F&O Manual | Bank Nifty faces selling pressure beyond 48,100, likely expiry around 48,000

Among sectors, IT, FMCG, oil & gas up 0.5-1 percent, while PSU Bank index down 0.5 percent.

Indian benchmark indices reached a record high intraday, driven by the IT, FMCG, and oil and gas stocks. Both the Nifty and the Bank Nifty are experiencing a mild correction with respective support base at 21,450 and 47,600.

The candlestick pattern on the daily chart suggests the bulls’ resilience at lower levels but caution at higher levels. While this formation indicates a bullish undertone, momentum indicators signal high overbought conditions.

By 12pm, the Sensex surged 200.60 points or 0.28 percent to 71,637.79, and the Nifty gained 74.60 points or 0.35 percent, reaching 21,527.70. Out of the total shares, 1,752 advanced, 1,444 declined, and 83 remained unchanged.

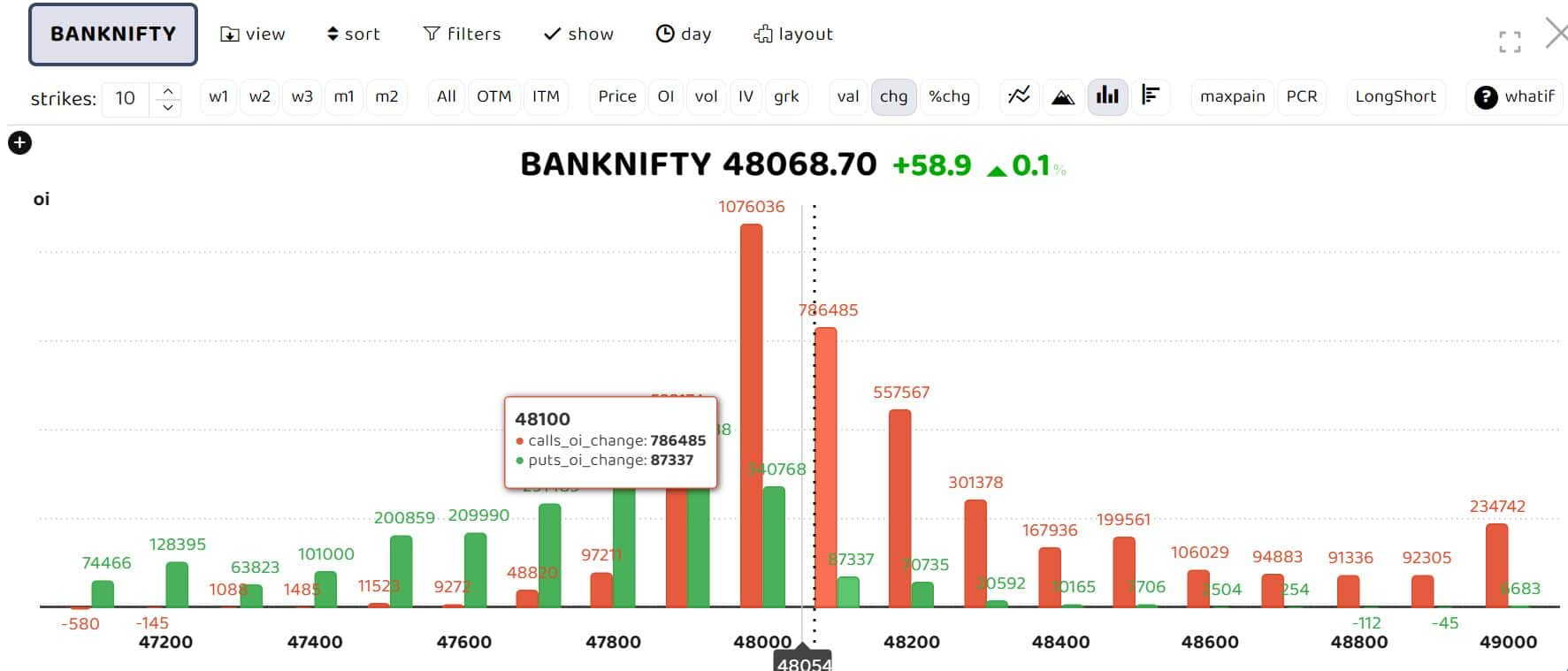

Bank Nifty

Bank Nifty weekly expiry outlook

Option data reveals selling pressure over 48,000 – 48,100 levels, suggesting heavy writing in both of these CE. The trend on the weekly expiry remains negative, with Bank Nifty expected to close below the 48,000 mark.

“The highest Open Interest (OI) concentration can be observed in the 48,000 CE, 48,100 CE, and 48,200 CE, indicating a scenario of writing. Traders may anticipate a decline once the index breaches the spot 47,900-mark; until then, the expiry is expected around the spot 48,000 level. Technically, the index may slide towards 47,800, and if it fails to show a rebound, it could further decline to the 47,600 level. The resistance on the expiry day remains at the 48,050 mark,” Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

Story continues below Advertisement

He recommends traders to take a long position in the 48,100 PE in the range of 110–100, holding 60 as the support level and targeting a range of 180–220.

