Shipping giants halt Suez Canal routes: Should you buy shipping stocks now?

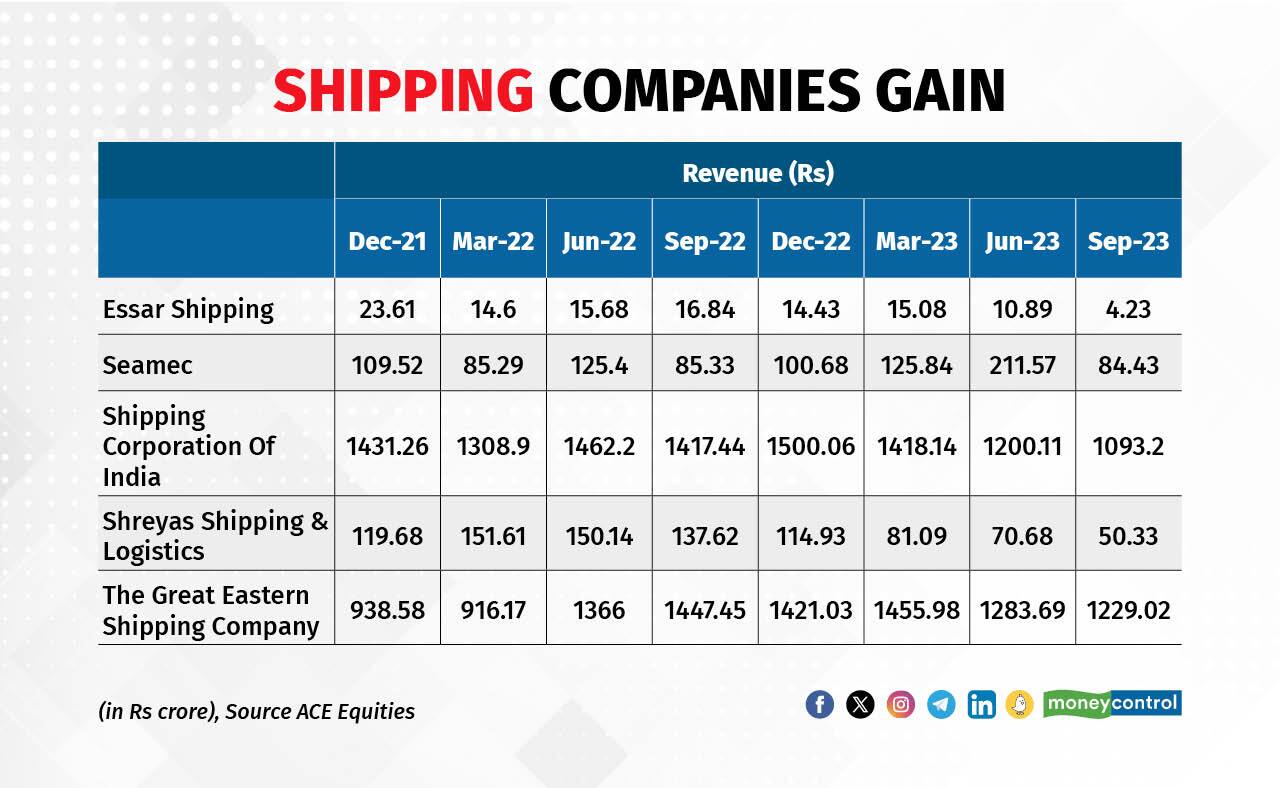

Listed shipping companies, like Shipping Corporation of India, Great Eastern Shipping, Essar Shipping, SEAMEC, and Shreyas Shipping & Logistics Ltd, are expected to benefit from increased freight charges and a rise in travel distances.

On December 17, two major shipping corporations — Liberian Shipping Corporation MSC and Denmark’s AP Moller-Maersk — announced their decision to pause movements through the Suez Canal route after the recent attacks on ships by Yemen-based Houthi rebels, backed by Iran, passing through the area.

Suez Canal authorities have said that they are monitoring the situation. Since November, around 55 ships have been rerouted from the Cape of Good Hope instead of the Suez Canal route.

While this is not the first time the Suez Canal route is seeing some blockade, the situation and its impact could be different, analysts estimate.

