More than 100 smallcaps gain 10-52% as index hit fresh record high

BSE-Midcap, and BSE-Smallcap added more than 2 percent each

The market began the new year on a positive note but ended the week with moderate losses. This was due to volatility caused by uncertainty over the future rate cut by Fed post-December meeting minutes, turmoil in the Red Sea, and ahead of Q3 earnings. The BSE Sensex shed 0.29 percent or 214.11 points to finish at 72,026.15, while the Nifty50 fell 20.6 points to end at 21,710.80. On January 1, the Sensex and Nifty touched fresh record highs of 72,561.91 and 21,834.35, respectively.

In addition, broader indices also touched new milestones during the week. BSE-Midcap and BSE-Smallcap added more than 2 percent each, while BSE-Largecap ended on a flat note.

“The week began strong with optimism about future rate cuts, easing global inflation, and softer bond yields. However, concerns over weak China and Eurozone manufacturing data, along with Red Sea tensions, led to a flat market close. Fed minutes added uncertainty around the delay in the future Fed’s rate cut,” said Vinod Nair, Head of Research, at Geojit Financial Services.

“Amidst global concerns and in anticipation of muted upcoming earnings season, the IT and Auto sectors exhibited weaker performance throughout the week. Conversely, mid, and small-cap segments sustained their rally, buoyed by healthy retail inflows. Notably, the realty sector emerged as the top performer, propelled by expectations of robust demand and healthy housing loan disbursement data announced by banks,” he added.

Among sectors, BSE Realty index added 8 percent, and Telecom, Healthcare, Power and Oil & Gas added 3 percent each., while Auto, Information Technology and Metal lost 1-2 percent.

Foreign institutional investors (FIIs) remained net buyers in this week, as they bought equities worth of Rs 3,290.23 crore, while Domestic institutional investors (DIIs) sold equities worth Rs 7,296.50 crore.

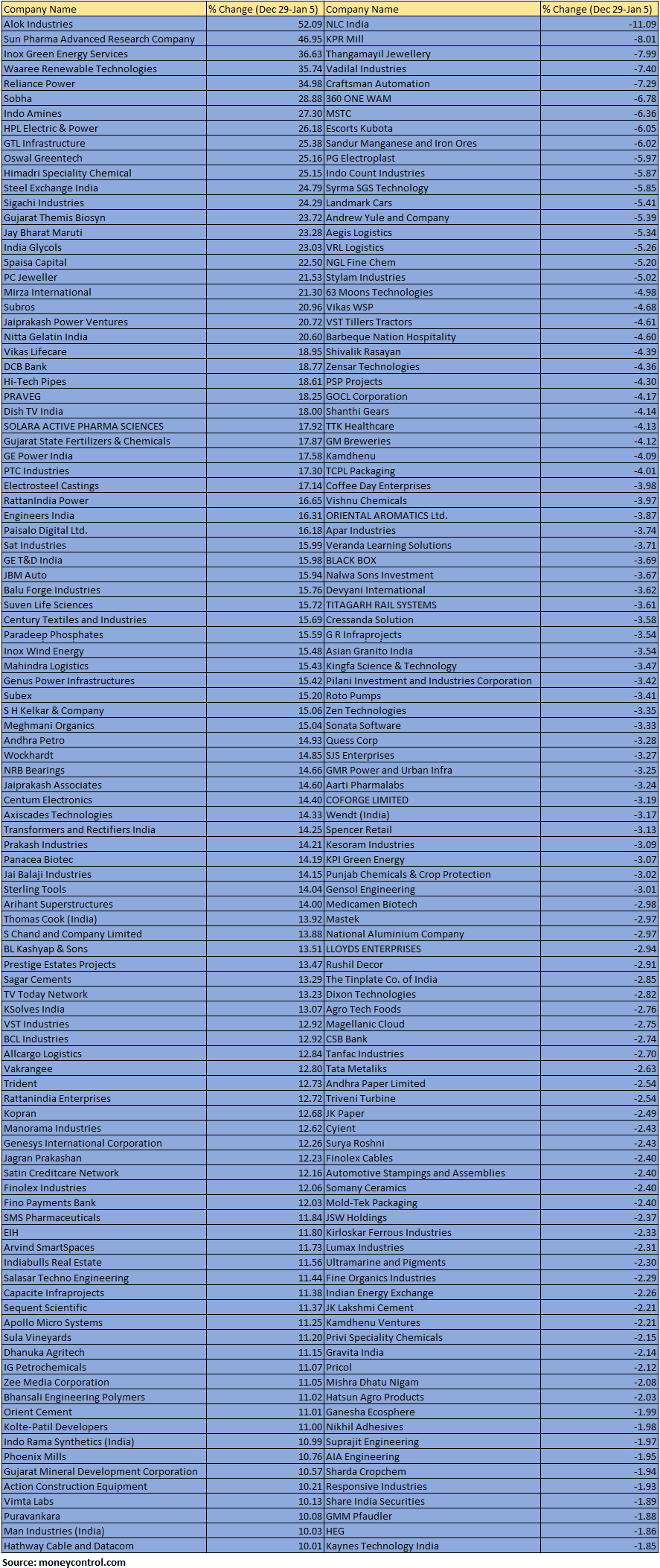

The BSE Small-cap index rose 2.6 percent and hit a fresh record high of 43,957.62. Alok Industries, Sun Pharma Advanced Research Company, Inox Green Energy Services, Waaree Renewable Technologies, Reliance Power, Sobha, Indo Amines, HPL Electric & Power, GTL Infrastructure, Oswal Greentech and Himadri Speciality Chemical added 25-52 percent.

Story continues below Advertisement

On the other hand, NLC India, KPR Mill, Thangamayil Jewellery, Vadilal Industries, Craftsman Automation, 360 ONE WAM, MSTC, Escorts Kubota and Sandur Manganese and Iron Ores declined 6-11 percent.

Where is Nifty50 headed?

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services:

We expect the market to take cues from the upcoming earning season which TCS and Infosys will kick-start on 11th January. HCL Tech, Wipro, and HDFC Life are a few others that will announce their results next week. Healthy pre-quarterly business updates indicate that the earnings growth momentum is likely to continue in Q3 as well. Overall we expect markets to remain in a positive range. Stock-specific action will gather pace with the start of earnings season.

Rupak De, Senior Technical Analyst at LKP Securities:

The present sentiment suggests a promising trajectory towards 21800-21850 for the Nifty. If it surpasses 21850, we might anticipate a further climb toward 22000. Notably, the index appears to have a short-term support level of around 21500. A downward shift would likely initiate only if it falls below this mark; until then, it seems favourable for buyers to take advantage of market dips.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

On Friday Nifty closed in the green after correcting for the previous couple of trading sessions. The fall in Nifty has halted around 21500 levels where multiple support parameters in the form of the 38.2% fibonacci retracement level and the lower end of the rising channel are placed.

We expect Nifty to hold on to this support and resume the next leg of up move. The hourly momentum indicator has triggered a positive crossover which is a buy signal. Thus, we expect the positive momentum to continue over the next few trading sessions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.