F&O Manual | Nifty trades marginally lower, analysts expect range-bound trade till year-end

Bullish set-ups were observed in Bajaj-Auto, Hindalco, National Aluminum, Reliance, Hcl Tech, Asian Paints, Zyduslife, Sail, Bhel, Fluorochem, Indian Hotel, LTTS, BDL, Deepak Fertilizer amongst others.

Indian benchmark indices are trading lower amid consolidative momentum. The BSE Midcap index is down 0.5 percent, and the small-cap index is trading flat. According to analysts, the Nifty is likely to see consolidative momentum until the year-end. Immediate support is placed at 21,250, then 21,100 zones, while resistance is at 21,500, then 21,650 zones.

At 10am, the Sensex was down 148.29 points or 0.21 percent at 71,166.80, and the Nifty was down 42.60 points or 0.20 percent at 21,376.10. About 1,679 shares advanced, 1,309 shares declined, and 101 shares remained unchanged.

Nifty Highlights

– Nifty December future closed at 21,477.25 with a premium of 58.60 points versus a 100.45 point premium in the last session.

– Nifty futures Open Interest decreased by 6.11 percent to 1.45 crore, and –

– Nifty Put/Call Ratio (Open Interest) decreased from 1.47 to 1.12 levels.

– India VIX was up by 5.86 percent from 13.13 to 13.90 levels, indicating increased volatility at life high territory.

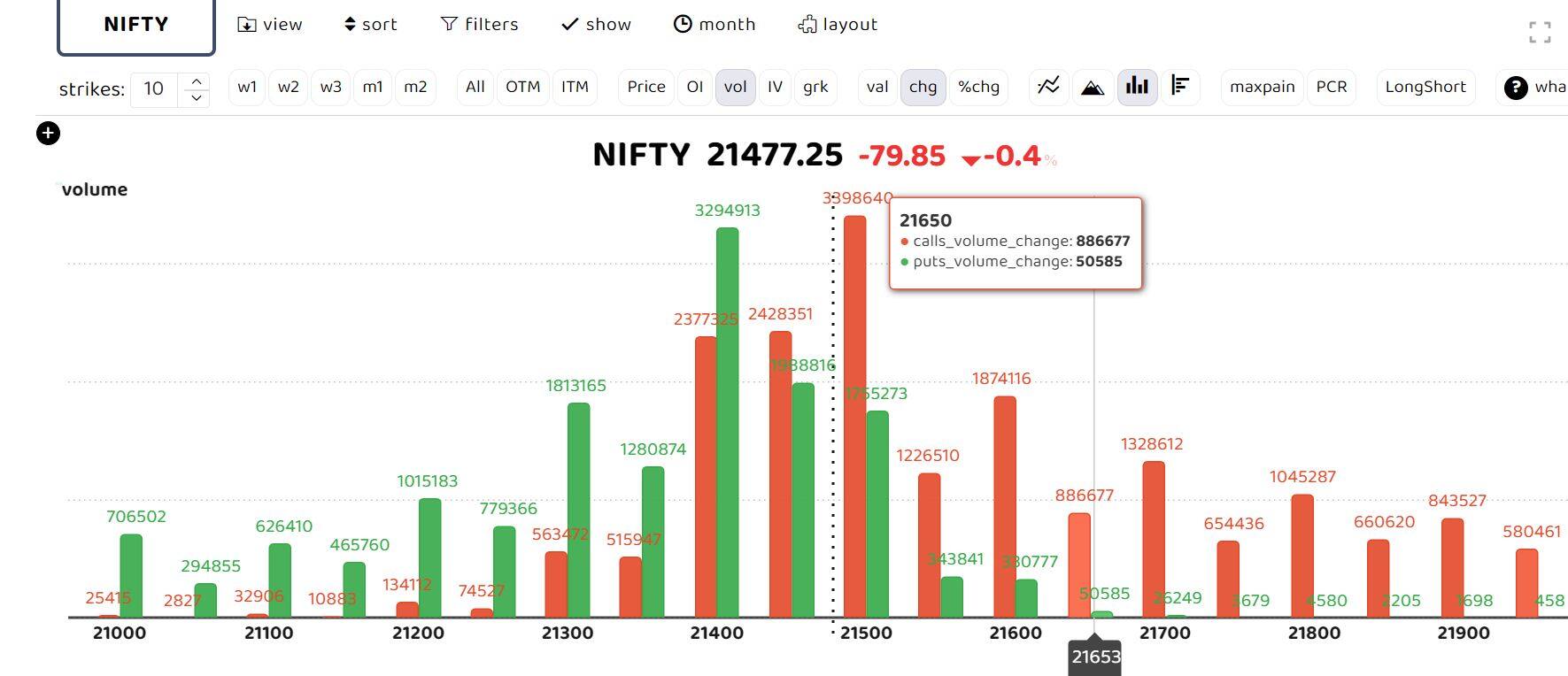

On the weekly front, Maximum Call Open Interest is at 21,500, then 22,000 strikes, while Maximum Put Open Interest is at 21,300, then 21,200 strikes. Call writing is seen at 21,500, then 21,450 strikes, while Put writing is seen at 21,400, then 21,450 strikes.

