Dalal Street Week Ahead: Red Sea crisis, oil prices, COVID-19 cases among factors to watch

Market may consolidate next week until surpasses previous record high

As we enter the last leg of this calendar year, Indian markets are staring at low trading volumes in a holiday-shortened week, a potential threat in a jump in COVID-19 cases and rising uncertainty in the Red Sea. The effects are already visible as Indian benchmarks snapped a 7-week gaining streak in the week gone by and closed lower.

Last week, BSE Sensex shed 0.52 percent or 376.79 points to finish at 71,106.96, while Nifty50 declined 107.25 points or 0.49 percent to end at 21,349.40. On December 20, the Sensex and Nifty hit fresh milestones of 71,913.07 and 21,593, respectively.

Among sectors, the Nifty PSU Bank index plunged 3 percent, the Nifty Media index was down 2 percent, the Nifty Auto index was down 1.4 percent, and the Nifty Metal index shed 1 percent. On the other hand, the Nifty FMCG and Pharma indices added 1 percent each. The Nifty Midcap 100 closed 1 percent lower while Nifty Smallcap 100 closed 0.27 percent down.

The ‘buy on dips’ strategy continued to drive investors during the subdued week, believe analysts. “Heading into the festive season and year-end, we can anticipate a range-bound trade scenario with limited data points,” Vinod Nair, Head of Research at Geojit Financial Services said.

The market will remain shut on December 25 for the Christmas holiday.

Here are some factors that will keep traders busy in the coming truncated week:

Red Sea Crisis

Story continues below Advertisement

The Houthi rebels have declared support for Hamas in the Israel-Gaza conflict and are thus targeting commercial ships travelling via the Red Sea. Several companies have either suspended operations or are diverting vessels, flaring up freight rates as routes get longer and volumes reduce.

Also Read: Code Red: Red Sea crisis may hobble the global economy

As of December 21, about 158 vessels had been re-routed away from the Rea Sea carrying over 2.1 million cargo containers, reported CNBC. The value of this cargo is estimated to be $105 billion.

Varun Gogia, Assistant Vice President and Sector Head, Corporate Ratings, ICRA Ltd, told Moneycontrol that the overall logistics costs are bound to rise, which Indian exporters and importers may find difficult to pass on to end users. If the Red Sea conflict lingers on for a long time or the conflict escalates, it could stoke inflationary pressures.

Also Read: Suez Canal crisis: Could this impact India’s earnings story?

COVID cases

Cases of COVID-19 new JN.1 variant has been rising in India, and the Central government has urged the states to maintain a state of constant vigil, and report all influenza-like and severe acute respiratory illnesses. States have also been advised to ensure adequate testing in all the districts as per COVID-19 testing guidelines and maintain the recommended share of RT-PCR and Antigen tests. If the situation worsens, it could spook the markets going ahead.

Oil prices

Oil prices eased on Friday ahead of the long Christmas holiday weekend on expectations Angola could increase output after leaving OPEC, reported Reuters, but rose for the week on positive U.S. economic news and worries Houthi ship attacks would boost supply costs.

Brent futures fell 32 cents, or 0.4 percent, to settle at $79.07 a barrel, while U.S. West Texas Intermediate (WTI) crude fell 33 cents, or 0.5 percent, to settle at $73.56. That left both benchmarks up about 3 percent for the week gone by after gaining less than 1 percent last week.

Also Read: Rebel Ripples: Oil prices may rise temporarily due to the Red Sea crisis, say analysts

With geopolitical concerns on the rise again, foreign institutional investors sold equities worth Rs 6,300 crore in the week gone by. Some analysts have also attributed the selling to the normal course of profit-taking. Meanwhile, domestic institutional investors bought Rs 8,900 crore worth of equities in the week gone by. Nonetheless, FIIs have been bigger buyers than DIIs in the cash market for the month so far.

Check the detailed FII flows breakup here

“FPI inflows which were negative in the previous three months have sharply turned positive in December. Total FPI inflows in December through 22nd is Rs 57,313 crores including the buying through stock exchanges and primary market. FPIs were big buyers in financial services and also bought in sectors like autos, capital goods and telecom,” Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services said.

“Since 2024 is expected to witness further declines in U.S. interest rates, FPIs are likely to increase their purchases in 2024 too,” he added.

Domestic data releases

Traders and investors will keep an eye on bank loan growth, deposit growth, foreign exchange reserves data as well as infrastructure output numbers that will be released after market hours on December 29.

Technical view

According to Sudeep Shah, deputy vice president and head of technical and derivative research desk at SBI Securities, 21,050-21,100 is now an important support for Nifty in the upcoming expiry week. “It is crucial for Nifty to cross 21,430 for continuation of positive momentum upto 21,650-21,700,” Shah said.

Ajit Mishra, SVP – Technical Research, at Religare Broking said it would be a healthy consolidation if Nifty spent some time around the current levels.

Also Read: Technical View | Recovery indicates Nifty may march towards 21,600 again, though snaps 7-week rally

Talking about Bank Nifty, Aditya Gaggar, Director of Progressive Shares said that there is a long way to go because as per the Descending Broadening Wedge pattern breakout, the target stands at 50,250. As per SAMCO Securities, immediate support for Bank Nifty remains at 46,600 while resistance is placed at the 48,220 level.

