Broader indices touch fresh highs; 48 small-caps give double digit return

For the year 2023 and Q3FY24, the broader indices have outperformed the main indices.

The market bounced back from the losses of the previous week and ended the year 2023 on a positive note. In the last week of December, it hit new milestones thanks to a number of positive factors, including falling US bond yields, decreasing crude oil prices, increased buying from foreign investors, and expectations of rate cuts by major central banks in the early part of 2024.

For the week, BSE Sensex gained 1,133.3 points or 1.60 percent to close at 72,240.26, while Nifty50 jumped 382 points or 1.78 percent to end at 21731.4.

On December 28, the Sensex and Nifty touched fresh record highs of 72,484.34 and 21,801.45, respectively. However, for the year 2023, BSE Sensex and Nifty50 rose 18.74 percent and 20 percent, respectively.

In this week, broader indices also touched fresh record highs with BSE-Midcap, BSE-Largecap and BSE-Smallcap added 2.6 percent, 2 percent and 1.6 percent, respectively.

For the year 2023 and Q3FY24, the broader indices have outperformed the main indices.

“Despite a slight profit booking on the last trading day of the year, the domestic market experienced a gradual rally, riding on the positive global market trend. The optimism is fuelled by expectations of rate cuts by the US Fed and a cooling global inflation scenario. Further, an ease in Red Sea disruption and a reversal of FII inflows supported the market to touch new highs. The anticipation of political stability in the upcoming national poll in 2024 and a positive market outlook are supportive factors. Sector-wise, auto and FMCG outperformed in expectation of a revival in demand, while the IT sector underperformed due to profit booking,” said Vinod Nair, Head of Research at Geojit Financial Services.

“The euphoria is expected to continue during the start of the next year on account of the exuberance of rate cuts and the drop in bond yields. We expect a modest return of 10 to 12% on the main market in CY24.”

“It is advised to diversify the investment pattern to multi-assets. It is suitable to be diverse when equities are trading above the long-term average for a prolonged period. We presume CY24 to be a year of reversal in sector and category-wise. We like large caps compared to mid and small caps. Generally, it will be a stock- and sector-specific year. Sectors we like are Banks, Manufacturing, Pharma, Chemical and IT. A correction in the consumer sector should be capitalised in CY24,” he added.

Story continues below Advertisement

The BSE Telecommunication, BSE Auto, and BSE Metal sectors each saw a 4% increase, while the BSE FMCG index rose 3%. However, the BSE Information Technology index dipped by 0.5%.

Foreign institutional investors (FIIs) bought equities worth Rs 8,648.96 crore, and domestic institutional investors (DIIs) also purchased equities worth Rs 666.06 crore. In December, FIIs bought equities worth Rs 31,959.78 crore, while DIIs purchased equities worth Rs 12,942.25 crore.

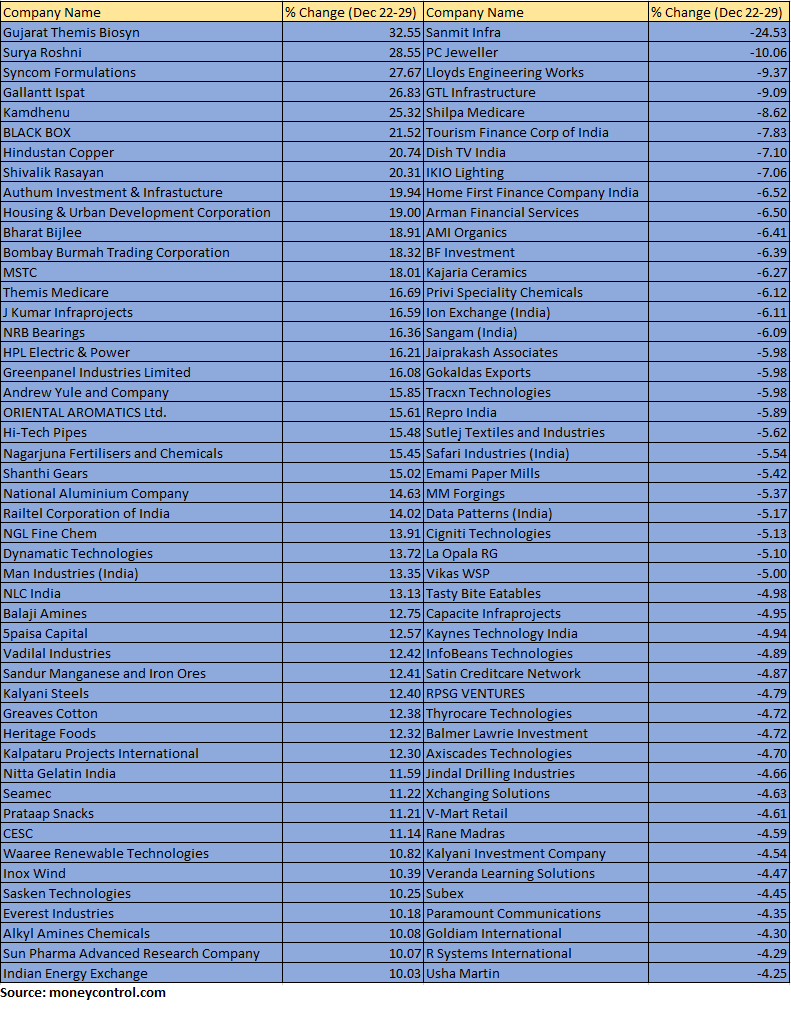

The BSE Small-cap index reached a fresh record high of 42,728.21, with a 1.6% increase. Gujarat Themis Biosyn, Surya Roshni, Syncom Formulations, Gallantt Ispat, Kamdhenu, Black Box, Hindustan Copper, and Shivalik Rasayan saw increases of 20-32%, while Sanmit Infra, PC Jeweller, Lloyds Engineering Works, and GTL Infrastructure each decreased by 9-24%.

Where is Nifty50 headed?

Ajit Mishra, SVP – Technical Research, Religare Broking

Markets took a breather on the final trading session of the calendar year and settled with a modest cut. We may see further consolidation in the index and it would be healthy after the recent surge. We expect Nifty to hold the 21,300-21,500 zone in case of a dip during consolidation and reiterate our positional target of 22,150 level. Participants should stay focused on the selection of stocks and prefer index majors.

Rupak De, Senior Technical Analyst at LKP Securities

Nifty remained sideways during the session, fluctuating within the range of 21650-21750. A doji pattern has formed on the daily chart, indicating indecisiveness in the market. This sentiment requires confirmation through a decisive breakout above 21750 or a breakdown below 21650. If it falls below 21650, the Nifty could potentially decline towards 21500. Conversely, if there’s sustained trading above 21750, the index might aim for 22000.

For Bank Nifty resistance is situated at 48300 on the higher end. As long as the index stays below 48300, the trend could lean towards favouring the bears. Moreover, a decisive drop below 48000 might drive the index below 47500. Conversely, a decisive move above 48300 could propel the index towards 48800-49000 on the higher end.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1220909109-00cd067f887a48408340f54ddf0ecb1d.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/advantages-and-disadvantages-of-using-a-mortgage-broker-17b1bf1df38947c3a7e74db2866dfb5f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/How-to-use-home-equity-loan-to-remodel-v12-07ad25a6096c4432b48c90f4b799ea83.png)