F&O Manual | Indices recover, Nifty’s upside hurdle shifts to 21,700, key support at 21,300

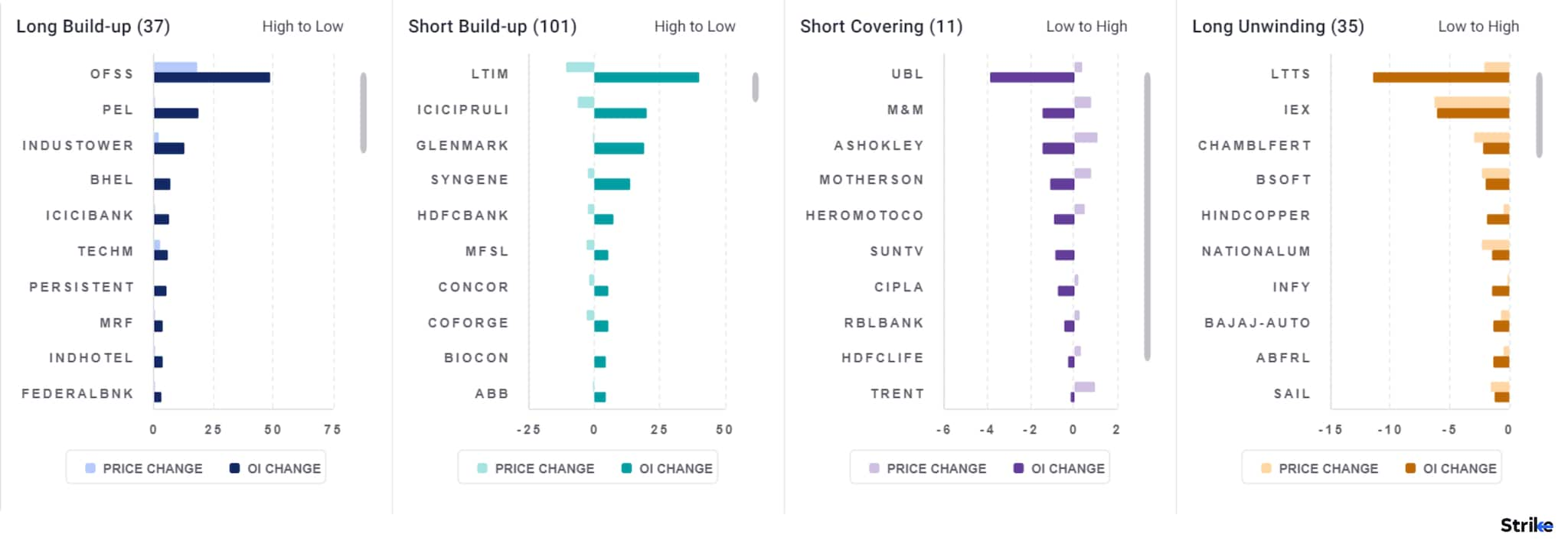

Among individual stocks, long build up is observed in OFSS, PEL, Indus Tower and BHEL. While short build up is observed in ICICIPruLife, Glenmark and Syngene.

The benchmark Indian indices stayed in the red on the third day of sustained rush to book profits on January 18, a day after a bloodbath in the market, taking Bank Nifty down over 2,000 points.

Looking ahead to Nifty weekly expiry on January 18, it has formed a bearish candle on the daily scale, negating the sequence of higher lows from the last four trading sessions. According to experts, as long as it holds below 21,700 zones, weakness could be seen towards 21,450 and 21,300 zones, while on the upside, the hurdle shifts lower at 21,700 and 21,850 zones.

