F&O Manual | Volatility index crosses 16; Nifty may test 22,000 on trading above 21,750

At 10 AM, the Sensex was down 72.90 points or 0.10 percent at 71,868.67, and the Nifty was up 4.90 points or 0.02 percent at 21,742.50

The benchmark indices traded flat amid volatility in the first hours of January 30, after the previous day’s short-covering rally in the Nifty, which was driven by a strong surge in Reliance and select IT stocks. With India VIX surpassing 16, experts predict the Nifty’s range to be 21,500 on the downside and 22,000 on the upside.

Among sectors, except for energy, all indices traded in the green, with IT, metal, realty, and oil and gas each posting a 0.5 percent increase.

At 10am, the Sensex was down 72.90 points or 0.10 percent to 71,868.67, and the Nifty was up 4.90 points or 0.02 percent to 21,742.50. About 1,862 shares advanced, 1,153 declined, and 92 traded unchanged.

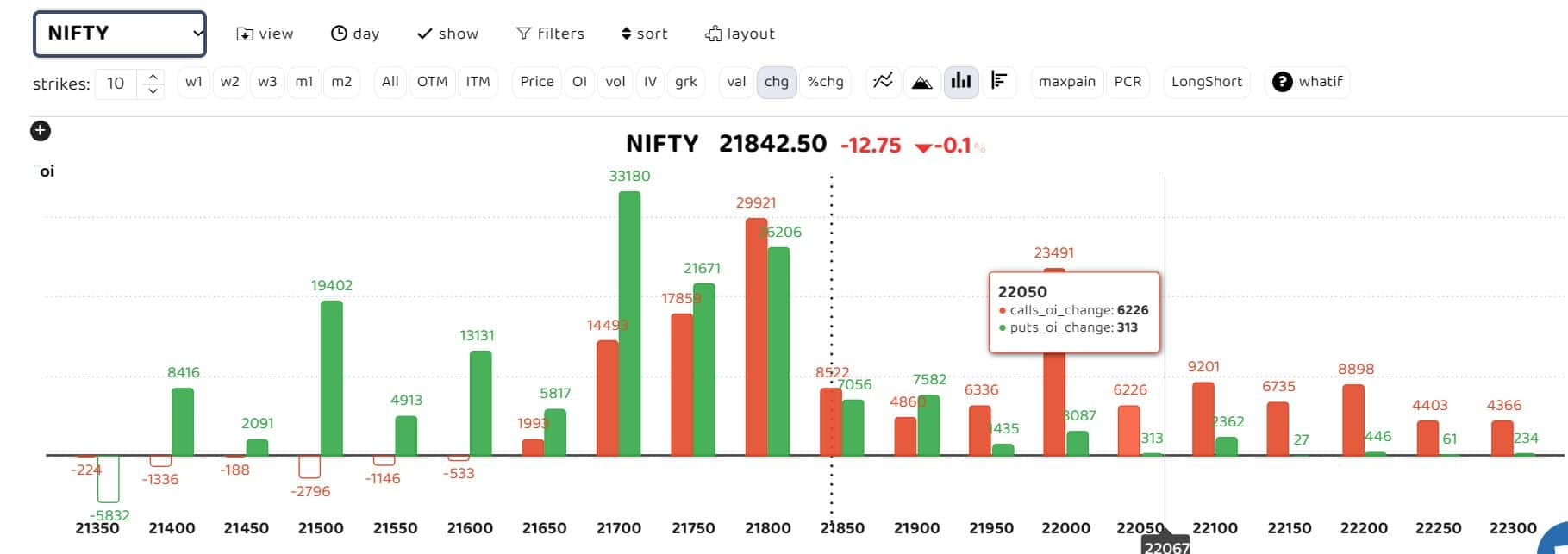

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Strong put writing is observed in the 21,600 and 21,500 strikes, while aggressive writing is noted in 21,800 and 21,900 calls. “Overall, the range for the coming few sessions could be 21,500 on the downside and 22,000 on the upside. Going forward, the Index will find support around the 21,560-21,600 zone, where the 10-day EMA is placed. As long as this holds, the rebound rally is likely to continue up to 21,900-21,950, where it is expected to face resistance,” Sudeep Shah, technical and derivative head at SBI Securities, said.

“In case 21,550 is breached, the Index could slide towards the 21,380-21,350 zone on the downside. Above 21,950, the Index could witness an extension of its rebound rally towards 22,100-22,150 levels,” he added.

“A sustenance above 21,750 would reverse the weak scenario for the index and would place it on a firm footing ahead of the budget, ” said Akshay Bhagwat, senior vice-president of derivatives research at JM Financial.

“The PCR has improved from 0.81 to 1.09 as put writers increased their positions at higher strikes, specifically at 21400/21500. The range from 21350 to 21600 witnessed significant put writing activity. There has been a noticeable shift in call writing bets from the 22000 strike to the 22500 strike, reflecting the impact of the recent strong upward move that has put call writers on the defensive. The premiums for At-The-Money (ATM) calls are nearly 1.3 times that of puts,” added Bhagwat.

Story continues below Advertisement

India VIX

The India VIX has reached a nine-month high, surging past 16 levels. “India VIX has experienced a significant uptick, with an increase of over 13 percent primarily attributed to call buying, including both unwinding of call writing positions and fresh Out-of-The-Money (OTM) buying. There has been substantial shedding of positions in the 21,300 to 21,500 calls, contributing to the intraday up-move,” Bhagwat said.

“We anticipate further escalation in volatility, potentially reaching levels in the 17-18 zone, in anticipation of the outcomes from the FOMC meeting and the Union Budget. The repercussions of both events will likely manifest on Thursday in the Indian markets,” added Sudeep Shah.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions