Odd ones out: Only 2 Nifty indices haven’t touched lifetime highs this year

While the benchmark Nifty and all sectoral indices have been on a record-smashing spree, two segments failed to join the party. Read on to find out which are the two and why

The Nifty Media and Nifty IT indices are ending 2023 on a bitter-sweet note

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

Have you ever been to a party where everyone is having a gala time but you are left standing in a corner watching the world go by? Two NSE sectoral indices just had this sort of a year.

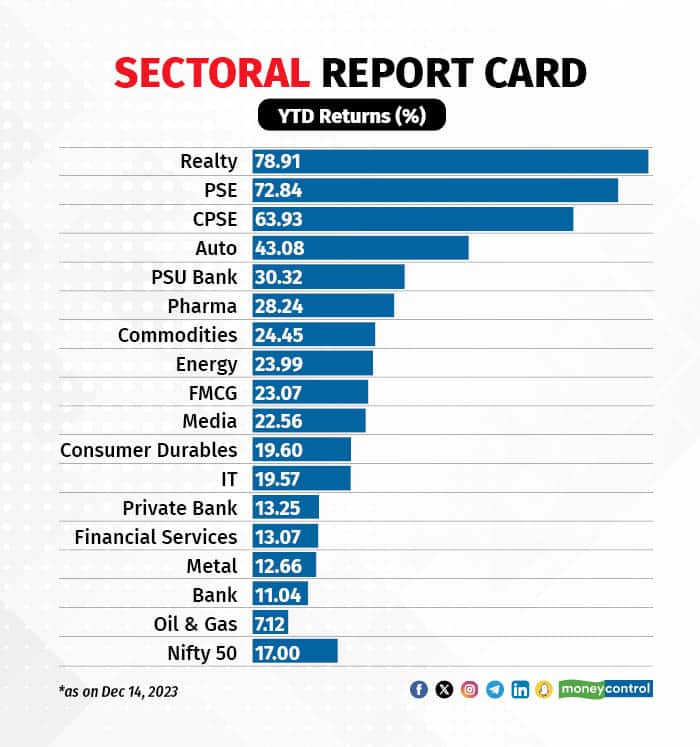

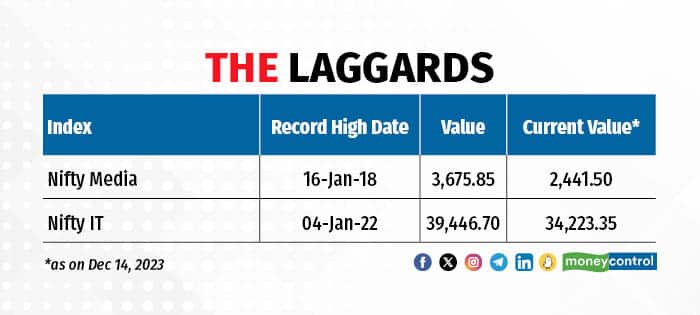

Nifty Media and Nifty IT indices are ending 2023 on a somber note. While the benchmark Nifty 50 and all sectoral indices touched fresh lifetime highs this year, these two segments missed the boat.

But it does not mean 2023 has been a complete washout for them.

Even though they did not make headlines, they managed to beat some high-profile peers like bank, metal and oil & gas indices when it comes to year-to-date returns.

No biz like showbiz

The last time the Nifty media index reached its record high, Salman Khan-starrer Tiger Zinda Hai was still running in theatres, Corona was a popular beer brand and Donald Trump was the US president.

Seems like eons ago.

Story continues below Advertisement

So, why is Nifty Media stuck in a time warp?

Analysts say it’s a combination of sectoral headwinds as well underperformance of the index’s biggest constituent – Zee Entertainment Enterprises.

Zee’s stock has been in a limbo since September 2021 when it announced a merger with Sony Pictures Networks India.

The deal was expected to be completed in eight-ten months but was stuck due to cases filed by financial institutions against Zee and market regulator SEBI cracking down on the company’s promoters Punit Goenka and Subhash Chandra for alleged diversion of funds.

