European markets close slightly lower as investors ponder Fed Powell’s comments; Unicredit jumps 8%

Delivery Hero stock drops 30% in a week

Delivery Hero CEO Niklas Östberg speaking at the Noah tech conference in Berlin on June 13, 2019.

Krisztian Bocsi | Bloomberg via Getty Images

Shares of German food delivery company Delivery Hero dropped further Monday, extending a huge slide from last week, after the firm released preliminary financial numbers showing sales growth in line with guidance a week and a half before they were due to be released.

Delivery Hero said Monday that its group GMV (gross merchandise value) rose 6.8% in 2023 year-over-year to 47.6 billion euros ($51.2 billion), while adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) exceeded 250 million euros.

Delivery Hero also forecast a buoyant 2024, with the firm guiding GMV growth of between 7% and 9% and a tripling of its adjusted EBITDA to between 725 million and 775 million euros.

That did little to soothe investor fears over the company’s strategy. Monday’s slump takes Delivery Hero’s overall share price losses in the past five trading days to more than 30%.

Delivery Hero share price performance in the past five days.

Delivery Hero sold all of its 4.5% minority stake in British food delivery firm Deliveroo. Speculation that Delivery Hero had ended talks with Singapore’s Grab to sell certain assets of its Foodpanda business in South East Asia — which Delivery Hero has denied — has also pressured shares.

– Ryan Browne

Stocks on the move: Lotus Bakeries up 15%, Nordea Bank down 5%

Shares of Belgian biscuit maker Lotus Bakeries jumped to the top of the Stoxx 600, up 14.9%, after reporting strong full-year results, with revenues up 21% to over 1 billion euros ($1.07 billion).

On the other end, shares of Nordea Bank fell 5.4% on lower-than-expected fourth-quarter profits.

Operating profit for the period was 1.42 billion euros, down from 1.61 billion the previous year and below the 1.64 billion forecast by analysts.

— Karen Gilchrist

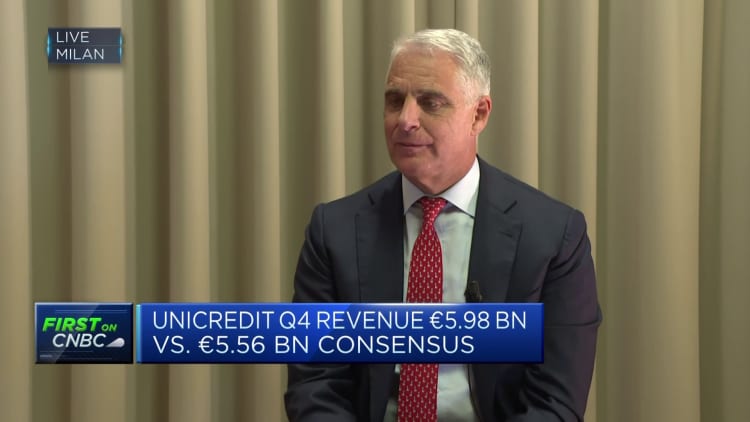

Unicredit shares at highest since 2015, up 9.8%

Shares of Italian bank Unicredit hit their highest level since 2015 Monday, rising 9.8%, after announcing that it would return 8.6 billion euros ($9.2 billion) to investors on the back of higher-than-expected profits.

The Milan-based bank shared details of the planned payout after reporting fourth-quarter profits of 1.9 billion euros, almost three times analysts’ expectations.

The payout, which will be delivered through a combination of buybacks and dividends, follows a strong year for the bank, which has been buoyed by higher interest rates.

— Karen Gilchrist

CNBC Pro: Wealth manager for the super-rich names 3 stocks to buy right now

Ongoing political tensions, still-high inflation levels and uncertainty over when the U.S. Federal Reserve will cut interest rates have raised questions about which sectors — and stocks — will outperform looking ahead.

For Kevin Teng, CEO of Wrise Wealth Management Singapore, which serves ultra-high-net-worth individuals across Asia, the Middle East and Europe, three top stocks stand out as good plays right now.

CNBC Pro subscribers can read more here.

— Amala Balakrishner

CNBC Pro: Citi just added these names to its ‘high-conviction’ list of stocks — giving one over 50% upside

Citi has updated its list of its top “high-conviction” stock picks from global markets including the United States, Europe and Asia-Pacific.

Those are the “high conviction, differentiated stock recommendations to generate alpha” that its analysts have selected.

“We identify catalysts that will trigger outperformance and chose liquid names in which investors can build positions,” Citi said in its Feb. 1 report.

Here are four of the names.

CNBC Pro subscribers can read more here.

— Weizhen Tan

European markets: Here are the opening calls

European markets are set to open flat to lower Monday.

The U.K.’s FTSE 100 index is expected to open 3 points higher at 7,619, Germany’s DAX down 38 points at 16,861, France’s CAC down 13 points at 7,577 and Italy’s FTSE MIB 89 points lower at 30,760, according to data from IG.

Earnings are set to come from UniCredit. Euro zone producer prices data for December is also due.

— Holly Ellyatt