82 smallcaps gain between 10-39% as record rally continues

Broader indices, BSE-Largecap, BSE-Midcap, and BSE-Smallcap, touched fresh record highs in this week.

After opening the week on a negative note and remaining in consolidation for next three sessions, market bounced back sharply on last day of the week as investors cheered the earnings from the IT giants Infosys and TCS.

For the week, BSE Sensex added 0.75 percent or 542.3 points to end at 72,568.45, while Nifty50 gained 183.7 points or 0.84 percent to close at 21,894.50. On January 12, the Sensex and Nifty touched fresh record highs of 72,720.96 and 21,928.25, respectively.

Broader indices, BSE-Largecap, BSE-Midcap, and BSE-Smallcap, touched fresh record highs in this week with a gain of 0.7 percent, 0.45 percent and 1.5 percent, respectively.

“The Indian equity market started the week on a bleak note, testing the pivotal support zone for the benchmark index and stayed sluggish for the remaining part of the week, hinting for a correction in the near period. However, the last session of the week was an exuberant one, wherein we witnessed a breakout amidst the magnificent moves in the IT space, uplifting the overall sentiments. Eventually, the Nifty50 witnessed a breakout and soared into uncharted territory, procuring 0.85 percent of gains,” said Osho Krishan, Sr. Analyst – Technical & Derivative Research, Angel One.

On the sectoral front, BSE Information Technology index rose 4.5 percent, BSE Realty index up 4.3 percent, and BSE Energy, BSE Oil & Gas and BSE Auto indices added 2 percent each. However, BSE FMCG index down 1.7 percent and BSE Bank index down 0.9 percent.

Foreign institutional investors (FIIs) sold equities worth of Rs 3,901.27 crore, while Domestic institutional investors (DIIs) bought equities worth Rs 6,858.47 crore.

