Trade setup for Budget day: 15 things to know before opening bell

Nifty likely to face resistance at 21,800-21,900 on Budget day

Technically the market turned strong ahead of budget day and recouped most of the previous day’s losses to close above the 21,700 mark on January 31. Hence, in the coming session, the index may face resistance at the 21,800-21,850 area and if it closes above 21,850 and sustains then 22,000 can be a possibility with support at 21,500-21,400 levels, experts said.

On January 31, the BSE Sensex rallied 612 points to 71,752, while the Nifty 50 jumped 204 points to 21,726 and formed a long bullish candlestick pattern on the daily charts with healthy volumes.

“Analyzing the chart reveals a trading range between 21,850 on the higher side and 21,400 on the lower side, with 21,200 serving as a key support. Both levels have been staunchly defended, but there is a likelihood that one zone may be breached, leading to a trending move in early February,” Rajesh Bhosale, technical analyst at Angel One said.

He expects heightened volatility on budget day and advised traders to exercise caution, avoiding undue risks and waiting for the market to stabilise before making aggressive moves.

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas also feels considering the event of an Interim Budget, the volatility is likely to continue. “Key support levels are 21,550-21,500, while immediate hurdle zone is placed at 21,850-21,900,” Gedia said.

The broader markets also traded higher and outperformed benchmarks as the Nifty Midcap 100 and Smallcap 100 indices rallied 1.6 percent and 2.25 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Story continues below Advertisement

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,527 followed by 21,458 and 21,346 levels, while on the higher side, it may see immediate resistance at 21,750 followed by 21,819 and 21,931 levels.

Meanwhile, on January 31, the Bank Nifty played a key role and surged 629 points or 1.4 percent to 45,997 before the budget announcement. The banking index reached the 46,000 mark and formed a long bullish candlestick pattern on the daily timeframe.

“On the upside, it is approaching key hurdles placed in the range 46,370-46,640 where the key daily moving averages are placed. Thus, the current rally can extend towards this zone from a couple of days perspective,” Jatin Gedia said.

On the downside, 45,200 will act as a crucial support zone, he feels.

As per the pivot point calculator, the Bank Nifty is expected to take support at 45,326 followed by 45,064 and 44,641 levels, while on the higher side, the index may see resistance at 46,173 followed by 46,434 and 46,858 levels.

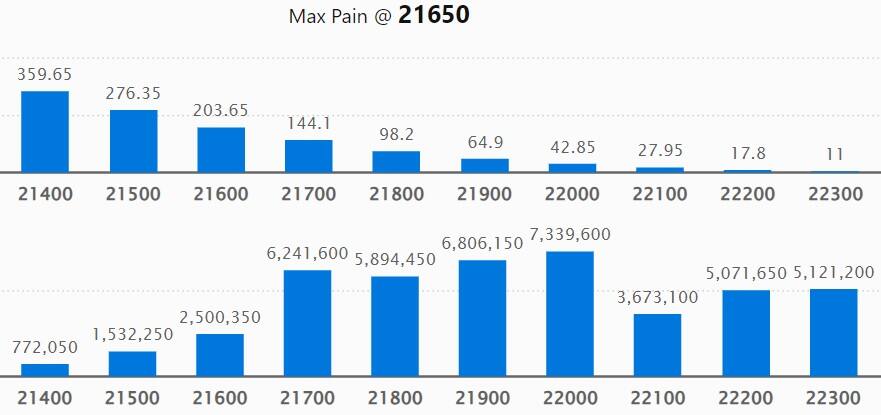

As per the weekly options data, the maximum Call open interest remained at 22,500 strike with 1.01 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,000 strike, which had 73.39 lakh contracts, while the 21,900 strike had 68.06 lakh contracts.

Meaningful Call writing was seen at the 22,500 strike, which added 29.07 lakh contracts followed by 21,900 and 22,300 strikes adding 24.78 lakh and 21.28 lakh contracts, respectively.

The maximum Call unwinding was at the 21,600 strike, which shed 13.62 lakh contracts followed by 21,500 and 21,700 strikes which shed 6.33 lakh and 2.86 lakh contracts.

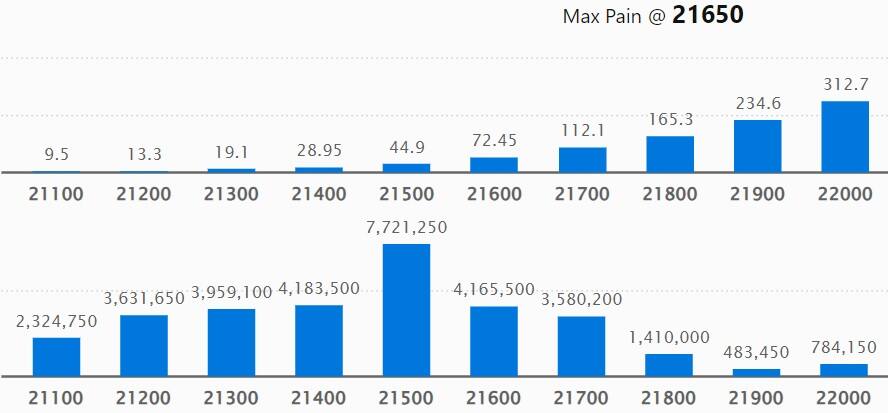

On the Put front, the maximum open interest was seen at 21,500 strike, which can act as a key support level for Nifty, with 77.21 lakh contracts. It was followed by 21,000 strike comprising 72.19 lakh contracts and then 20,500 strike with 43.77 lakh contracts.

