F&O Manual | Nifty trades in red, analysts predict profit-booking below 21,500 levels

At 12:03 hrs IST, Sensex was down 467.41 points or 0.65 percent at 71,558.74, and the Nifty was down 144.00 points or 0.66 percent at 21,566.80.

The benchmark Indian indices traded negatively around noon on January 8, taking vibes from weak global markets. According to analysts, the crucial support level for the Nifty is pegged at 21,500. A breach of this level may trigger caution, leading to a potential round of liquidation.

Further, the market outlook is expected to be significantly influenced by the upcoming quarterly earnings reports from major IT companies such as TCS and Infosys this week.

At 12:03pm, the Sensex was down 467.41 points or 0.65 percent at 71,558.74, and the Nifty was down 144.00 points or 0.66 percent at 21,566.80. About 1,591 shares advanced, 1,788 declined, and 79 remained unchanged.

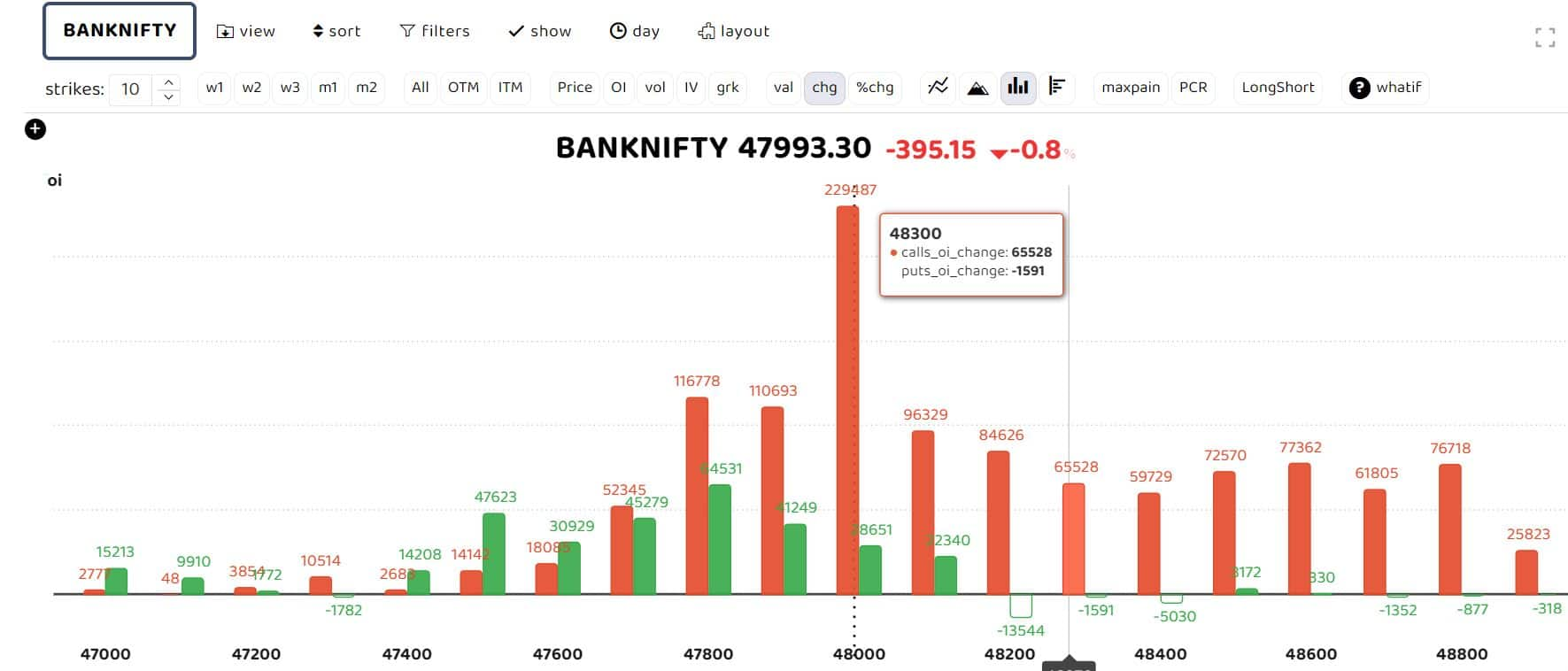

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Options data indicates that call writers dominated the day, with heavy call writing at 21,700 levels, followed by 21,750 and 21,800 strikes, forming strong resistance for the day.

“On the data front, despite marginal liquidation seen in Nifty open interest, it remains on the higher side at nearly 1.3 crore shares. Such high leverage may trigger a round of liquidation, and hence one should exercise caution below 21500 levels. Simultaneously, Nifty premium has experienced significant volatility, moving sharply from 140 points to 70 points alternatively, suggesting indecision at higher levels,” ICICI Securities said.

“We remain positive on the Nifty as long as it holds above 21,500 levels, below which a round of profit-booking cannot be ruled out.,” added the brokerage house.

Story continues below Advertisement

Open interest data suggests heavy call writing at Bank Nifty 48000, 48200, and 48400 strikes. “Bank Nifty broke the crucial support of 47800 on Monday, indicating a negative bias. Any bounce should be seized for shorting opportunities on an intraday basis,” Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

“Option data reveals strong writing in 48,000 CE, with high concentrations at 47,900 and 47,800. The trend for today remains sell on rise,” he added.

As advice to traders, Bagkar recommends taking a long position in 47,900 PE around the 230–200 level when the index experiences some pullback, given that the selling pressure from the morning demands some retreats. He anticipates the index to close below 47,750 today.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to consult with certified experts before making any investment decisions.