In a nutshell: The biggest stock winners and losers of 2023

Here’s a list of stocks that gained and slipped the most across large-caps, mid-caps, and small-caps.

It has been a fairly rewarding 2023 for investors as benchmark indices scaled to record highs. Not only that, the mid-cap and small-cap stocks also added to the bullish momentum through the year. Here’s a list of stocks that gained and slipped the most across large-caps, mid-caps, and small-caps.

NTPC: Involved in the setting up of power plants and power generation, has witnessed robust momentum due to planned capacity expansion. Last month, Moneycontrol exclusively reported that the company has identified at least nine states where it plans to build pumped hydro storage units with a total installed capacity of 14,000 MW (14 GW).

Tata Motors: India’s leading EV player has been the shining star among all automobile stocks. The robust momentum comes on the back of a strong JLR outlook, improving margins, and the company’s increased focus on SUVs as disposable incomes rise. Furthermore, customers are shifting to renewable forms of transportation, and in the 4-wheeler segment, the Nexon-maker is the biggest beneficiary.

Bajaj Auto: One of India’s leading two-wheeler companies, Bajaj has been riding effortlessly on the back of its premium segment, and its collaboration with Triumph. Not only that, the company’s three-wheeler segment is not margin dilutive, and the company has a positive outlook on the verticals’ growth.

Coal India: In November, the company saw the most upgrades among all Nifty companies. This is because analysts suggest that events of the past year in the power sector have shown that coal demand won’t diminish soon. Furthermore, India plans to construct more thermal power plants by 2032.

Larsen and Toubro: The bullish sentiment around the construction major has been ‘significant’ order wins. On December 30, L&T was awarded the tender for the civil work of the 46-km Kanaka Line (Heelalige –Rajanukunte) in the Bengaluru suburban rail project worth Rs 1,040 crore. Just a week earlier, the company also won orders in the Middle East.

Story continues below Advertisement

Adani Enterprises: Shares of the flagship Adani company have had a year to forget. This comes on the back of the Hindenberg report, which claimed that the Gautam Adani-led company was involved in accounting fraud and stock manipulation. Post the report, Adani stocks came crashing down. While the stock has been marginally bounced back after the apex stated that “We don’t have to treat the Hindenburg report as being a statement of truth”, it still wasn’t enough for the scrip to trade in green in 2023.

UPL: The undisputed king of the agrochemicals sector in India, has been plagued with problems in the last year – declining growth, a drop in chemical prices across the world, and perhaps the biggest of them, a sticky debt. As a result of this, analysts are increasingly turning bearish on the counter. Furthermore, in Q2, the company reported a net loss of Rs 189 crore.

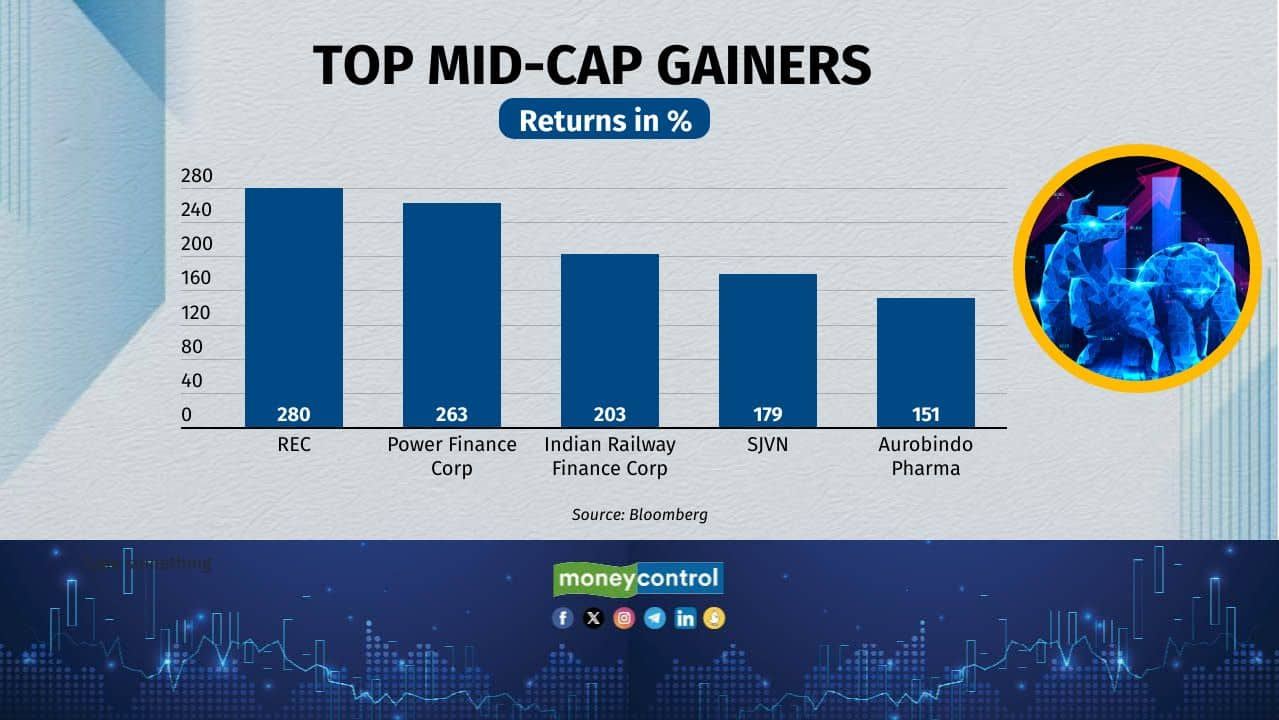

REC: Involved in financing and promoting transmission, distribution and generation projects throughout India, the company has been the biggest beneficiary of power projects that the government’s push towards sustainable energy.