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Options data suggests a tussle between call and put writers at 21,400 and 21,500 strikes. “The Nifty is expected to consolidate, moving range-bound within 200 points until the year-end, with the next up move expected in January. Bank Nifty, on the other hand, may see a correction up to 47,500 levels,” Jyoti Budhia, a derivatives trader, said.

Story continues below Advertisement

“Going forward, the immediate resistance is established in the zone of 21,480-21,500, while support is placed at 21,330, followed by 21,250. India VIX is up by 5.88 percent, nearing its highest levels in over 8 months, indicating a rise in volatility at higher levels,” Sudeep Shah, head of derivative and technical research at SBI Securities, said.

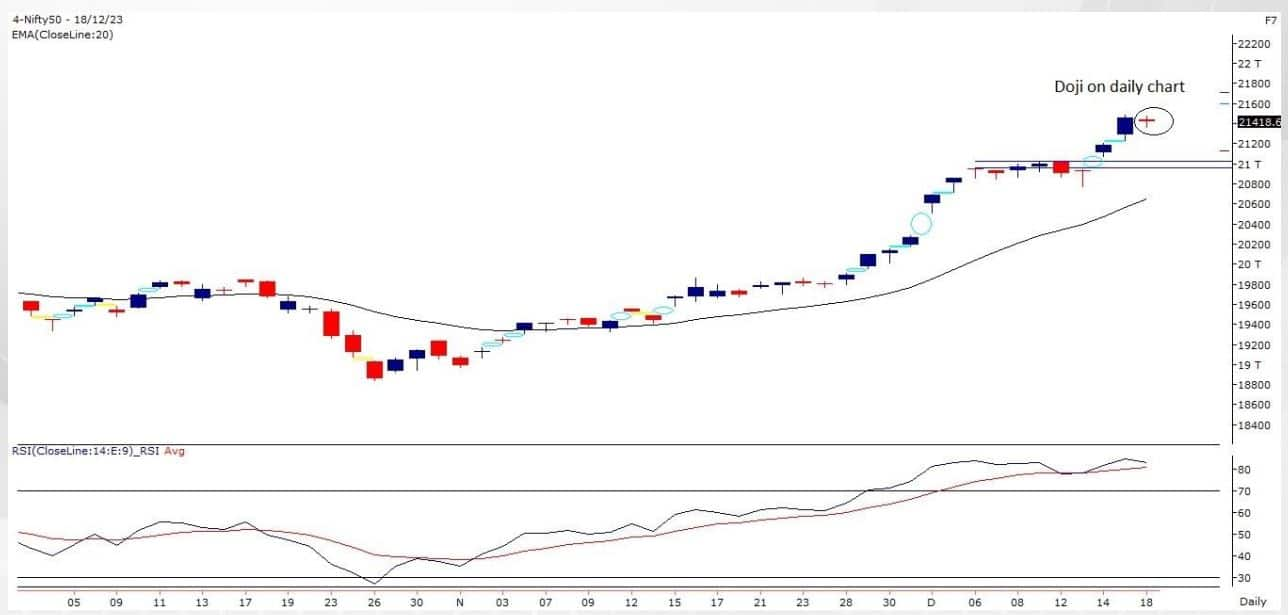

Technical chart of Nifty showing doji candle formed | Source: Motilal Oswal Financial Services

Technical chart of Nifty showing doji candle formed | Source: Motilal Oswal Financial Services

“The Nifty immediate support at 21,250 then 21,100 zones while resistance at 21,500 then 21,650 zones. Now it has to hold above 21,350 zones, for an up move towards 21,500 then 21,650 zones whereas supports are placed at 21,250 then 21,100 zones,” Motilal Oswal Financial Services said.

From the broader market, as per Shah, bullish set-ups were observed in Bajaj-Auto, Hindalco, National Aluminum, Reliance, Hcl Tech, Asian Paints, Zyduslife, Sail, Bhel, Fluorochem, Indian Hotel, LTTS, BDL, Deepak Fertilizer, Uti AMC, Hind Copper, Idbi, Prince Pipes, Exide, Rail Tel, CUB, Cyient and IRCTC.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.