China stocks tumble to 5-year low after weak manufacturing data; Australia shares hit all-time high

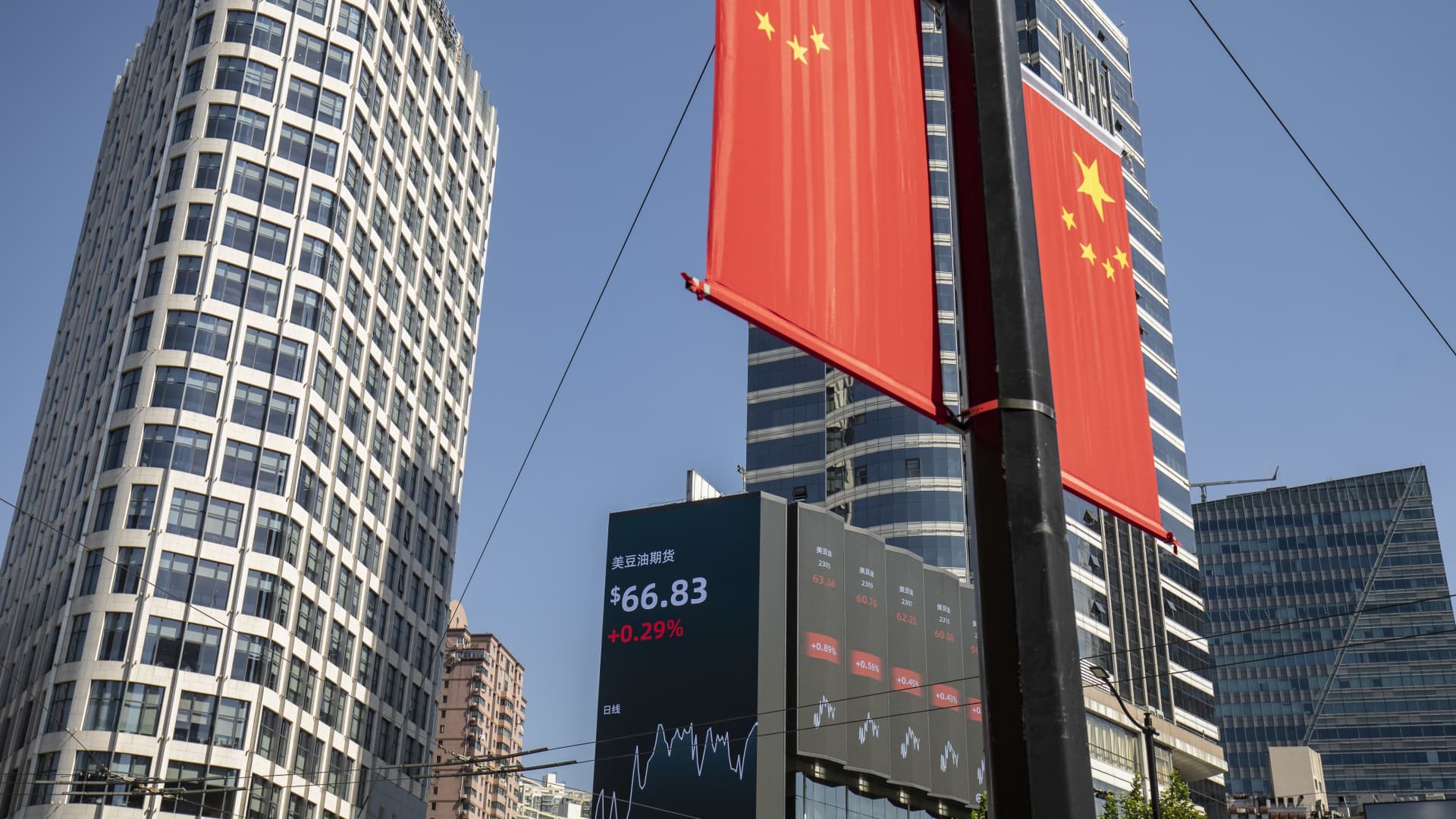

A public screen displays stock figures in Shanghai, China, on Monday, Oct. 10, 2022.

Bloomberg | Bloomberg | Getty Images

Mainland Chinese stocks fell to a five-year low while Australian stocks smashed all-time records on Wednesday.

The S&P/ASX 200 gained 1.06% and closing at 7,680.7, surpassing its previous record high of 7,632.8 set back on August 13, 2021.

This comes after the country’s fourth-quarter inflation rate was lower than expected at 4.1%, its lowest level since the quarter ended December 2021.

China’s CSI 300 slid to a five-year-low, sinking 0.91% to close at 3,215.35 after China’s manufacturing activity shrank for the fourth straight month in January, with the official manufacturing purchasing index at 49.2. Hong Kong’s Hang Seng index dropped 1.78%.

Other Asia-Pacific markets were mixed. Japan’s Nikkei 225 closed 0.6% higher at 36,286.71, while the broad based Topix also ended nearly 1% higher at 2,551.10.

South Korea’s Kospi was down 0.07% at 2,497.09, while the small cap Kosdaq saw a bigger loss of 2.4% closing at at 799.24.

The moves come after heavyweight Samsung Electronics reported a 34% fall in operating profit year-on-year in the fourth quarter, as well as a 73.4% plunge in net profit in the same period. Shares of Samsung fell 2.15%.

Overnight in the U.S., the three major indexes ended the day mixed as Wall Street also waits for the latest Fed decision on interest rates.

The Fed funds futures market has priced in a 97% probability that the central bank will leave rates unchanged, according to the CME FedWatch tool, so investors are instead left anticipating a shift in the policy statement that will close out the meeting.

The S&P 500 slipped 0.06%, while the Nasdaq Composite pulled back 0.76%. In contrast, the Dow Jones Industrial Average added 0.35% to end at 38,467.31, marking its seventh record close this year.

— CNBC’s Brian Evans and Alex Harring contributed to this report