Meaningful Put writing was at 21,500 strike, which added 39.36 lakh contracts, followed by 21,000 strike and 21,700 strike, which added 24.68 lakh contracts, and 19.8 lakh contracts.

Put unwinding was seen at 20,400 strike, which shed 4.45 lakh contracts, followed by 20,300 strike, which shed 2.07 lakh contracts, and 20,600 strike, which shed 1.33 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Pidilite Industries, HCL Technologies, Aurobindo Pharma, Power Grid Corporation of India and ITC saw the highest delivery among the F&O stocks.

A long build-up was seen in 74 stocks, which included Dr Reddy’s Laboratories, Max Financial Services, Coromandel International, SAIL and Gujarat Gas. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 7 stocks saw long unwinding including BPCL, Hindustan Petroleum Corporation, Astral, Aurobindo Pharma and NMDC. A decline in OI and price indicates long unwinding.

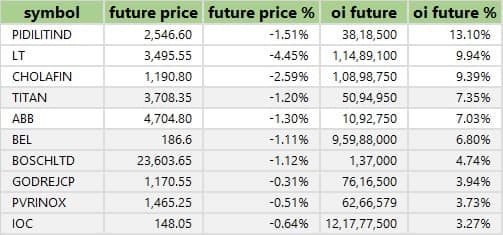

22 stocks see a short build-up

A short build-up was seen in 22 stocks including Pidilite Industries, Larsen & Tourbo, Cholamandalam Investment & Finance, Titan Company and ABB India. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 84 stocks were on the short-covering list. This included Exide Industries, M&M Financial Services, Federal Bank, Punjab National Bank and AU Small Finance Bank. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, rose to 0.9 on January 31, from 0.82 levels in the previous session. The below 1 PCR indicates that the Call volumes are higher than the Put volumes, which generally indicates an increase in bullish sentiment.

