Here are 68 stocks that turned multi-baggers from the last Republic Day

Market likely to be strong in the year ahead only if Fed cuts interest rates aggressively, experts said

One year from the last Republic Day it has been phenomenal for the equity markets as the Nifty 50 rallied a little more than 19 percent. Most of the gains were seen between the middle of May and September 2023, and then again in December, while the rest of the period was consolidative for the market during the year.

The performance of broader markets was brighter than the benchmarks with the Nifty Midcap 100 and Smallcap 100 indices surging 54 percent and 64 percent, respectively.

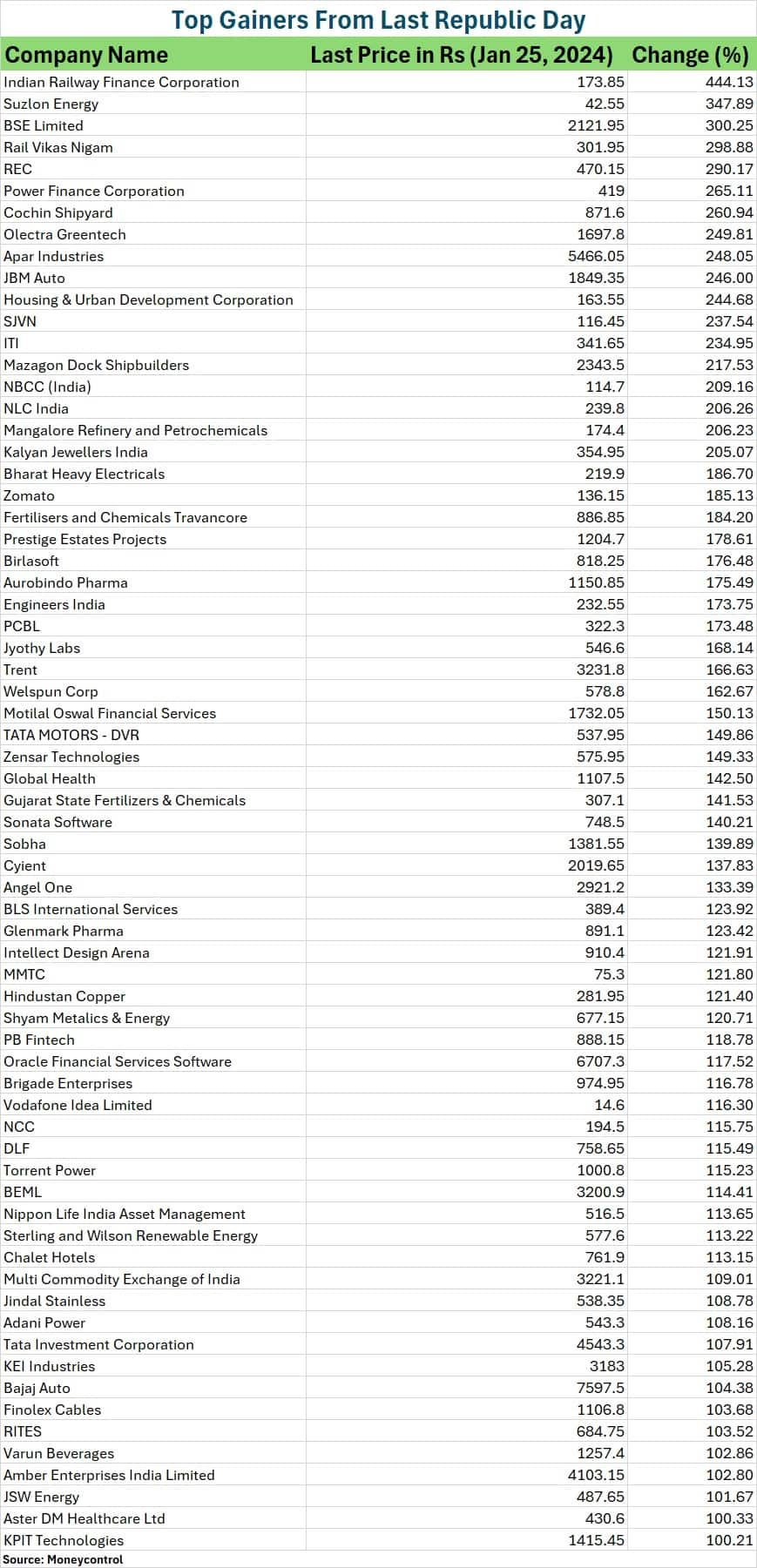

A total of 68 stocks of the Nifty 500 index stood out as star performers with multi-bagger returns from the closing of January 25, 2023, till January 25, 2024 (the period considered for the story), while the Nifty 500 index gained 28 percent during the same period.

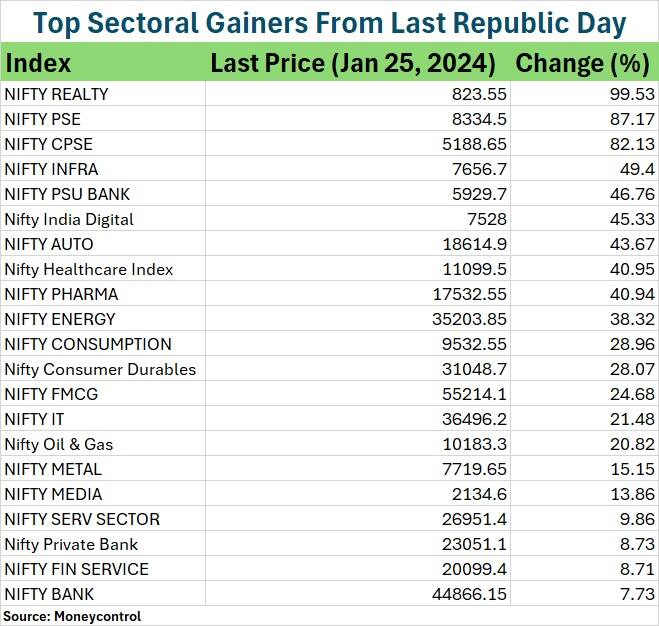

Further, the big gainers among sectors were realty, public sector undertaking (PSU), infrastructure, auto, pharma and energy stocks, registering a rally between 38 percent and 100 percent.