Also Read: Sony faces Hobson’s choice with Zee merger

Zee’s share price is up 14 percent this year but still down around 10 percent from its September 2021 levels.

“If you look at the Nifty Media index, apart from Sun TV and DB Corp, none of the stocks have done well this year. Zee has seen a lot of ups and downs due to issues related to its merger with Sony.

“In the cinema business, PVR-INOX is still lagging occupancy levels in terms of pre-Covid numbers. Radio companies and cable TV distributors too are struggling,” Karan Taurani, Senior Vice President-Research Analyst at Elara Capital, told Moneycontrol.

Taurani, who has covered the media and entertainment sector for over a decade, highlighted a fundamental shift that is underway in this space.

“Consumption is aggressively moving towards digital, and traditional media is in a spot of bother, as they are not able to monetise digital in a similar manner. Digital is a fragmented market, you have social, search, e-commerce, etc in the ecosystem. Traditional media has perfected their business model over 25-30 years but they are yet to figure out digital monetisation in a significant manner,” he said.

That said, the market view is cautiously optimistic for the sector as a whole, with ad spends in the run up to the general elections of 2024 seen as a major boost in the near term.

Analysts also expect the Zee-Sony merger to conclude soon, which will lead to a re-rating of the stock.

Zee’s operational performance in Q2 FY24 was better than expected, with EBITDA margin improving to 13.6 percent after being in single digit for the last two quarters, domestic brokerage firm Prabhudas Lilladher said in a recent note.

“Given NCLT approval is already in place and SAT has overturned SEBI’s decision that barred Mr Punit Goenka from holding managerial position in a listed entity, we do not foresee any further delay in merger with Sony,” it added.

Grin and Bear IT

Elevated interest rates and weak consumer sentiment in the US and Europe – the biggest markets for domestic software firms – have made 2023 a forgettable year for India’s IT majors.

The slowdown in discretionary spends has led to delays in decision-making as well as deal conversions for software services companies.

The pain was evident in the IT pack’s results for the quarter ended September.

Also Read: Here are the 10 biggest wealth-creators of 2023, do you own any?

TCS, the country’s biggest IT services company, posted a sequential decline in dollar revenue for the first time since the pandemic-marred June 2020 quarter, while Infosys slashed its FY24 revenue growth guidance for the second straight quarter to a measly 1-2.5 percent.

These two stocks, which account for over 50 percent weightage in the Nifty IT index, have had a lackluster year. TCS has risen 12 percent this year, while Infosys is down nearly 2 percent.

“We feel that the near-term outlook of the Indian IT players is not very optimistic due to prevailing macroeconomic uncertainty in the US and Europe. Most of the IT companies have revised their guidance downward, citing a challenging demand environment and declining growth in the industry,” Rajesh Sinha, Senior Research Analyst at Bonanza Portfolio, told Moneycontrol.

The silver lining is that deal wins remain strong.

“Many Indian IT service companies reported the highest-ever order book despite the lack of near-term visibility. Clients reprioritizing non-discretionary projects due to uncertain economic conditions have led to strong order inflows for Indian IT companies,” he said.

The ability to regain momentum in Nifty IT index hinges on how CY24 IT budgets pan out.

“We advise investors to wait for one-two quarters to get clarity on the macro outlook from the US and Europe,” Sinha added.

However, with the US Federal Reserve leaving its key interest rate range unchanged on December 13 and also signalling rate cuts in 2024 due to improving macroeconomic conditions, some experts feel this is a good time to enter the IT segment.

“Long-term investors can now turn into buying IT stocks, primarily large-caps as they have stronger balance sheets. There were also expectations of order flows being dried up but these largecaps have showcased sustained order books in the last few quarters,” said Rajesh Agrawal, head of research, AUM Capital Markets.

“The biggest positive presented by IT companies at the current juncture is their reasonable valuations as compared to the historical averages. Such pockets in the market are difficult to find, especially after the recent bull run. Moreover, several largecap IT majors also reward their investors with good dividends and constant buyback which is a bonus,” he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.