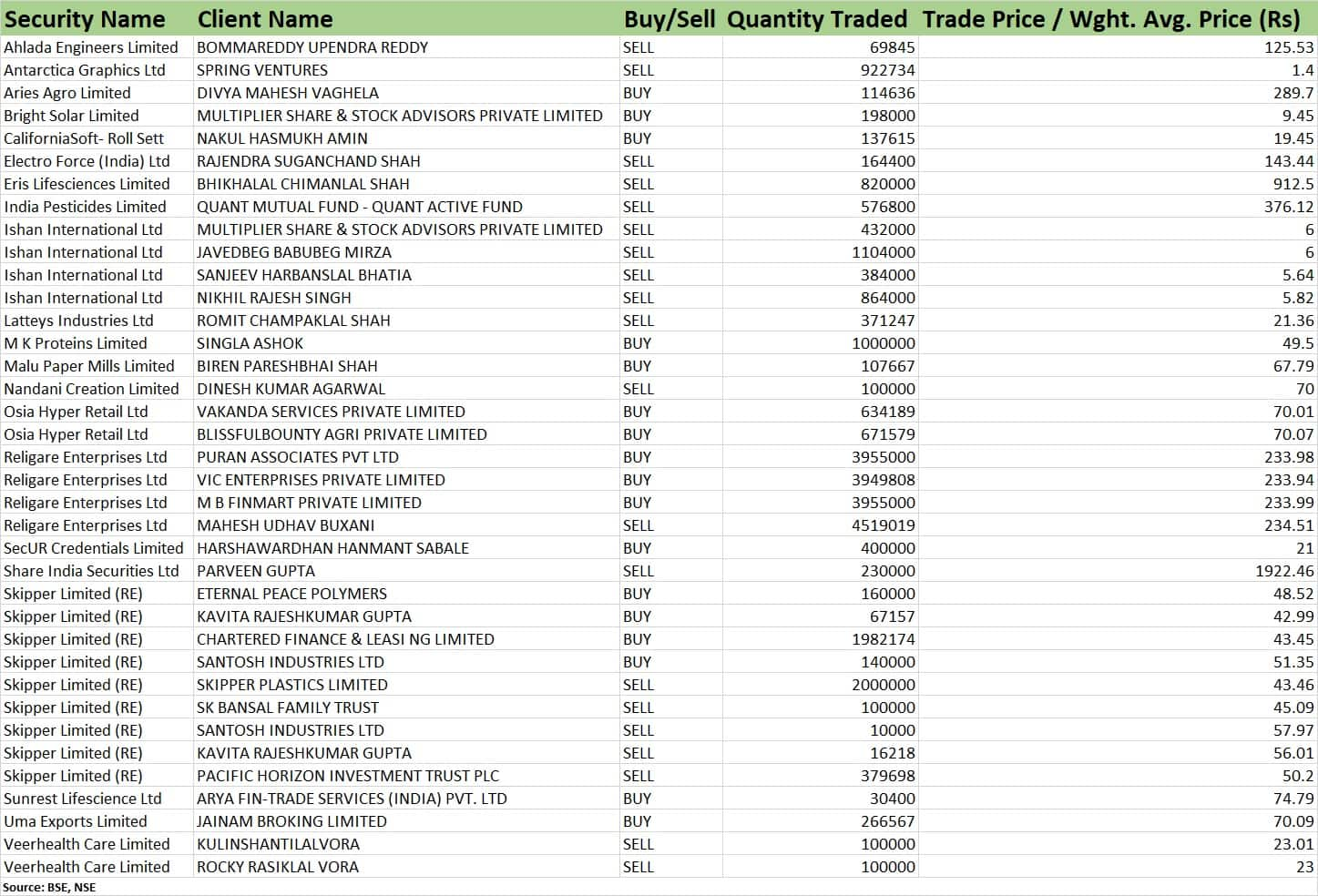

Religare Enterprises: Puran Associates, VIC Enterprises and M B Finmart, which are part of Burman family, bought 1.18 crore equity shares equivalent to 3.6 percent of paid-up equity in the company via open market transactions valuing at Rs 277.48 crore.

For more bulk deals, click here

Titan Company, Adani Enterprises, Adani Ports and Special Economic Zone, AAVAS Financiers, Abbott India, Aditya Birla Capital, Bata India, City Union Bank, Deepak Fertilisers, eClerx Services, Indian Hotels Company, India Cements and Dr Lal PathLabs will be in focus ahead of quarterly earnings on February 1.

Stocks in the news

One 97 Communications (Paytm): The Reserve Bank of India has taken further action against Paytm Payments Bank, saying no further deposits or credit transactions or top-ups will be allowed in any customer accounts, prepaid instruments, wallets, FASTags, NCMC cards, etc. after February 29, 2024. On March 11, 2022, the RBI had directed Paytm Payments Bank to stop onboarding of new customers with immediate effect.

Glenmark Pharmaceuticals: Glenmark joined hands with Pfizer to launch Abrocitinib in India. Abrocitinib is used for the treatment of moderate to severe atopic dermatitis.

Shree Cement: The cement company has recorded 165 percent on-year growth in standalone net profit at Rs 734 crore for the quarter ended December FY24, with improved realisation & cost reduction amidst robust demand growth. Revenue from operations grew by 20 percent year-on-year to Rs 4,901 crore.

Godrej Consumer Products: The FMCG company has registered a 6.4 percent on-year growth in consolidated profit at Rs 581 crore for the October-December period of FY24, driven by healthy operating numbers. Consolidated revenue from operations for the quarter increased by 1.7 percent to Rs 3,660 crore compared to the corresponding period of the last fiscal.

Jindal Steel & Power: The company has recorded a consolidated profit of Rs 1,928 crore for the quarter ended December FY24, growing 272 percent over the profit of Rs 518 crore in the year-ago period. The base in Q3FY23 was low due to exceptional loss and higher tax costs. Consolidated revenue from operations fell 6 percent year-on-year to Rs 11,701.3 crore.

Dixon Technologies: The electronic manufacturing services company reported an 87 percent on-year growth in consolidated net profit at Rs 97 crore for the October-December quarter of FY24, driven by a healthy topline, though the operating margin was weak due to higher input cost. Revenue from operations surged 100 percent to Rs 4,818.3 crore compared to the year-ago period.

Funds Flow (Rs crore)

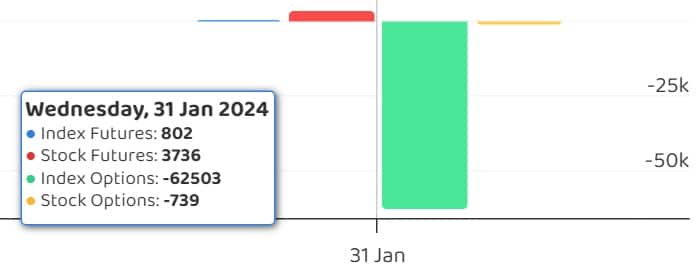

Foreign institutional investors (FIIs) net bought shares worth Rs 1,660.72 crore, while domestic institutional investors (DIIs) purchased Rs 2,542.93 crore worth of stocks on January 31, provisional data from the NSE showed.

Stocks under F&O ban on NSE

The NSE has added SAIL to the F&O ban list for February 1, while retaining Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.