F&O Manual | Indices trade flat, experts suggest sell on rise until Nifty breaches 21,450

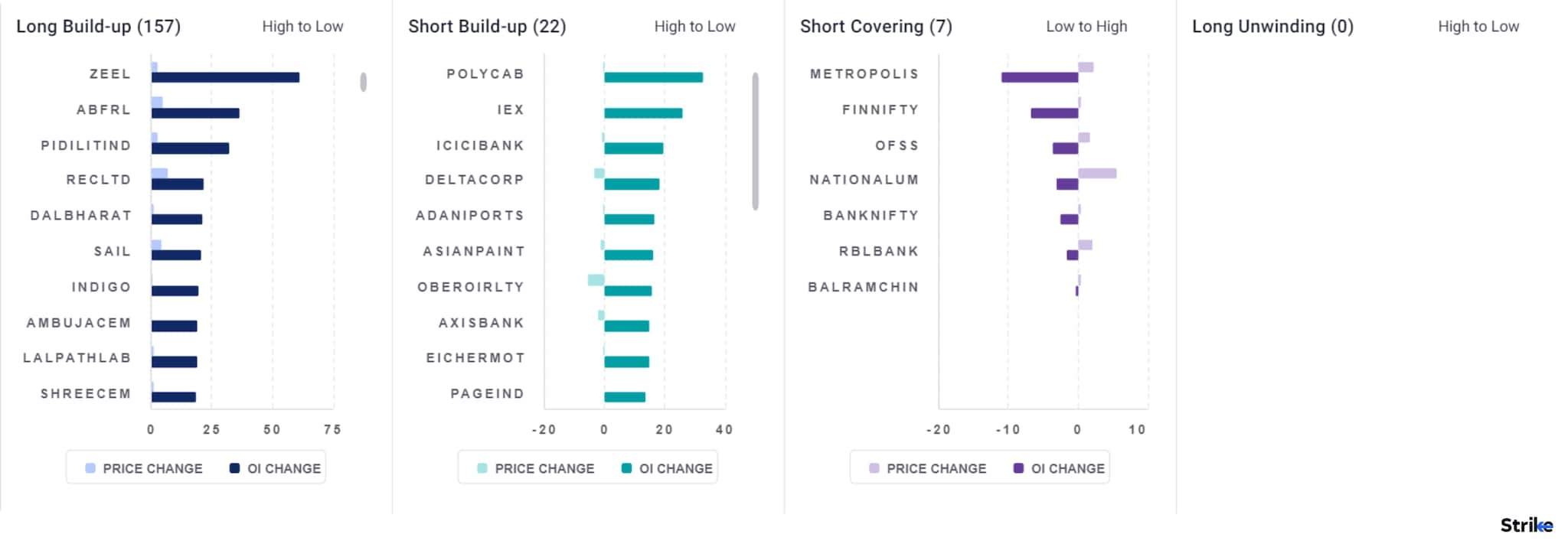

Among individual stocks, long build up can be seen in ZEE ltd, PidiliteIndia, REC Ltd. While short build up can be seen in Polycab, IEX, ICICI Bank and Delta corp.

The benchmark Indian indices are trading positive to flat after opening gap-down on January 24. The sentiment continues to be ‘sell on rise’ until major resistance zones of 21,400-21,450 are breached for the Nifty and 45,450-45,500 for Bank Nifty.

The expected range for the day for the Nifty till expiry is anticipated to be in the range of 21,200-21,460. Experts advise caution to traders before taking aggressive long positions.

At 11:38am, the Sensex was up 237.58 points or 0.34 percent at 70,608.13, and the Nifty was up 77.20 points or 0.36 percent at 21,316.00.

About 1,951 shares advanced, 1,181 declined, and 74 traded unchanged.