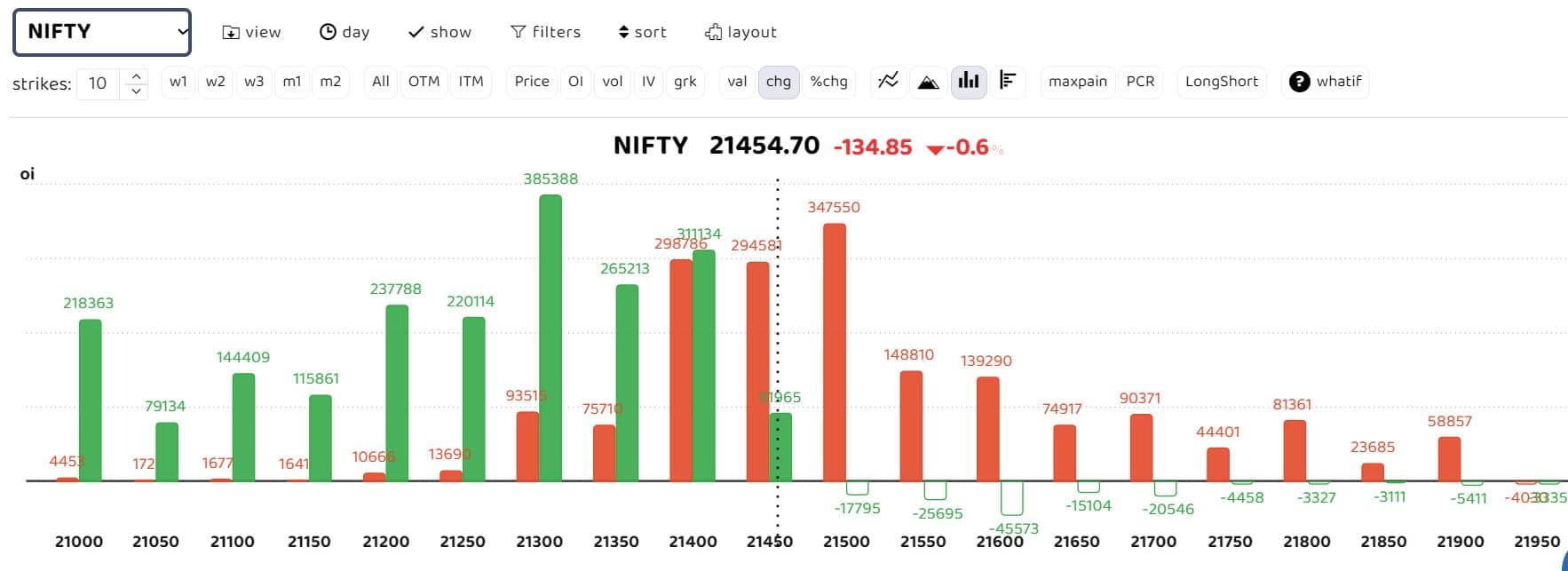

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers.

The cumulative futures open interest for the index declined by 7 percent while the price fell by 2 percent, indicating long unwinding of positions. “Nifty PCR OI has cooled off to 0.55 levels and is approaching oversold zones. Put writing is seen in 21,500 and 21,400 strikes, while 21,600, as well as 21,700 calls, have seen aggressive writing. Overall, the range for the coming few sessions could be 21300 on the downside and 21700 on the upside,” Sudeep Shah, head of derivatives research at SBI Securities, said.

“Going forward, since the Nifty has slipped below its 20-day EMA placed at 21,580, from a short-term perspective, the next support is likely to be seen at 21,300-21,350 level, and resistance on the upside will be closer to 21,620-21,650. In case 21,300 is breached, the Index could slide towards 21160-21080 zone on the downside. Above 21,650, the Index could resume its uptrend towards the 21,790-21,850 zone,” added Shah.

“The correction is likely to continue up to 20,950-21,000 but not linearly. There will be phases of dead-cat bounces from intermediate trading support levels. On the upside, it is unlikely that the Nifty tests a new ATH at least in the January series. Immediate resistance has moved lower to 21,850, above which 22,100-22,150 will pose as a strong hurdle for the month,” Avani Bhatt, senior vice-president of derivative research at JM Financial, said.

“For the weekly expiry, 21,500 is the hope support. In case of a gap-down below 21,500, the Nifty is likely to slide up to 21,360-21,400 from where an intraday dead-cat bounce is possible. On the upside, resistance for the day is at 21,690-21,750,” Bhatt said.

Story continues below Advertisement

According to Motilal Oswal Financial Services, for today’s Nifty weekly expiry, it has formed a bearish candle on the daily scale and negated the sequence of higher lows from the last four trading sessions. “As per experts, as long as it holds below 21,700 zones, weakness could be seen towards 21,450 and 21,300 zones, while on the upside, the hurdle shifts lower at 21,700 and 21,850 zones.”

Among individual stocks, long build-up is observed in OFSS, PEL, Indus Tower and BHEL. While short build up is observed in ICICIPruLife, Glenmark and Syngene.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.