Also read: Suez Canal closure worries industry but government confident of minimal impact

Impact for shipping firms

Could this ongoing blockade impact shipping stocks and the industry itself? Analysts Moneycontrol spoke to as well as global trade commentators are keeping a close watch to see how the issue unfolds as approximately 12 percent of global trade passes through the Suez Canal route. It is also the quickest route from Asia to Europe, making it a preferred trade route. Andrew Holland, Managing Director and Head of Equity Capital at Avendus, explains that if the situation persists, it would lead to higher shipping rates, persistence of higher inflation and a shortage/delay in delivery of goods that need to be transported – whether it is raw materials or finished products.

Also read: How are the Red Sea attacks impacting shipping in the Suez Canal?

Rising freight costs

Story continues below Advertisement

Talking to CNBC TV-18 on December 19, G Shivakumar, CFO of GE Shipping said that the situation was evolving and it could end up seeing an increase in freight rates, especially in the container market. The tanker market, where there are more Indian shipping players , could be impacted as the market is already “tight”.

An increase in demand could lead to an increase in freight rates. The recent news that the US has offered to send convoys to support the passage of these ships has, to an extent, provided some ease to the markets, but Shivakumar added that how effective this would be is something they would have to wait and watch.

Over the last few quarters, a series of global crises have raised freight costs. In October, the Baltic Dry Index gained over 50 percent over September 2023. According to estimates, in the long-term transportation expenses could surge 30-40 percent.

While an increase in freight rates could lead to lower volumes, shortage of vessels for shipping companies and increased transportation costs for importers, on the flip side, there will be perverse beneficiaries.

If costs increase further, it could be a positive for shipping companies and their share prices. According to Vikram Suryavanshi, Vice President – Institutional Research, PhilipCapital, earnings for most shipping companies have been rising, thanks to trade disturbances.

Suryavanshi cites the example of GE Shipping, the largest player in the space. It has seen substantial improvement in earnings over the last 4-6 quarters because of trade disturbances.

“What typically happens is that when trade disturbance occurs, shipping companies have to make longer journeys which increase tonne-mile demand for the same amount of cargo. This reduces supply-side shipping capacity and ultimately impacts freight rates. This is good for shipping companies. Most of the increases in costs like insurance, and fuel will be borne by the importer/exporter,” he says.

For the last six quarters, the freight rate increase in the tanker has been very significant and tanker shipping companies have been very much benefited from these global disturbances, right from the Russia-Ukraine conflict.

Listed shipping companies, like Shipping Corporation of India, Great Eastern Shipping, Essar Shipping, SEAMEC, and Shreyas Shipping & Logistics Ltd, are expected to benefit from increased freight charges and a rise in travel distances.

“Conversely, companies focused on exports may encounter challenges as a result of the escalated transportation costs,” Awanish Chandra, executive director and head of institutional equities, SMIFS, adds.

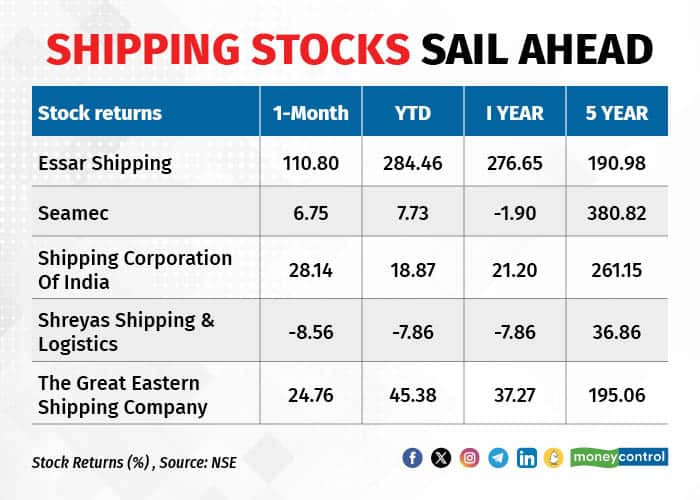

On December 19, shares of shipping stocks were trading in the green with gains of 2- 5 percent across the board. The biggest gainers were Great Eastern Shipping and Essar Shipping, with around 4 percent each. But while the stocks have seen a boost, most analysts advise that one should wait and watch before taking a specific call on shipping stocks based on the ongoing situation. Major implications on businesses and stocks would take some time to show, they said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.