F&O Manual | Indices trade marginally higher, neutral candlestick shows indecisiveness in Nifty

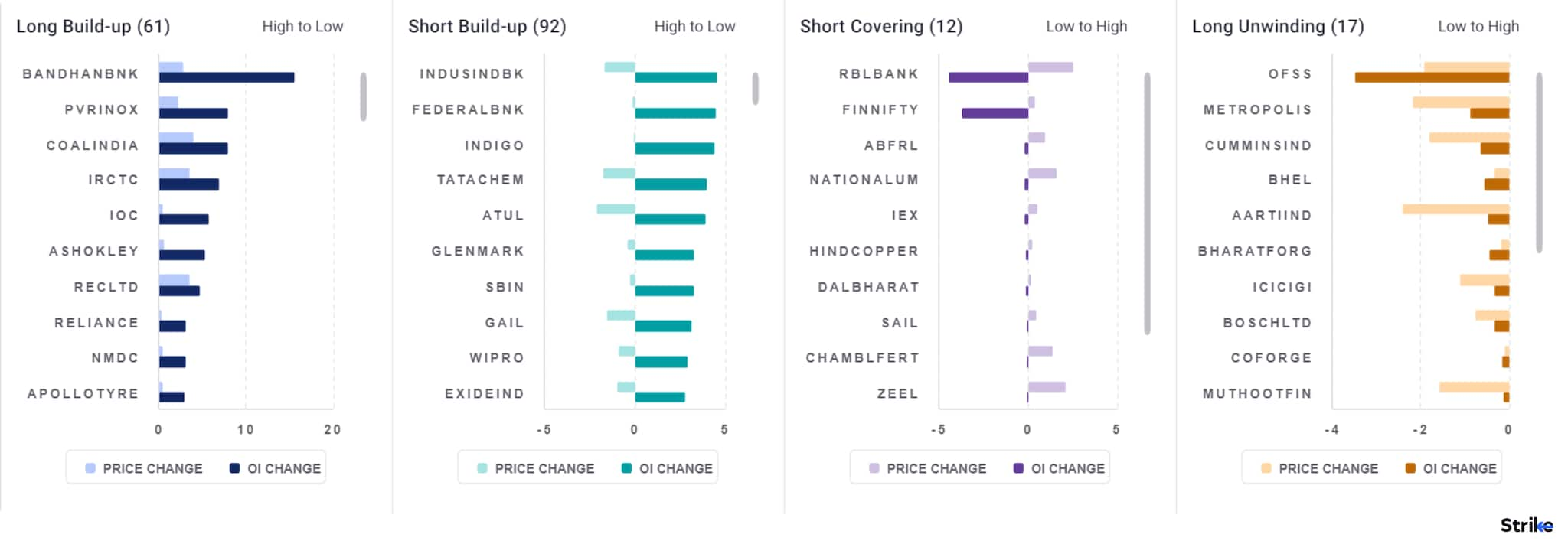

Among individual stocks, long build up is witnessed in BandhanBank, PVR Inox, CoalIndia while short build up is seen in Indusind bank, federalbank and Indigo.

The benchmark indices traded marginally higher on the back of positive global cues on January 20. On the daily chart, the Nifty formed a neutral candlestick at the bottom, reflecting indecisiveness among buyers and sellers. Crucial support is seen at 21,500–21,400, while resistance is estimated at 21,800–21,850.

Among sectors, buying is seen in pharma, metal and power names, while selling is seen in the auto, FMCG, oil and gas and realty stocks. BSE midcap and smallcap indices are trading in the green.

At 10am, the Sensex was down 1.78 points to 71,681.45, and the Nifty was up 6.80 points or 0.03 percent to 21,629.20. About 1,857 shares advanced, 1,163 declined, and 88 stayed unchanged.