Power Finance Corp: The company’s exceptional performance in 2023 is not only because of an infrastructural push by the government but also due to a host of large deal wins throughout the year. The company has signed 19 contracts worth Rs 2.37 lakh crore in the clean energy space. These agreements, part of the company’s plan to position itself as the leading funding agency for energy transition, were signed with companies in the solar, wind, green hydrogen, battery storage, and electric vehicles space as well as green energy equipment manufacturers.

IRFC: The financial arm of the Ministry of Railways, the mid-cap stock enjoyed success on the back of the rapid expansion of railways as the tourism segment gradually bounced back from the COVID-19 lockdowns. The company finances through short-term loans, external commercial borrowings, taxable bonds and institutional finance.

SJVN: Involved in the business of hydroelectric power generation, SJVN has had a stellar year largely due to multiple order wins as the public and private sectors gradually shift to renewable forms of energy. Its 200 MW win project worth Rs 1,400 crore in November and Rs 500-crore 100 MV solar project are pertinent order wins among others.

Aurobindo Pharma: The company’s robust performance in the year can be attributed to a host of USFDA nods to manufacture drugs. Furthermore, a robust Q2 where the company’s net profit jumped 85 percent YoY, has also aided market sentiment for the stock.

Rajesh Exports: The company is a leading gold refiner and Manufacturer of various types of Gold products. Volatility in gold prices in 2023, and a steep 88 percent decline in Q2 net profit have made investors cautious. On November 15, the counter slipped 17 percent to hit a 52-week low.

ABRFL: One of the key reasons for muted sentiment around the stock was its Q2 results, where the company turned loss-making amid weak consumption. ABFRL’s Lifestyle Brands is home to some of India’s most reputed companies such as Louis Philippe, Van Heusen, Allen Solly and Peter England. The company also owns Pantaloons and American Eagle.

Honeywell Automation: The company is involved in environmental and combustion controls, and sensing and control, and also provides engineering services in the field of automation and control to global clients. In Q1, it reported its slowest profit growth in five quarters for the first quarter of FY24, as expenses, led by rising costs, outpaced revenue.

Crompton Greaves: The company’s net profit in the second quarter declined 23 percent, and its revenue increased a marginal 4 percent. The company attributed the subdued performance to challenges in the business-to-consumer (B2C) segment leading to price erosion and revenue decline.

ACC: While the company has swung back to black in black in the second quarter, the stock performance has been marred by the uncertainty around the Adani group companies after a US-short seller cited brazen stock manipulation. ACC is a leading player in the Indian building materials space, with a pan-India manufacturing and marketing presence.

Jai Balaji Industries: The company is a steel manufacturer with Captive Power Generation and plants in nine locations. The company has undergone a remarkable transformation, transitioning from being listed in the second RBI list of infamous defaulters in 2017-18 to gaining over 1,000 percent on the exchanges in a single year.

AurionPro Solutions: It is a technology company, headquartered in Navi Mumbai, India. It primarily serves the banking, mobility, payments, and government sectors. Ace investor Sumeet Nagar’s Malabar India Fund picked up a 1.15 stake in the tech company. Furthermore, RBI’s approval from the Reserve Bank of India to operate as a payment aggregator also aided sentiment around the stock.

Inox Wind Energy: The company has been a massive beneficiary of the government’s sustainability push. Furthermore, multiple order wins throughout the year also has pleased investors. Last week, it bagged an order for 279 MW from a large C&I player. The order is for the company’s latest 3 MW Wind Turbine Generators (WTGs).

Lloyds Enterprises: The company is engaged in the business of trading steel products. Their products include hot-rolled (HR) coils and cold-rolled steel sheets. Data shows, that 5-year compounded profit growth is 98 percent.

Titagarh Rail System: Engaged in the manufacturing and selling of freight wagons, passenger coaches, metro trains, train electricals, steel castings, specialised equipment and bridges, and ships, the company has benefited from the expansion of railways. Furthermore, order wins and strategic tie-ups have also added to the positive sentiment around the company.

EKI Energy Services: The company provides consultancy services for the end-to-end management of carbon assets including carbon credit generation, supply, monetization and offsetting.

GRM Overseas: The company is engaged in the production, purchase export and sale of rice and paddy in India. The company has its processing unit located at Panipat in Haryana with the capacity to process almond kernels, paddy clove pista rice and wheat. It sells its products under the brand name Kamdhenu and its Basmati rice is exported to Saudi Arabia Europe and other countries.

Best Agrolife: The insecticides, herbicides, and fungicides manufacturer’s 27 percent decline in its consolidated net profit to Rs 95 crore for the second quarter of this fiscal year, has led to a sharp fall in the small-cap stock.

PC Jeweller: The company is involved in setting up large format, stand-alone showrooms. A fourth consecutive quarter of losses has dented sentiment around the company. Furthermore, a slew of lenders namely, State Bank of India (SBI), Indian Bank, IDFC First Bank, Union Bank, and seven more, have moved to Debt Recovery Tribunal (DRT) Delhi against the company towards recovery of their dues. PC Jeweller’s troubles began in February 2023, when banks decided to recall loans advanced to it.

Sanmit Infra: The company provides a microwave disinfection system for the disinfection of biomedical waste/hospital waste. In addition, it engages in the infrastructure and real estate development business.