Dalal Street Week Ahead: Q3 earnings, Red Sea, China GDP, Europe inflation among 10 key factors to watch

Experts see Nifty at 22,000-22,100 in near term, followed by consolidation

Thanks to the earnings-led rally in technology stocks that not only helped the market close higher but also pushed to a new record high for the week ended January 12 despite higher-than-expected US inflation. Index heavyweight Reliance Industries, reaching a new high, also boosted market sentiment.

Given the optimism at Dalal Street, in the coming week, the market may climb further higher to 22,000-22,100 levels on the Nifty 50, but intermittent consolidation can’t be ruled out, with focus majorly on corporate earnings with heavyweights announcing numbers that will bring in stock-specific action and China’s GDP for Q4CY23 & Europe inflation on the global front, experts said.

During the week gone by, the Nifty 50 rose 184 points to 21,895, and the BSE Sensex jumped 542 points to 72,568, while the Nifty Midcap 100 and Smallcap 100 indices underperformed benchmarks, rising 0.25 percent and 0.7 percent respectively.

On coming Monday, the market will first react to Wipro and HCL Technologies numbers as well as monthly inflation and industrial production data released on Friday after market hours.

“In the near term, investors’ trade positions will be more inclined towards the upcoming result season; the overall forecast for earnings growth remains optimistic, projecting double-digit figures,” Vinod Nair, head of research, Geojit Financial Services said.

On the global front, Santosh Meena, head of research at Swastika Investmart said macroeconomic data from the USA and China, along with movements in the dollar index, US bond yields, and crude oil prices, would be closely monitored. “Geopolitical tensions worldwide continue to be a source of uncertainty, demanding the market’s vigilant attention.”

Here are 10 key factors to watch:

Story continues below Advertisement

The key focus next week will be on the domestic corporate earnings season, especially after the solid start by technology companies last week. Nearly 200 companies will be releasing their December quarter numbers during the coming week with a major focus on Reliance Industries, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Hindustan Unilever, Asian Paints, LTIMindtree, IndusInd Bank, UltraTech Cement, and Jio Financial Services.

Among others, Angel One, Federal Bank, ICICI Lombard General Insurance, Jindal Saw, L&T Technology, Union Bank of India, Credo Brands Marketing, Network18 Media & Investments, TV18 Broadcast, ICICI Prudential Life Insurance, Innova Captab, Jindal Stainless, Polycab India, Poonawalla Fincorp, Hindustan Zinc, One 97 Communications (Paytm), RBL Bank, and IREDA will also announce numbers in the coming week.

Also read: In the long run we are all dead, but the markets will be up

Domestic Economic Data

On the economic data front, India’s monthly wholesale inflation, as measured by the Wholesale Price Index, for December will be released on January 15. Experts expect the WPI inflation to increase further, against it was at 0.26 percent for November, the highest print in eight months.

Passenger vehicle sales and balance of trade data for December will also be announced on the same date, while foreign exchange reserves will be released on January 19.

Global Economic Data

On the global front, the market participants will keep an eye on China’s quarterly GDP and industrial capacity utilisation numbers for Q4-CY23 releasing on January 17. China’s economy grew 4.9 percent year-on-year in the July-September period in 2023 against 6.3 percent in the previous quarter. In November last year, the International Monetary Fund expects the Chinese economy to grow at 5.4 percent for 2023 and Organization for Economic Co-operation and Development (OECD) sees 5.2 percent growth.

Also read: Exclusive: RDC Concrete plans to go public next year with valuation up to Rs 4,000 crore

Apart from that, the focus will also be on US jobs data, Europe’s December inflation numbers, and retail sales for December in the US & China, while the participants will also take cues from the speech by the ECB President Lagarde.

Red Sea

Further, the global investors will also closely watch the geopolitical tensions with the Red Sea in action. The United States and the United Kingdom launched several air strikes on Iran-allied Houthi militants in Yemen on January 11 in response to attacks by Houthi rebels on Red Sea shipping, escalating more tensions in the Middle East that started since the Israel-Hamas war in October last year.

After the airstrikes by the US and UK, several of the world’s major tanker companies, including Hafnia, Torm and Stena Bulk, on January 12 halted traffic toward the Red Sea, the crucial trade gateway in response to an advisory from the Combined Maritime Forces, a multinational coalition led by the US. The CNBC reported.

Also read: Nifty IT shining: Pick these 2 tech stocks for healthy returns

Oil Prices

With the further escalation of tensions in the Red Sea area after airstrikes by the US & UK in the Houthi-controlled areas of Yemen, all focus will be on oil prices. Brent crude futures crossed the $80 a barrel intraday last Friday and settled down at $78.29 a barrel but still up from the week’s low of $75.26. Experts feel the geopolitical tensions will keep supporting the oil prices.