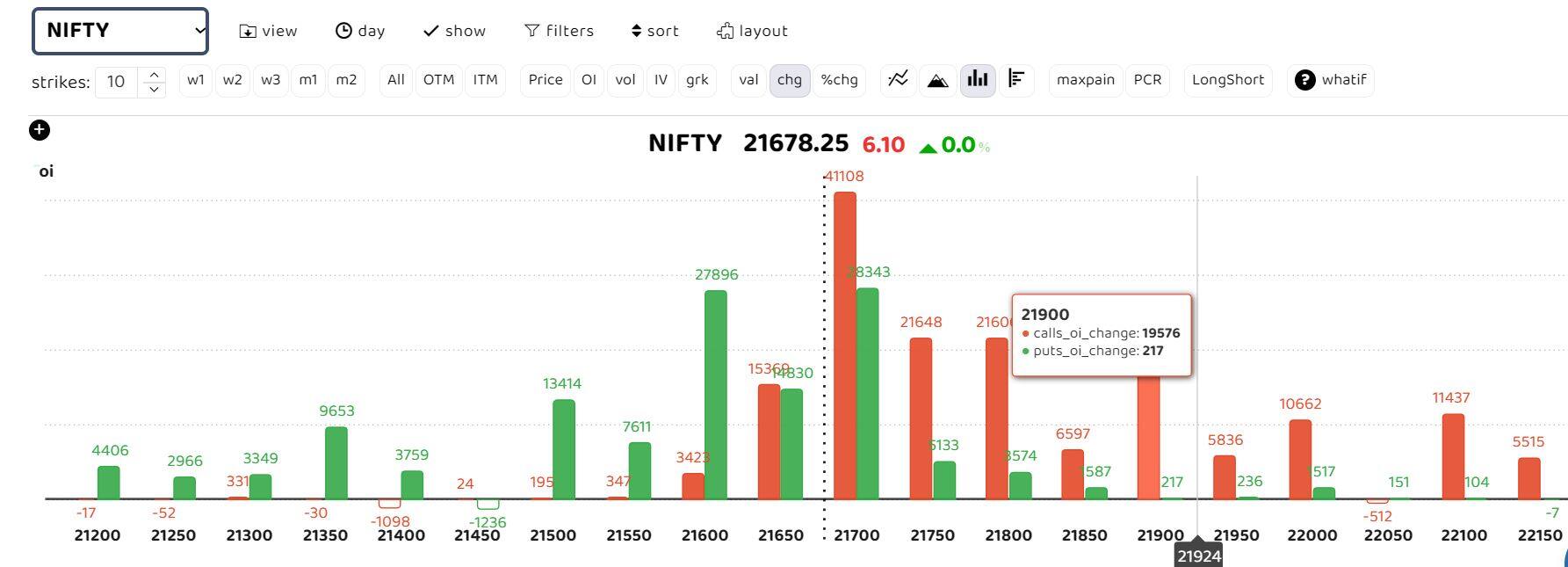

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

“On the daily chart, Nifty formed a neutral candlestick at the bottom, reflecting indecisiveness among buyers and sellers. Crucial support is positioned at 21,500–21,400, while resistance is situated at 21,800–21,850. Overall, the trend remains positive, and the current dip should be perceived as a buying opportunity,” Mandar Bhojane, research analyst at Choice Broking, said.

“Near-term target expected till 21,700-21,750 levels. The overall trend shall get better provided the index gives a decisive breach above the 21,750 zone to anticipate for retesting the all-time high levels once again in the coming days with near-term support maintained at 21,300 zone. Support for the day is seen at 21,500, while the resistance is seen at 21,750,” Prabhudas Lilladher said.

“The overall bias for the index remains fragile despite scaling over the 21,656 yesterday, its 20-exponential moving average (EMA), as major hurdle floats between 21,800-21,8500 levels. On the downside, 21,550- 21,500 zone keeps bolstering the upward bias, and if the index succeeds to overcome 21,850, further upside to 22,000 cannot be ruled out, ” said Avdhut Bagkar, derivatives and technical analyst at StoxBox.

“Option data shows writing in 21,500 PE in early morning session, indicating a clear support. On the upside, 22000 remains a key hurdle as 22000 CE displays short bias,” Bagkar said.

Story continues below Advertisement

Bank Nifty

“Bank Nifty on the other hand remained sluggish with a slight negative bias on the back of weak movementfrom HDFC Bank which extended the losses and is near the 52-week low level of 1,460. The index would have the crucial and important support zone of 44,600 levels of the significant 200 period MA zone below which needs to be sustained. Bank Nifty would have a daily range of 45,400–46,000 levels.”

Among individual stocks, long build up is witnessed in BandhanBank, PVR Inox, CoalIndia while short build up is seen in IndusInd bank, Federal Bank and IndiGo.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.