Voltas surges as bullish Mat Hold candle pattern signals breakout

Representative image

The BSE Consumer Durable Monthly Chart index has broken out after a two-year consolidation patch. Among individual stocks in the BSE Consumer Durable Index, the Voltas scrip is displaying the maximum bullish traction.

As of 10:26 am on December 20, Voltas is trading at Rs 947.90, up by 50.80 points or 5.66 percent.

According to Kapil Shah, Technical Analyst at Emkay Global, “Voltas stock has encountered three major declines in the past decade, and each time it has dropped around 42 percent. However, the most recent decline of 44 percent suggests that the fall is likely to end, based on the stock’s previous history.”

“The stock is forming a Bullish Mat Hold candle pattern, which is a positive development and could indicate an upward trend in the near future,” added Shah.

Voltas: Buy | LTP: Rs 947 | Stop-Loss: Rs 840| Target: Rs 1040 | Time frame: One month

Stock of Voltas showing Bullish Mat Hold Candle pattern | Source: Emkay Global

Stock of Voltas showing Bullish Mat Hold Candle pattern | Source: Emkay Global

Additionally, the stock has found support at a horizontal line and formed a base for one year, which can be considered an accumulation zone. This, according to Shah, is a sign that the stock is stabilizing.

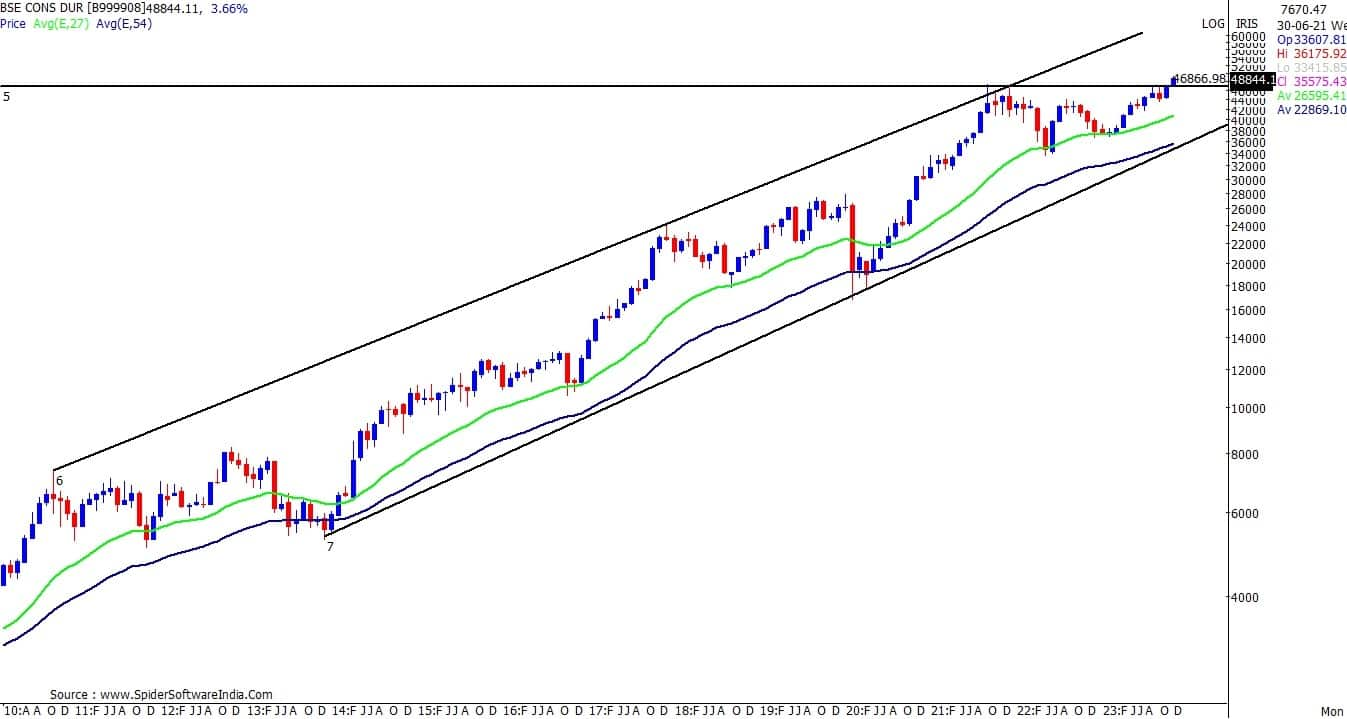

On a broader scale, Shah highlights that the BSE Consumer Durable Index’s monthly chart has broken out after a two-year consolidation patch and has been trading in a rising channel for nearly 14 years. He adds, “Despite an intermediate correction, the market seems to have found support in the moving average band, pointing to a potential bullish continuation.”

Story continues below Advertisement

Emkay Global provides the BSE Consumer Index monthly chart, indicating a breakout after a two-year consolidation patch as the source.

Bse consumer index monthly chart indicating the index has breaking out after a two-year consolidation patch | Source: Emkay Global

Bse consumer index monthly chart indicating the index has breaking out after a two-year consolidation patch | Source: Emkay Global

“The Consumer Durable sector has been underperforming the broader strategic indices, but there has been observed upward momentum in household appliance stocks recently,” commented Shah.

Based on this analysis, he advises that the stock looks promising for accumulation in the range 930 to 910. However, he cautions that if the stock falls below the 840 level, the bullish view will be negated. In the scenario of a positive trend, the upside potential could reach up to the 1040 level.

Follow our live blog for all market action

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2150466569-52a85a86f8bf44fb8d2dee9c1f497c40.jpg)