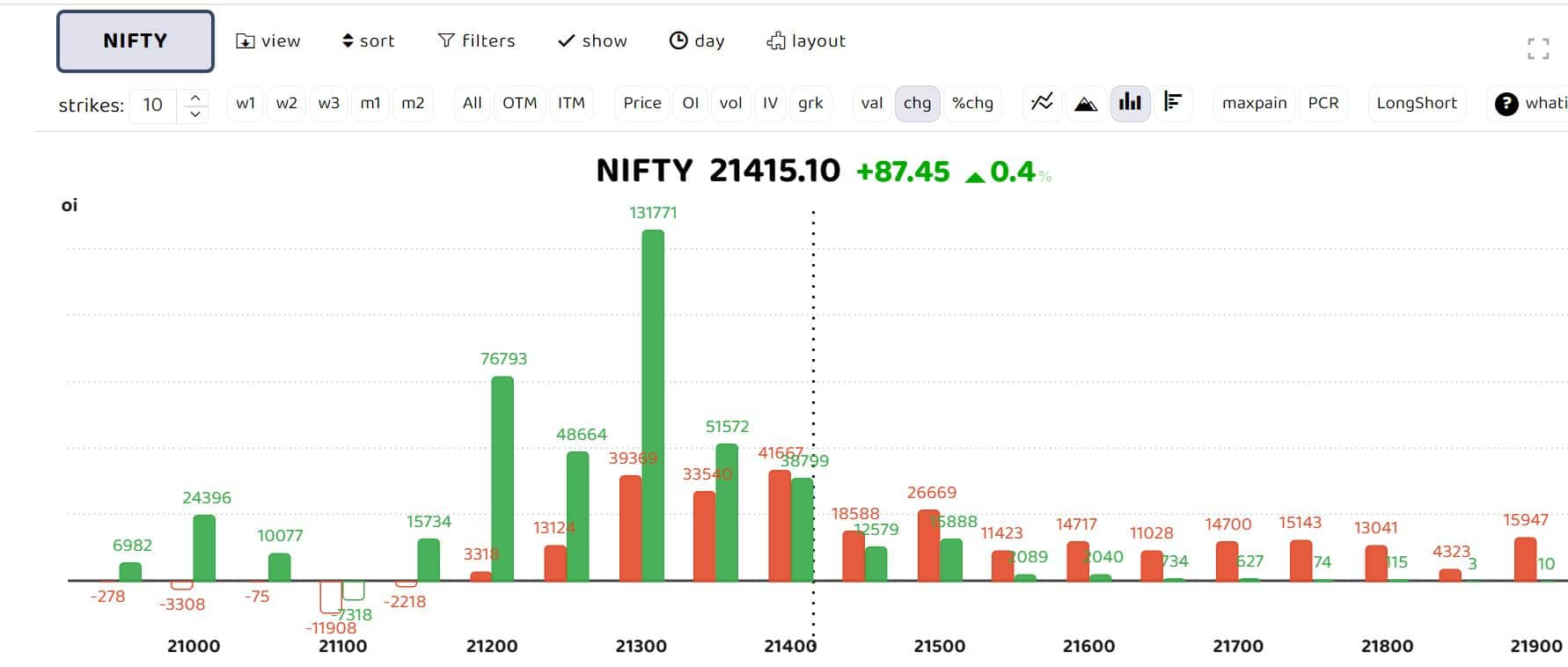

Open interest position build-up

On weekly front, the maximum Call OI is at 21,200 then 21,300 strike, while the maximum Put OI is at 21,100 then 21,000 strike. Call writing is seen at 21,300 then 21,500 strike, while Put writing is seen at 21,100 and 21,000 strike.

Story continues below Advertisement

The options data suggests a broader trading range of in 20,800-21,500, while an immediate range is between 21,000 and 21,350.

“The highly anticipated FOMC event favoured bulls globally and was indeed reflected in the chart patterns,” Angel One said.

The recent consolidation led to a strong breakout, propelling the key indices to their all-time highs. As the Nifty navigates uncharted territory, identifying the next potential resistance is challenging, the brokerage firm said. Considering the extremely overbought parameters, it is advisable to regularly book profits, it said.

“On the other hand, the bullish gap of 21,070-20,950 is likely to serve as an intermediate support zone for the time being, with 20,800 holding as the sacrosanct support.”

The red bars show the change in open interest (OI) of call writers and the green show of put writers

The options data reveals concentration in 21300 CE and PE, suggesting indecision, while the writing in 21200 PE and 21500 CE provides a range bound trade with an upward tilt.

Follow our live blog for all market action

Motilal Oswal Financial Services said for the Nifty, the immediate support is at 21,000 and then 20,850, while resistance is at 21,350 and then 21,500 zones.

After hitting highs, the index took a breather, however, “the underlying bias remains highly robust for today, and we anticipate a bullish close”, said Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox.

“We anticipate the Nifty 50 spot to close over 21,300, and risk players may attempt to enter long in 21300 CE around 120 level, holding 80 as a stop loss. We aim at hitting 200 level,” he said.

The banking index must overcome the selling pressure emerging around 47,800 to move on the upside. If Bank Nifty sustains above 47,800, it can hit a new intraday high, moving towards 48,000, Bagkar said.

Among individual stocks, a long build-up was seen in National Aluminium Company Limited, Coforge, Persistent and Bandhan Bank. REC Ltd, HAL and PFC saw a short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.