Most of the stocks in the multi-bagger list are from the above-mentioned sectors. Moreover, half of these sectors like PSUs, infrastructure (including railway) and energy are expected to be star performers in the years to come as well, largely due to capex-driven growth, experts believe.

The railway stocks were the best performer of the lot with Indian Railway Finance Corporation topping the list among the 68 stocks registering a 444 percent gain, Rail Vikas Nigam took the fourth spot with a 299 percent surge, while RITES was up 103 percent.

Power and ancillaries space created the maximum multi-baggers during the year given the government’s push to clean energy space, infrastructure and manufacturing sector, which ultimately boosted demand and as a result, there has been consistent addition in capacities by the company to meet the rising demand.

Suzlon Energy, REC, Power Finance Corporation, SJVN, Bharat Heavy Electricals, Torrent Power, Sterling and Wilson Renewable Energy, Adani Power, JSW Energy and Olectra Greentech were the gainers in power space (directly as well as indirectly), rising 101-347 percent.

Story continues below Advertisement

Also read: Republic Day 2024: PM Modi, Macron discuss Red Sea crisis, Gaza conflict, and more

“Contrary to global challenges, India’s conducive environment for capex-driven growth stood out, evident in GST implementation, rising collections, and substantial government allocations to capex. Sectors like defence, railways, infrastructure, power, and PSU banks became focal points for investment,” Anirudh Garg, partner & fund manager at Invasset PMS said.

Moreover, most experts expect the government to add more weight to the infrastructure sector by increasing capex in the upcoming budget. Hence, the opportunities will remain huge in the years to come, they believe.

“We expect the government to further intensify capex on infrastructure to achieve its longer-term goals. There is no reason to put brakes on this important infrastructure transformation. The growth in the infrastructure space will continue to remain strong,” Ashwini Shami, Executive Vice President & Portfolio Manager at OmniScience Capital said.

Also read: Bearish bites in Jan rollover, but a glimmer of hope sparks for Feb

Over the last many years, while maintaining fiscal discipline and adequately providing capital for important infrastructure projects, the government has also undertaken multiple structural reforms to strengthen the economy.

“We continue to see great opportunities in power, railway infrastructure and the clean-tech space,” Ashwini said.

PSU stocks remained in the limelight, with Cochin Shipyard, Mazagon Dock Shipbuilders, ITI, Engineers India and MMTC climbing 122-261 percent, while the real estate space caught the attention of bulls due to demand revival and declining inventories after a long period of consolidation. Housing & Urban Development Corporation, NBCC (India), Prestige Estates Projects, Sobha, DLF and Brigade Enterprises gained 115-245 percent.

Among other stocksBSE, Zomato, PB Fintech, Kalyan Jewellers India, PCBL, Jyothy Labs, Motilal Oswal Financial Services, Global Health, Angel One, Vodafone Idea, Chalet Hotels, Multi Commodity Exchange of India, Bajaj Auto, Finolex Cables, Varun Beverages, Amber Enterprises India and Aster DM Healthcare rallied more than 100 percent either due to attractive valuations, news, improving financial metrics or were a major beneficiary of sector revival.

Markets in the year ahead

Now, coming back to markets, the rally in benchmark indices was driven largely by the hope of a start in interest rate cuts in 2024, overall strong earnings growth, and likely continuation of policies after general elections due to favourable state elections results in the recent past, consistent DIIs support, stable crude oil prices, and the results of economic reforms & measures announcing by the government. It was despite the geopolitical tensions.

Also read: Nomura expects Fed to cut interest rates by 100 bps in 2024

But, the year ahead may not generate similar kind of returns, experts said. They expect the year to generate around 10 percent market returns or a little less than that, and most likely to be volatile due to general elections in India & United States, and the focus on interest rate trajectory in the US.

“The year 2023 was a good one for most of the stock markets globally barring a few, such as China. The double-digit percent return came not only in India but also in the US,” Shailendra Kumar, Chief Investment Officer at Narnolia Financial Services said.

Along with major geopolitical events and election outcomes during 2024, the US Fed policy stance will be key to how the market will move through 2024, he feels.

According to Shailendra, current valuation and earnings growth going forward suggest a low single-digit return for the Indian market but if the FED policy change happens then 2024 will be another strong year. All in all Indian market remains a strong Buy if any correction happens, he believes.

Nimesh Chandan, CIO at Bajaj Finserv Asset Management also agreed with Shailendra, saying it’s crucial to monitor the interest rate trajectory in the US. Apart from that, overall, he expects 2024 to be an eventful year. “The most important ones (event) are elections, both in India and the US,” Chandan said.

Speaking about the Lok Sabha Elections 2024, he said, “Continuity of the incumbent government is something which equity markets have already started to price in after the recent state election outcomes. Any adverse election outcomes in June can derail the market sentiment. Currently, we see this as a low-probability event.”

As far as the interest rates trajectory, Nimesh is of the view that the market currently anticipates a “Goldilocks” scenario, with interest rates easing without a recession. “Any deviation from this assumption could introduce significant volatility to the equity markets,” he added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/Foreclosed-House-Spencer-Platt-Staff-Getty-Images-56a5804c5f9b58b7d0dd3030.jpg)