Also Read: MC Explainer | Backtesting and how to read a backtest report

The primary market will remain active in the last week of 2023, mainly for the SME segment and not for the mainboard segment as there won’t be any new launches from the mainboard segment. The Rs 570-crore Innova Captab IPO will be closing on December 26, while all the public issues closed last week will make a debut on the bourses in the coming week.

Muthoot Microfin, Motisons Jewellers, and Suraj Estate Developers will be listing shares on December 26, while Happy Forgings, RBZ Jewellers, and Credo Brands Marketing will debut on December 27.

Azad Engineering will list its equity shares on the bourses on December 28, and Innova Captab on December 29.

In the SME segment, investors can subscribe to AIK Pipes and Polymers IPO from December 26-28, while the subscription for Shri Balaji Valve Components, Manoj Ceramic, HRH Next Services, and Akanksha Power and Infrastructure IPO will take place from December 27-29. Kay Cee Energy & Infra will be the last IPO to open in the current year on December 28 and its closing date will be January 2.

In the coming week, Trident Techlabs, Supreme Power Equipment and Indifra IPOs will be closed on December 26, while the public issue of Sameera Agro and Infra will close on December 27.

On the listing front, Sahara Maritime will make its debut on December 26, and Shanti Spintex & Electro Force (India) on December 27, while Trident Techlabs, Supreme Power Equipment and Indifra will list their shares on December 29.

F&O Cues & India VIX

As per the monthly options data, the Nifty 50 is expected to face resistance at 21,500-21,600, while 21,200-21,000 is likely to act as key support, followed by crucial support at 20,800 levels. Overall, the data suggested that the index may remain in the broad range of 20,800-21,600 levels for the coming days.

The 22,000 strike owned the maximum Call open interest, followed by the 21,500 strike & 21,600 strike, with meaningful Call writing at the 22,500 strike, then 22,000 & 21,800 strikes, while the maximum Put open interest was visible at the 21,000 strike, followed by 21,200 strike & 20,800 strike, with Put writing at 21,300 strike, then 21,200 & 21,400 strikes.

Meanwhile, the India VIX, which is referred to as the fear gauge, is holding above 13.5 levels, indicating an upcoming rise in volatility, said analysts. Low volumes in holiday-shortened weeks can also result in high volatility.

“With India VIX crossing and sustaining above 13.5-14 levels after 8 months signalling a shift in volatility regime for next few months. Buying the dips gradually is suggested with reduction of over leveraged positions,” Sudeep Shah said.

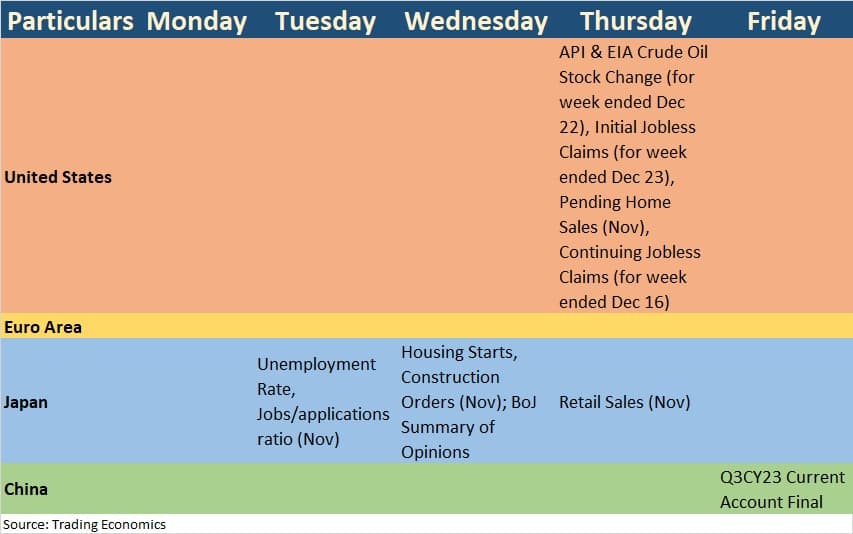

Global Economic data points

Here are key global economic data points to watch:

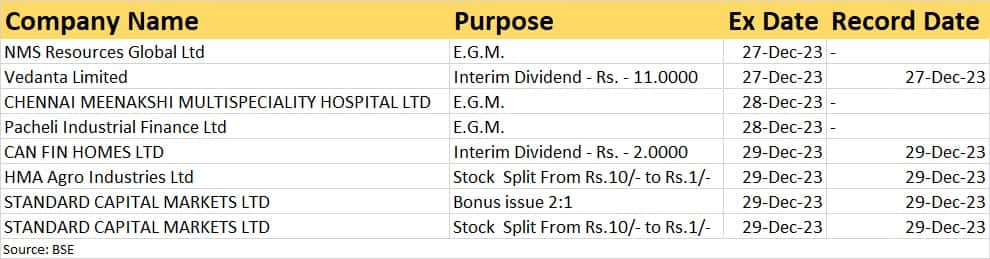

Corporate action

Here are key corporate actions taking place in the last week of 2023:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2150466569-52a85a86f8bf44fb8d2dee9c1f497c40.jpg)