“Concerns about a broader conflict in the Middle East and potential direct involvement by Iran posed threats to output and flows in a region responsible for a third of the world’s crude production,” Ravindra Rao, VP-Head Commodity Research at Kotak Securities said.

He feels crude oil prices may remain supported amid fears of disruptions and the need for vessels to divert, especially as Saudi Arabia warned that recent actions by the US and its allies could inflame tensions.

After a significant buying in December, the foreign institutional investors’ flow to Indian equities turned red, which may be due to a rebound in US 10-year treasury yields (might be after higher-than-expected US inflation in December) and profit booking. Further, the institutional flow will also be important to watch out for as the market approaches the Union Budget 2024.

FIIs have net sold Rs 3,900 crore worth of shares in the week ended January 12 and for the current month, their net selling was a little more than Rs 600 crore in the cash segment. The US 10-year treasury yields climbed over the 4 percent mark during the week, before ending at 3.94 percent on Friday.

Domestic institutional investors were also net sellers for the month to the tune of Rs 438 crore, but for the passing week, they made strong buying of Rs 6,858 crore in the cash segment helping the market to hit a new high.

IPO

Meanwhile, the action in the primary market will continue in the coming week as in the mainboard segment, the Rs 1,172-crore Medi Assist Healthcare Services IPO will hit Dalal Street on January 15 with a price band of Rs 397-418 per share and Jyoti CNC Automation will debut on the bourses on January 16.

In the SME segment, the IPOs by Maxposure, Addictive Learning Technology and Konstelec Engineers will be launched on January 19, while the subscription to Shree Marutinandan Tubes, New Swan Multitech, and Australian Premium Solar (India) IPOs will close next week.

IBL Finance will list its shares next week on January 16, while trading in New Swan Multitech and Australian Premium Solar (India) will commence on January 18.

Technical View

The Nifty 50 finally has seen a breakout of a downward sloping resistance trendline at 21,750, triggering a new high of 21,928, with continuing higher highs, and higher lows for the second consecutive session. For the week, the index has seen bullish candlestick formation with long lower shadows and continued higher highs for seven weeks in a row.

Hence, technically experts expect the Nifty 50 marching towards the 22,000-22,100 area before getting into consolidation mode.

“Nifty successfully breached the 21,800 resistance level, with 22,000 acting as a psychological hurdle and 22,220 identified as the next target level. On the downside, the 21,750–21,650 range constitutes the immediate demand zone, with 21,500 serving as a key support level,” Santosh Meena of Swastika Investmart said.

F&O Cues

On the weekly options front, the maximum Call open interest was seen at 22,500 strike, followed by 22,300 & 21,900 strikes, with meaningful Call writing at 22,600 strike, then 22,500 and 22,700 strikes.

On the Put side, the 21,700 strike owned the maximum open interest, followed by 21,000 & 21,800 strikes, with writing at 21,700 strike, then 21,800 & 21,000 strikes.

The above options data indicated that 21,800-21,700 is expected to be an immediate support for the Nifty 50, with an immediate hurdle on the higher side at 22,000.

“The option activity at 22,000 strike will provide cues about Nifty’s intraday direction on Monday. The resistance for Nifty shifts to 22,500 level from 21,800 level after Friday’s close,” Ashwin Ramani, derivatives & technical analyst at SAMCO Securities said.

The volatility increased during the last week after a sharp decline in the previous week, but still far below December’s high of 16.47 levels. The fear index, India VIX was up by 3.72 percent to 13.10 during the week ended January 12, after a 12.91 percent fall in the previous week.

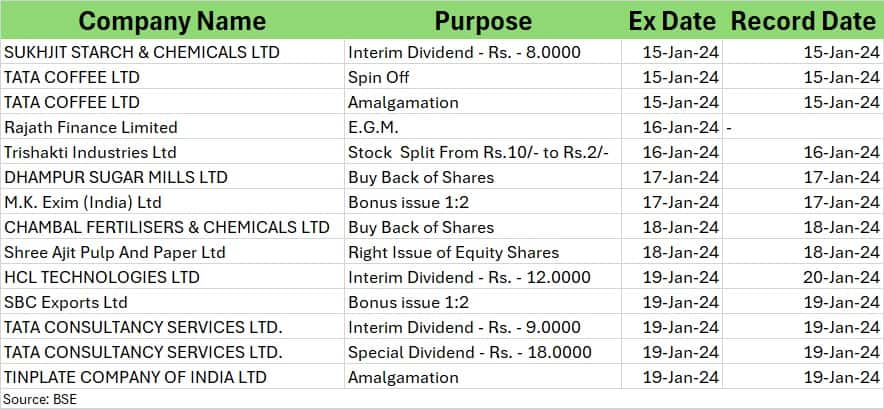

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.