F&O Manual | Benchmarks trade positive, limited downside in Sensex on expiry till 70,750

Mid day, all the sectoral indices are trading in the green with auto, pharma metal and realty up 1 percent each.

The benchmark Indian indices traded positively amid volatility till mid-day December 22. In the Sensex expiry, the price action suggests a limited downside for the index, however, if the day’s low of 70,750 is breached, it could potentially reach 70,500.

The Nifty is most likely to trade in the 20,700–21,700 range in the December expiry, with 21,000 acting as a pivotal level.

All sectoral indices are trading in the green, with auto, pharma, metal, and realty up 1 percent each.

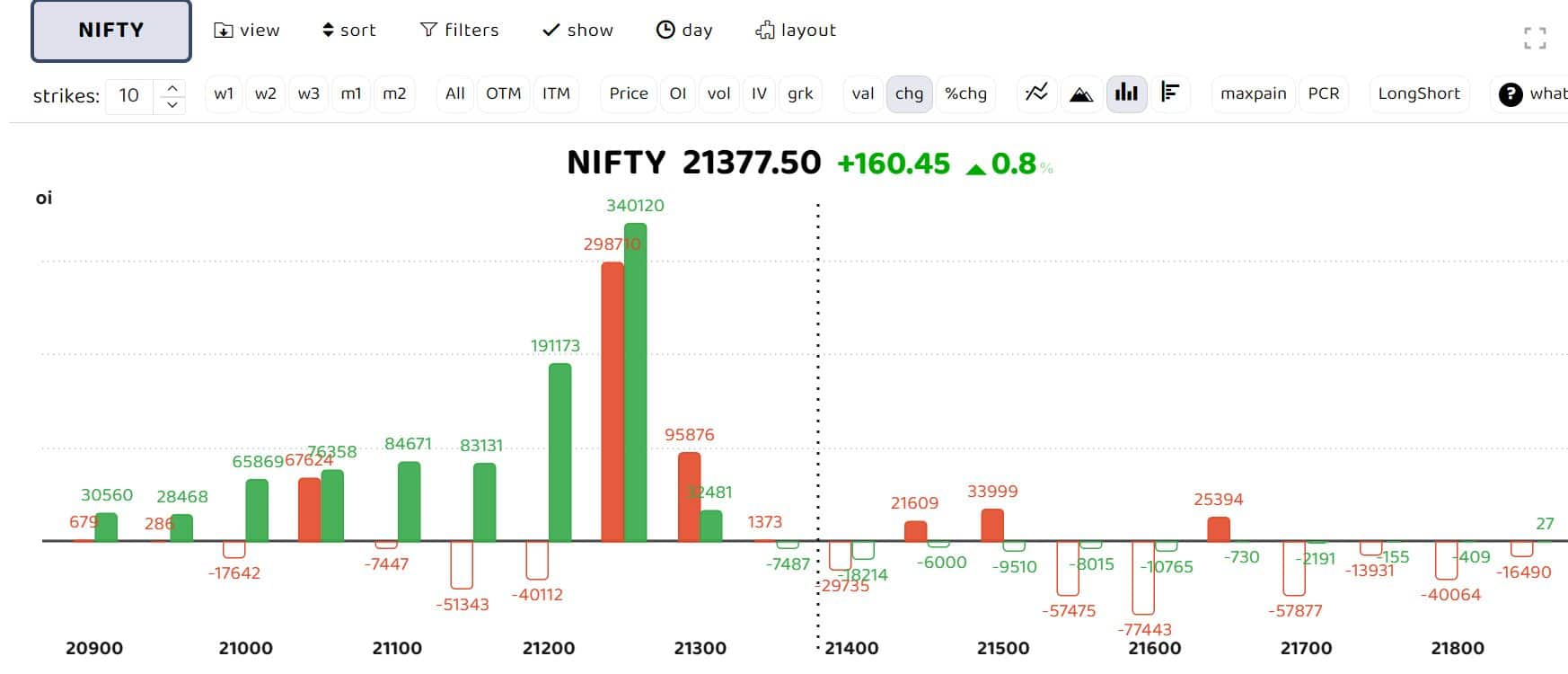

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Option data shows strong support at 21,150, followed by 21,100 and 21,000 levels. A tussle between put and call writers can be seen at the 21,250 strike, forming key straddle positions.

“The Nifty options OI distribution shows that the 21,500 and 21,500 Call strikes have the highest OI concentration and may act as strong resistance for the current expiry. Nifty Put strikes at 21,000 and 20,800 witnessed the highest OI concentration and may act as strong support for the current expiry. The Nifty is most likely to trade in the range of 20,700–21,700 in the December expiry, with 21,000 acting as a pivotal level,” Axis Securities said.

The Put to Call ratio (PCR) is quoting around 1.02. The December series has witnessed a wide range of PCR from 0.76 to 1.09. The PCR is moving to a bearish territory, indicating the expansion of firms and cautious movement at higher levels.

Sensex Expiry Day View

Story continues below Advertisement

“The Sensex has surpassed the 61.8 percent Fibonacci level of Wednesday’s fall and has decisively crossed the crucial level of 71,000. Today is the expiry for the weekly contracts, and significant put writing is observed at the strike prices of 71,000, 71,100, and 70,800. On the upside, 72,000 has the highest OI addition, depicting that Sensex is likely to trade below it for today’s expiry,” Sheersham Gupta, director and senior technical analyst at Rupeezy, said.

“Price action suggests a limited downside for the Sensex. However, if the day’s low of 70,750 is broken, the Sensex could see the level of 70,500,” he added.

Among individual stocks, bullish setups were observed in BPCL, Bank of Baroda, Power Grid, Britannia, Voltas, Dixon, Hindustan Copper, Metropolis, IRB, Cochin Shipyard, NLC India, Cyient, MGL, MCX, NMDC, Shyam Metalics, Zensar Technologies, BEML, IRFC, Chemplast, and Vmart.

FII Data

Market participant data indicates that FIIs have decreased their short positions in Index Futures. They have also reduced exposure in index calls and significantly decreased exposure in Put options.

Overall, FIIs have added 1,32,610 long contracts in index futures, increased long contracts by 1,57,047 in Call Options, and added 60,927 contracts in Put Options as of December 20, 2023.

“With no signs of short formation in the derivative space as indicated by the FII data, the fall appears to be local in nature, likely due to overbought conditions, which have now been nullified to a great extent. Additionally, within the cash segment, post this fall, we might witness a change in the leadership of sectors, and the previously dominant sectors may not take the lead in the rebound move. This downturn has served as a wake-up call for those who were overly confident in betting on small-caps and lesser-known midcap names,” Sudeep Shah, head of derivatives and technical research at SBI Securities, said.

He highlights the importance of focusing on structurally sound stocks rather than chasing small-caps that have experienced significant gains in the last few months.

:max_bytes(150000):strip_icc():format(jpeg)/INV-HER-MONEY-MINDSET-Small-Business-Grants-For-Women-FINAL-111-ab24d20523cf4ab89d84145b410b2040.png)

:max_bytes(150000):strip_icc():format(jpeg)/INV-HER-MONEY-MINDSET-HOW-TO-TALK-ABOUT-MONEY-WITH-YOUR-PARTNER-FINAL-1-f2e1ae40a5c5456ba1ef77d811c2640b.png)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1311372369-ddca915fb1a84bf5911f31bc7c20c8c5.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1463900900-d61f928c336943cbbe192db7543b3ccb.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1411781329-6f3a8d8841e1416ab74b55f3d82fb0ec.jpg)