Put option premiums muted, protection cost to remain low as market looks up ahead of polls

Mallick pointed out that the option premiums were lower in 2019 than in 2014. Now, they are even lower.

As the bulls continue to drive equity markets to unprecedented highs with each passing day, attention has now shifted to assessing the sustainability of this rally in the lead-up to the general elections in 2024. Historically, the NSE Nifty 50 has experienced surges in the run-up to the Lok Sabha polls in 2014 and 2019. This time, it’s a little different.

“The watershed event before elections seems to be the November-December period the previous year when key Hindi heartland states go to the polls. Post that, meaningful moves have happened in election years that can be directly attributed to the national mandate,” said Nandik Mallik, Chief Investment Officer, Avendus Capital Public Markets Alternate Strategies.

“A similar pattern seems to have started emerging this time again for the 2024 cycle since December 3,” Mallik said. However, this time, the uncertainty has been taken out with BJP’s state election victories. Thus, a lot of the rally for this year has been front loaded, he added.

Put option premiums fall after market rallies as election uncertainty taken out

What also distinguishes this cycle for traders is the intriguing aspect that amid the ongoing rally and overbought conditions, premiums on put options have fallen considerably lower than call options. This is likely to remain so, since amid the current rally, it’s safer for traders to call a market bottom rather than trying to find the top, said Mallick.

“Put prices will especially be lower than what they were in 2019, and we are likely to have a rising market scenario where Call prices are consistently higher than Put prices going into the election event,” said Mallick.

“Markets seem to be already factoring in lesser uncertainty on the domestic front, and barring any major negative headline globally, will move towards a zone of low option prices,” added Mallick

Bank Nifty put premiums around December 2023 state elections

Story continues below Advertisement

To understand, Mallick highlights that the Bank Nifty at-the-money strike put option price fell to as low as 70 percent of the same strike call option immediately after the state election results. This, he said, is ‘abnormal’. In his own experience, ATM strike put option prices usually do not fall below about 85 percent of call premiums.

Bank Nifty call vs put premiums: Investors willing to pay more to secure upside

Discussing the run in Bank Nifty and its option trends, Mallick said, “After almost 10 percent underperformance in the last 6 months, Bank Nifty has had a fantastic start to December. The index has distinctly outperformed after state elections were out, entering a deeply overbought zone (Relative Strength Index – RSI of almost 80).” An RSI above 70 indicates overbought conditions

Despite the overbought conditions, Bank Nifty call option prices remained higher than put option prices for the whole week post state election results, he said. “The pattern may well manifest for the next few months when protection costs could be lower, not just to the historical put prices, but also to the call premiums that investors may be willing to pay higher for now to secure potential upside participation.”

This implies that the costs associated with option protection will remain low. For put option writers, this translates to a limited opportunity to make substantial profits as compared to previous election rallies. Mallick pointed out that the option premiums were lower in 2019 than that in 2014. Now, those are even lower.

Decoding Nifty rallies in the run up to 2014 and 2019 general elections

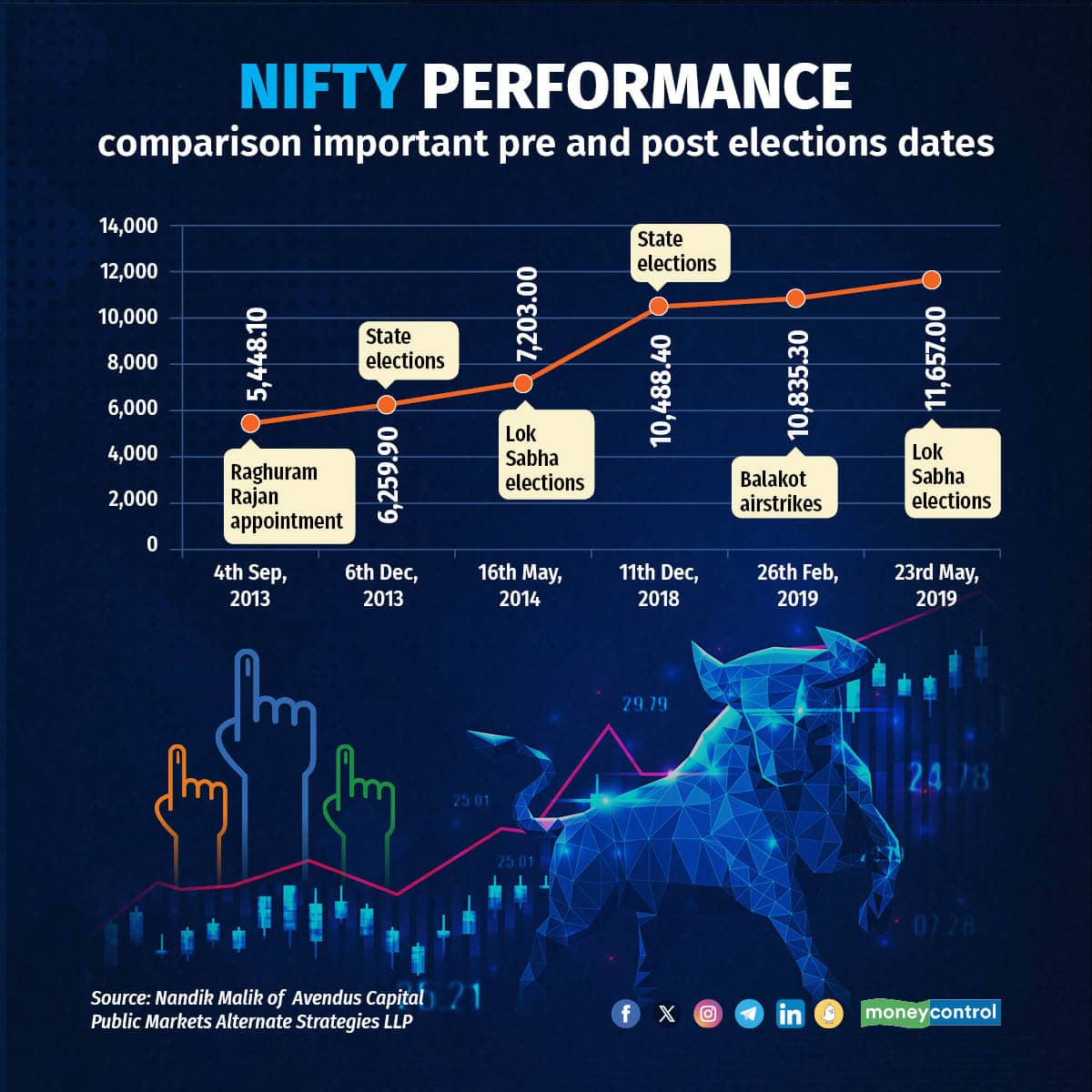

Understanding historical pre-election trends in 2014 and 2019, Mallik compares Nifty performance from important pre and post-election dates. Mallik’s data analysis reveals that the Nifty witnessed a 15 percent plus pure election rally ahead of 2014 elections from December onwards, after already having had a 15 percent rally the quarter before.

In comparison, Nifty had a more subdued 10.5 percent rally in 2019, with most of it occurring after the government’s retaliatory airstrikes in response to the terrorist attack in Pulwama. This time around, Nifty has already rallied 6.5 percent (from 20,268) since the BJP swept all three key states in the Hindi heartland.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.