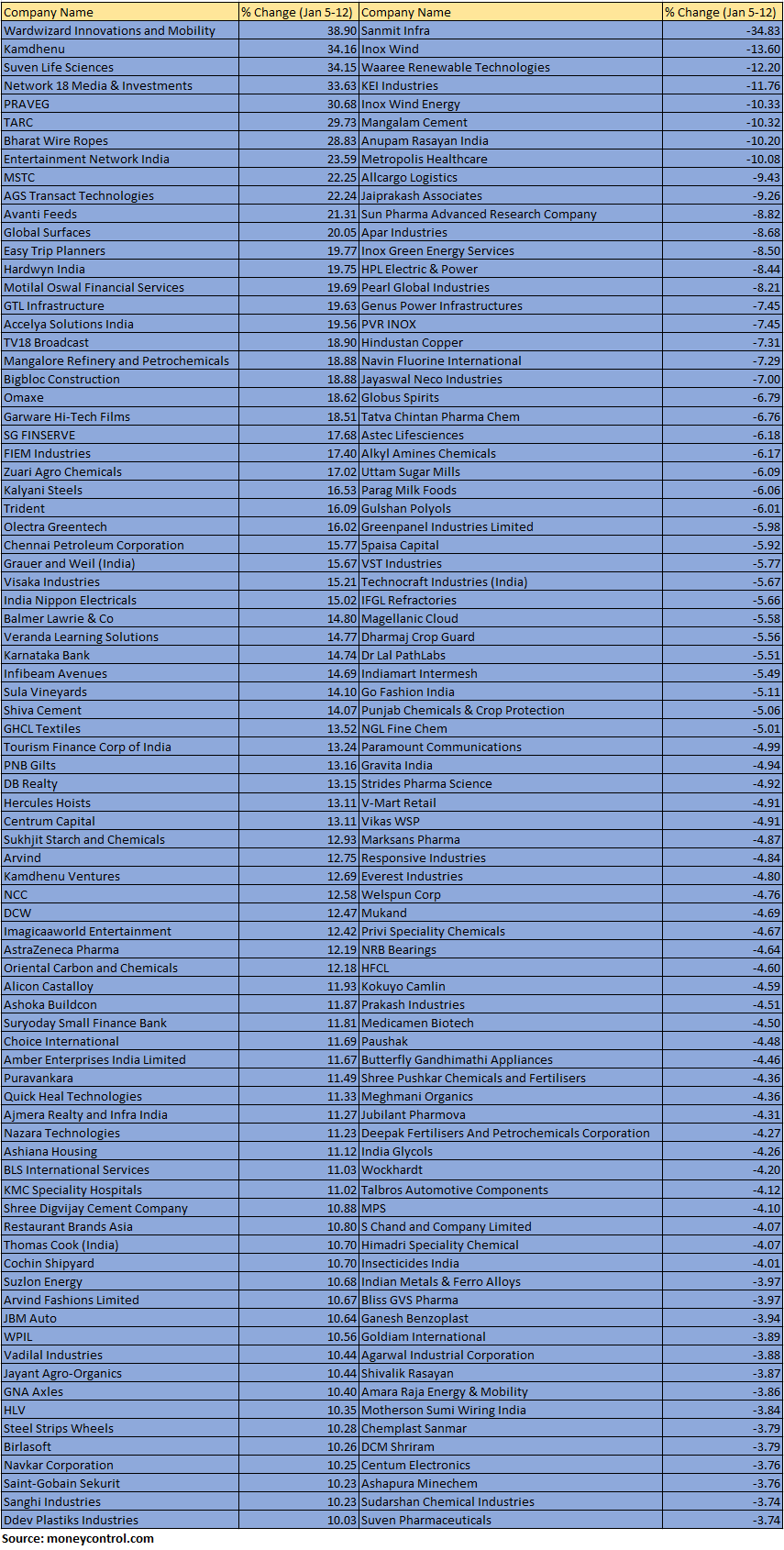

The BSE Small-cap index touched fresh record high of 44,644.04 and gained 1.5 percent. Wardwizard Innovations and Mobility, Kamdhenu, Suven Life Sciences, Network 18 Media & Investments, Praveg, TARC, Bharat Wire Ropes, Entertainment Network India, MSTC, AGS Transact Technologies, Avanti Feeds and Global Surfaces added 20-39 percent.

Story continues below Advertisement

On the other hand, Sanmit Infra, Inox Wind, Waaree Renewable Technologies, KEI Industries, Inox Wind Energy, Mangalam Cement, Anupam Rasayan India and Metropolis Healthcare shed 10-34 percent.

Where is Nifty50 headed?

Kunal Shah, Senior Technical & Derivative Analyst, LKP Securities:

The Nifty index exhibited significant strength, securing a notable breakout on the daily chart as it surpassed the key resistance level of 21,800. This bullish move positions the index for potential short-term targets of 22,000 and 22,200. Traders are advised to consider buying opportunities on any dips toward the support level. The momentum indicator RSI has also provided a buy crossover, further confirming the bullish sentiment in the market.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap up and traded with a positive bias throughout the day to close with gains of ~260 points. On the Daily charts, we can observe that the Nifty has decisively broken out of the 21500 – 21850 range on the upside. The breakout suggests a resumption of trending moves on the upside. We expect the Nifty to target levels of 22000 immediately and above that 22300. On the downside, the zone of 21750 – 21700 shall act as an immediate support as per the role reversal principle.

Bank Nifty started to form higher tops and higher bottoms on the daily charts indicating trend reversal from down to up. We expect the positive momentum to continue till 48000 on an immediate basis and above that it can extend till 48500.

Shrey Jain, Founder and CEO SAS Online:

Propelled by a surge in IT stocks, major indices achieved unprecedented highs today, as both Sensex and Nifty surpassed their previous all-time peaks. Sensex demonstrated a robust rally, climbing over 800 points to reach a new pinnacle of 72,720, while Nifty breached the 21,900 level for the first time, concluding the day at 21,894.55. The Nifty IT index reached a new 52-week high driven by in-line results from IT majors, posting an impressive gain of over 5 percent during intra-day trade.

The key question is whether the thrilling stock market surge will persist. Looking ahead, data suggests that Nifty might exceed 22,000 as early as Monday. The market is backed by a steady inflow of funds into mutual funds and active buying from local investors. The ongoing earnings season for the December quarter is anticipated to be a decisive factor in shaping the market’s performance in the coming days.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.