F&O Manual | Markets move sideways, Bank Nifty to expire in 47,000 to 47,500 range

At 12:02 hrs IST, the Sensex was up 13.88 points or 0.02 percent at 71,400.09, and the Nifty was down 8.20 points or 0.04 percent at 21,536.60.

The markets moved sideways with the benchmark indices trading in a range amid subdued global trends. On the expiry day, the Bank Nifty index is likely to trade within 47,000 to 47,500 points.

At 12:02am, the Sensex was up 13.88 points or 0.02 percent to 71,400.09, and the Nifty was down 8.20 points or 0.04 percent to 21,536.60.

About 1,683 shares advanced, 1,520 declined, and 80 stayed unchanged.

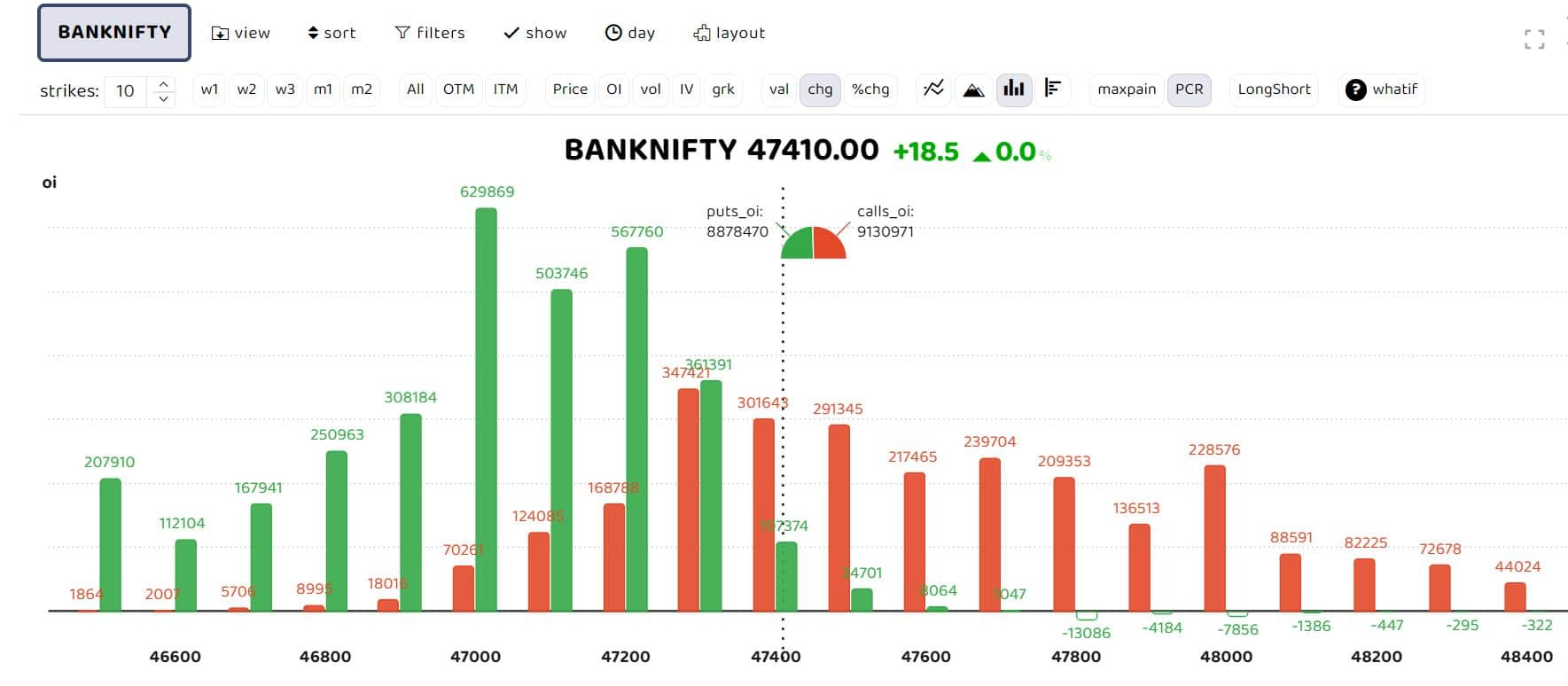

Options data indicates that the highest open interest can be observed at the 47,000 and 46,800 levels, forming crucial support for the day. “For the current expiry, it is expected that Bank Nifty will trade within the range of 47,000 to 47,500, with substantial Open Interest at both the Put and Call strikes. The day holds significant importance for Bank Nifty, with 46,900 serving as a crucial support level; a breach below this mark could lead to a substantial downside risk,” Shrey Jain, founder and chief executive of SAS Online – India’s Deep Discount Broker, said.

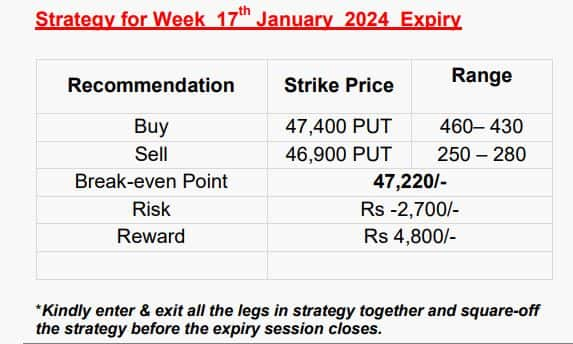

Axis Securities maintains a moderately bearish view on Bank Nify and recommends traders to initiate a Put spread for the January 17, 2024 expiry. “The spread suggested consists of buying one lot of the 47,400 strike Put option and simultaneously selling one lot of the 46,900 strike Put Option.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions