Polycab volatility to persist as short buildup indicates weakness, support at 3,600

Representative image

Shares of Polycab fell 23 percent on January 11 to the day’s low of Rs 3,801 following the income tax department’s announcement of discovering “unaccounted cash sales” of about Rs 1,000 crore during searches of the company’s premises.

The stock pared some of the losses in the afternoon but was still deep in the red at Rs 3,970. The stock has been in a downtrend, plunging more than 27 percent in the last five sessions. A respite is unlikely with the stock exhibiting weakness as indicted by technical charts and open interest data.

Candlestick chart showing steep fall in Polycab scrip along with a steep rise in open interest indicating short build up | Source: strikemoney.com

Candlestick chart showing steep fall in Polycab scrip along with a steep rise in open interest indicating short build up | Source: strikemoney.com

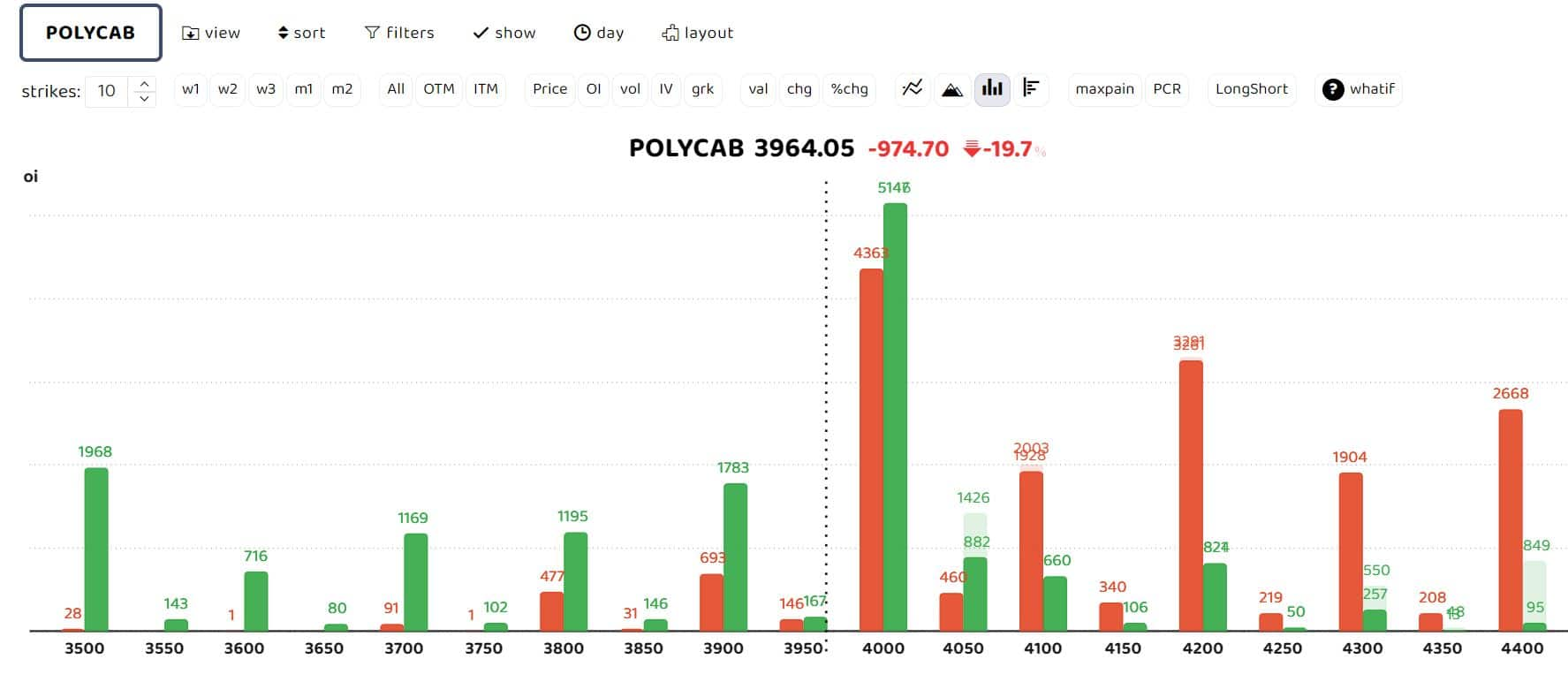

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

The options data suggests that Polycab scrip has key support at Rs 3,700, followed by Rs 3,600, while a tussle between put and call writers is seen at Rs 4,000.

“The stock has tanked heavily in the last two-three sessions, breaching below the important 200-period MA of 4,430 levels, and is hovering near the 3,900 levels with a bearish view and sentiment as of now maintained overall weak,” said Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher.

The next crucial support zone is around 3,500 of the long-term trendline support zone, where some consolidation can be anticipated. A major revival is necessary, with at least a break above the 4,200 zone to improve the bias to some extent, Shiju Koothupalakkal said.

According to Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox, the stock slipped below the 200-simple moving average (SMA) during the day, signalling a bearish bias if the price action fails to recoup losses in the next one or two sessions. “The counter may enter medium-term bearishness below the 200-SMA placed at 4,422,” he added.

Story continues below Advertisement

Polycab India has seen a steep fall from 5,800-5,300 in two-three trading sessions due to the corporate governance issue and the IT raid. “Going forward, a lot of volatility is expected in the stock, and the next support is observed at 3,650 and 3,640 levels,” said Kapil Shah, Technical Analyst at Emkay Global.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions