F&O Manual | Nifty trades higher; 21,900 acts as crucial hurdle for the day

At 10 AM, The Sensex was up 365.30 points or 0.51 percent at 71,720.52, and the Nifty was up 115.60 points or 0.54 percent at 21,628.60.

The Indian market opened gap-up after a rally in the US markets and strong gains in Asian indices. All the sectoral indices traded in the green with the Information Technology index up 1.5 percent and BSE Midcap and Smallcap indices in green on January 9 morning.

At 10am, the Sensex was up 365.30 points or 0.51 percent to 71,720.52, and the Nifty was gained 115.60 points or 0.54 percent to 21,628.60. About 2,202 shares advanced, 883 declined, and 80 stayed unchanged.

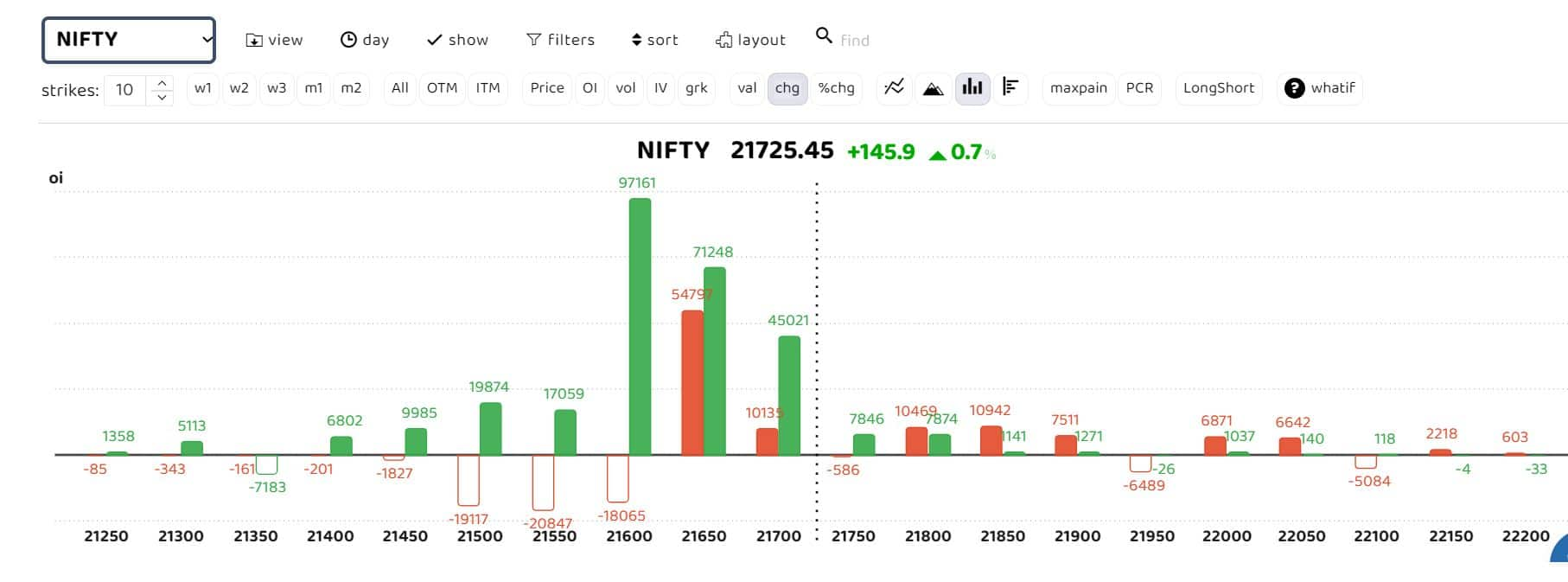

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Options data indicates that the Nifty shows crucial support levels at 21,500 and 21,600. “The index is taking a breather after the spectacular 16 percent up move over the past two months. For the day, we expect Nifty to maintain support at 21,500 levels, while on the higher side, 21,900 is anticipated to pose a significant hurdle,” ICICI Securities said.

“The index will undergo consolidation in the 21,900-21,300 range amid stock-specific action as we enter the Q3 earnings season. This would contribute to a healthier market and set the stage for the next leg of an upward move.”

According to Sudeep Shah, head of derivative and technical research at SBI Securities, above 21,680, the Nifty would continue with the positive momentum up to the life highs in the 21,800-21,830 zone. “India VIX rebounded yesterday to 13.50 and is once again approaching its crucial level of 14-14.20. Above 14.20, one should consider trimming overleveraged positions and hedging wherever possible,” he said.

Among individual stocks, long build-up is seen in Adani Ports, ABB India and Adani Enterprise, while short build-up is seen in Idea, Polycab and GMR Infra.

Story continues below Advertisement

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1560536860-8fc6f55dc4c34720bd3a8063f6d6114a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1305866005-69f5b9ab5d5d4c6183cf3199b1eefdcc.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-14971887171-d8f73331af4b48ef822120b31f93bcff.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-13058660051-5659a9b58a9a4cecb5b14bdda66cadae.jpg)