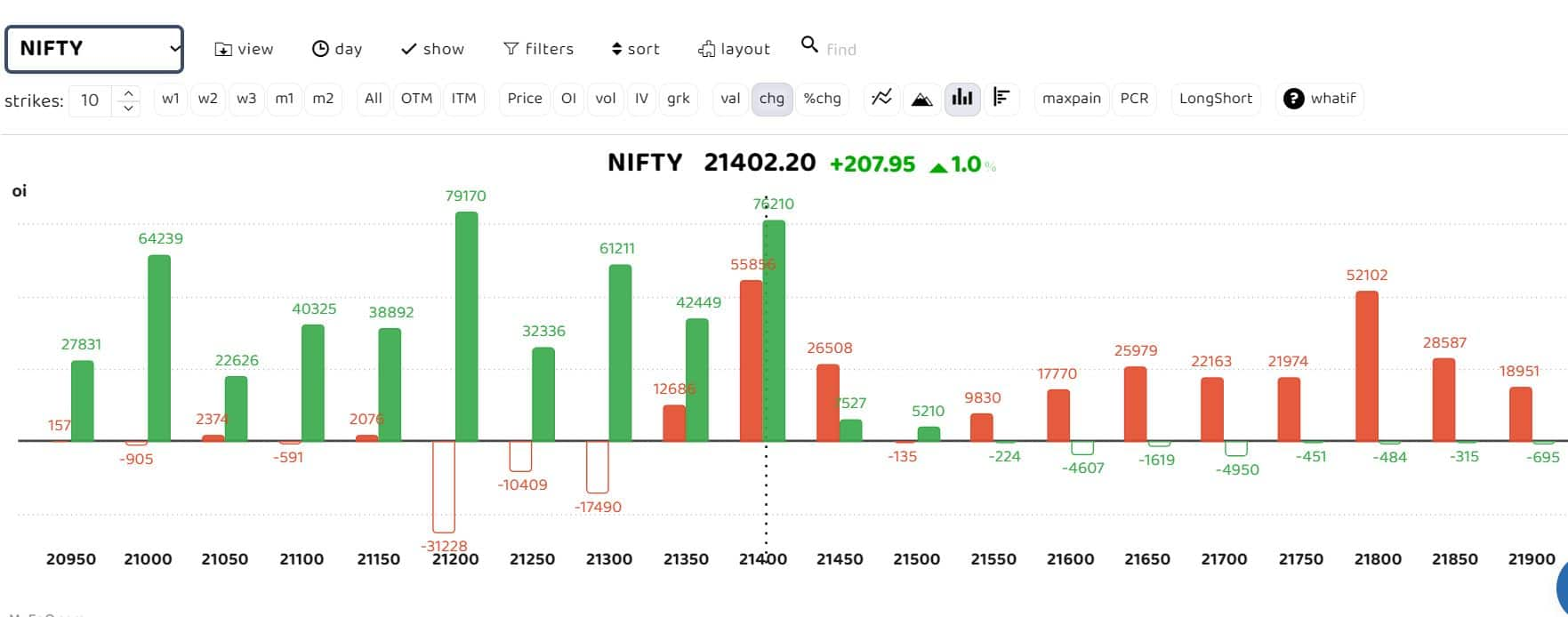

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

“Nifty 21300 and 21200 levels have seen call writers unwinding their positions along with significant put writers additions. The range is expected to be around 21200-21460 to be range till monthly expiry,” Sudeep Shah, head of derivatives and technical at SBI Securities, said.

“The crucial resistance for the day can be seen at 21,400-21,450 where significant call writer additions is seen. So, until this level is breached, ‘sell on rise’ continues. Traders are advised to be cautious before taking aggressive long positions,” Shah said.

Bank Nifty

Story continues below Advertisement

“Bank Nifty continue to remain a pain point for the markets as weakness led by HDFC Bank and Axis Bank. According to option data, 45,000 followed by 45,500 Call hold sizeable OI which is likely to act as major resistance area,” ICICI Securities said.

For Bank Nifty, Shah advised to ‘sell on rise’ till 45,450-45,500 resistance is breached.

Among individual stocks, long build-up can be seen in Zee, PidiliteIndia and REC, while short build-up can be seen in Polycab, IEX, ICICI Bank and Delta Corp.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.