F&O Manual| Nifty hits new high; a close above 21,800 can take it to 22,000

At 11:33 hrs IST, the Sensex was up 647.30 points or 0.90 percent at 72,368.48, and the Nifty was up 180.60 points or 0.83 percent at 21,827.80

The market traded higher on January 12, with the Nifty hitting a new high helped by gains in IT heavyweights TCS and Infosys following a positive showing in December quarter.

Sector wise, the Nifty IT index led the gains, surging up to 5 percent. Notable performers on the Nifty included Infosys, Wipro, Tech Mahindra, TCS, and LTIMindtree, while M&M, Cipla, Divis Labs, Bajaj Finserv and Eicher Motors were among top losers.

At 11.33 am, the Sensex was up 647.30 points, or 0.90 percent, at 72,368.48. The Nifty, which hit record 21837.85 points in the morning, was trading at 21,827.80, up 180.60 points or 0.83 percent.

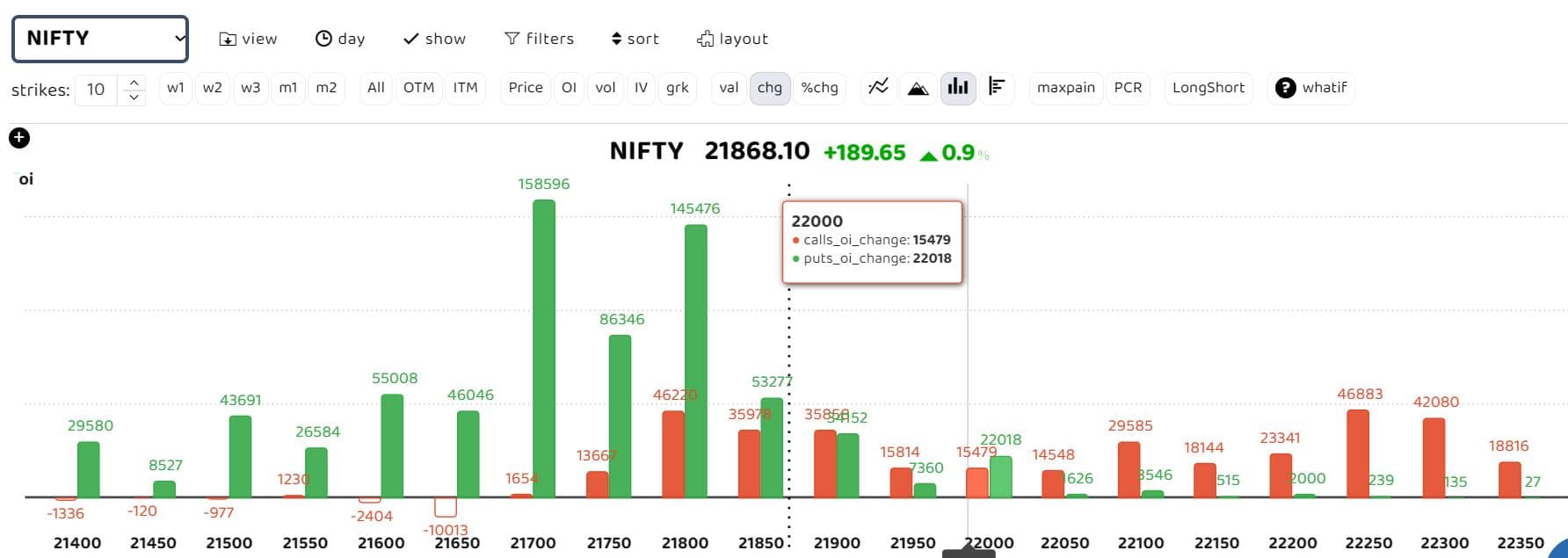

The bars in red indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

According to Avani Bhatt, senior vice president, derivatives research, at JM Financial Services, the Nifty opened gap up above 21,700 and continued to strengthen, reaching record highs. A significant open interest (OI) of 1.5 lakh contracts was added at 21,700 and 21,800 puts, suggesting a gradual formation of a support base rising from 21,500 to a higher level of 21,700. The Nifty OI-PCR (put-call ratio) also spiked up to 1.38 from 0.85, indicating a positive bias and providing support for further upward movement.

“If the Nifty sustains above 21,800 on a closing basis, it will be well-positioned to test record levels of 22,000 in a very short time. As today marks the weekly closing, sustaining above 21,750-800 would be a highly positive development for the continuation of the ongoing rally,” he said.

Story continues below Advertisement

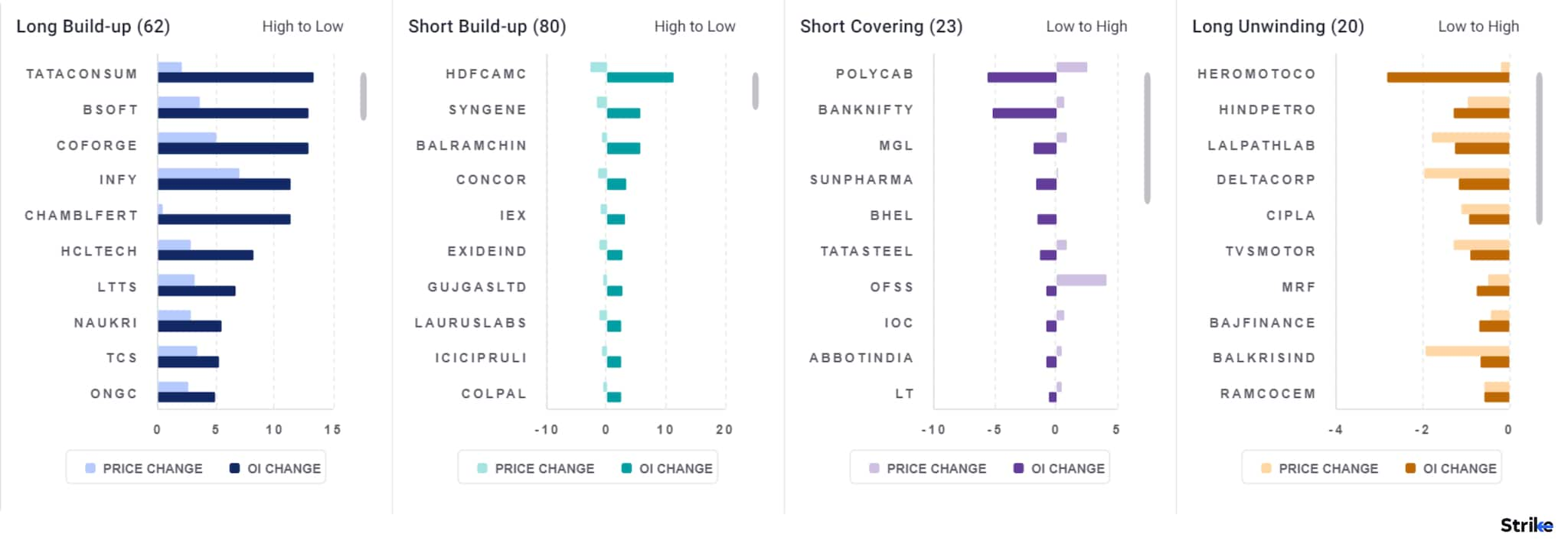

Among individual stocks, a long buildup could be seen in L&T Technology Services, HCL Technology, TCS and ONGC. While short build up was seen in HDFC AMC, Syngene, Balrampur Chini and ICICI Prudential Life Insurance.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.