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

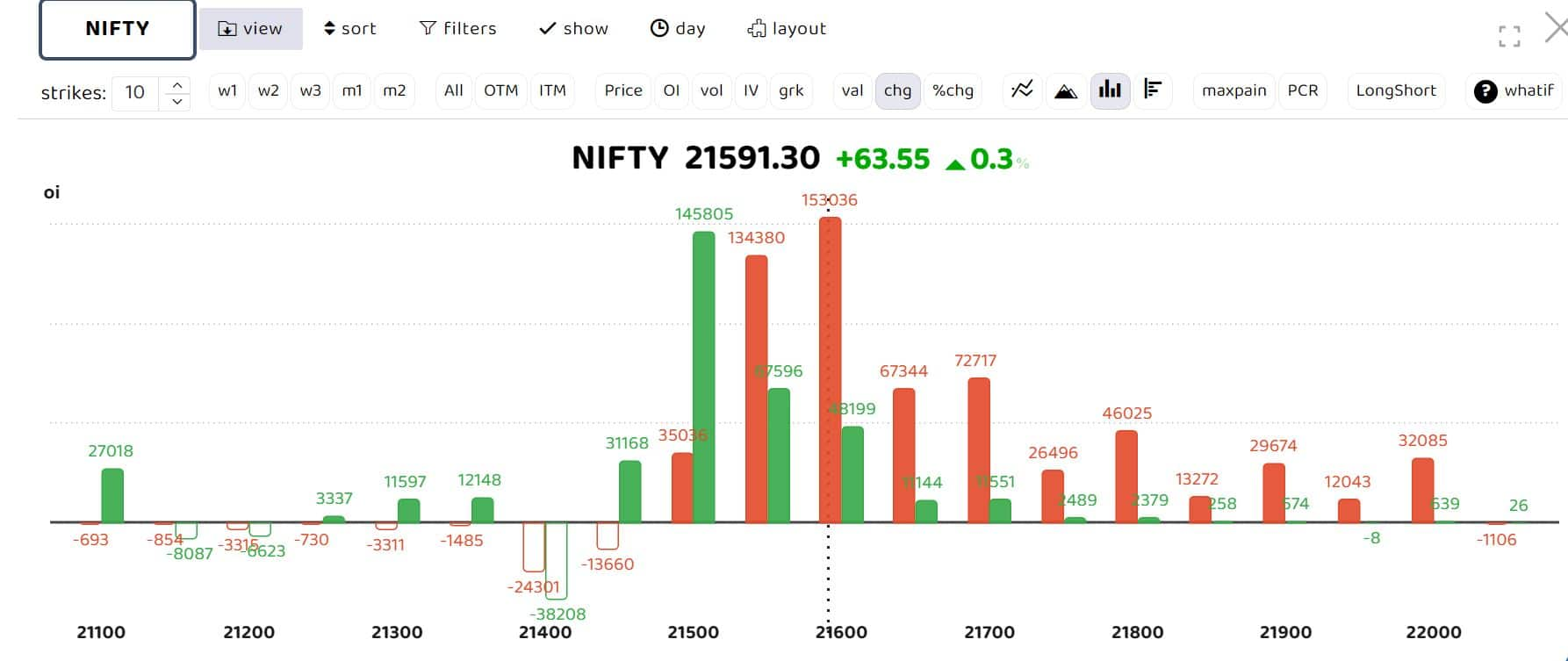

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

“Significant call writing buildup is observed at 21,500 and 21,600 strikes, with considerable Open Interest additions on the puts front, specifically at 21,400-21,300-21,200. Overall, the expected range for the day is 21,380 on the downside and 21,630 on the upside,” said Sudeep Shah, head of derivatives and technicals research, at SBI Securities.

“Given the absence of significant triggers and the market approaching the Christmas week, we anticipate continued time-wise consolidation. During this period, dips may be consistently bought, while caution is advised at higher levels. Immediate support is identified around 21,350, followed by support at the bullish gap at 21,200,” Angel One said.

“A significant price correction may only be triggered if these levels are breached. On the upside, the range of 21,550 to 21,600 represents a key resistance, formed by the 200 percent reciprocal retracement of October month’s decline. Traders are recommended to monitor these levels closely and tailor their strategies accordingly,” said the brokerage house.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1296348323-44c7aca2cbb14d2f84b65b393fec649a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-171349083-062edb8f4c13435797d038746c27422f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-21669937071-728bfabe684b4c8aa17fc9c47255a740.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1338457868-a84a285627f64532a38b290e15fc48ea.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1440361960-8ba9445e90a74d6d9177d1c88bd6608b.jpg)