F&O Manual| Indices trade flat, support for Nifty at 21,700

At 10:33 hrs IST, the Sensex was down 58.20 points or 0.08 percent at 72,027.43, and the Nifty was up 14.20 points or 0.06 percent at 21,868.00.

Equity benchmarks were trading flat on February 5 morning after a volatile budget week during which the indices moved more than a percent on a daily basis.

The interim budget and the US Federal Reserve meeting weighed on sentiment but the Nifty made fresh new high on February 2 and also closed the week with gains of nearly 2.5 percent.

For the Nifty, 21,700 will be crucial support, ICICI Securities said.

At 10.33 am, the Sensex was down 58.20 points, or 0.08 percent, at 72,027.43, and the Nifty was up 14.20 points, or 0.06 percent, at 21,868.00.

About 1,788 shares advanced, 1,451 declined, and 95 were unchanged.

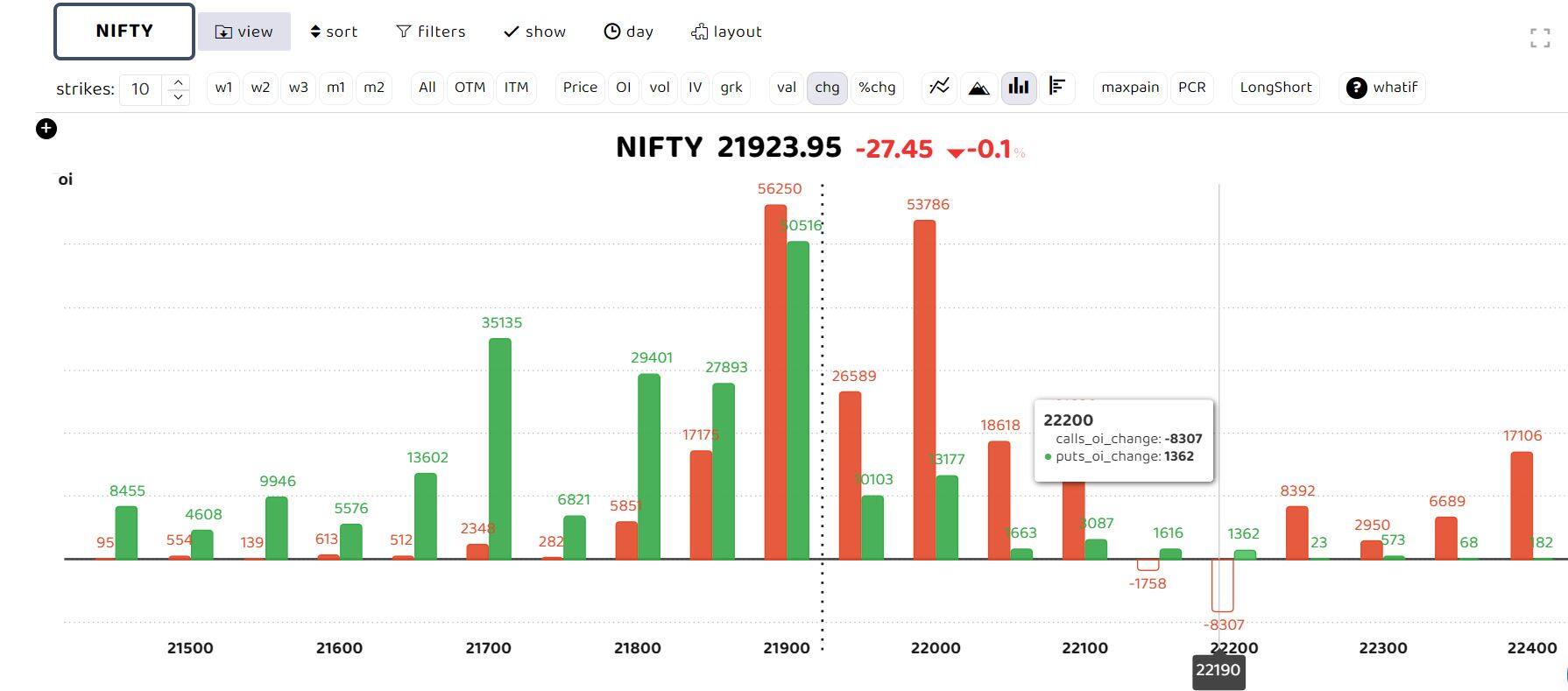

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

According to Raj Deepak Singh, Head of Derivatives at ICICI Securities, despite a flat weekly expiry day, sharp moves were seen in either direction throughout the week. “For the coming weekly expiry, options concentration is quite distributed, with the highest Call OI placed at the 22,200 strike. Considering Nifty has spent considerable time below 21,700 in the last few weeks, these levels are likely to act as immediate support,” he said. Going ahead, 21,700 will be the crucial support .

Sudeep Shah, Head of Technical and Derivative Research Desk, SBI Securities, added 21,680-21,710 is poised to serve as a critical support. A move below 21,680 could trigger profit booking to the 10-20 EMA zone of 21,580-21,600.

Resistance is at 22,000-22,100, as the index has reversed from this zone twice, Shah said.

Story continues below Advertisement

Bank Nifty

Avdhut Bagkar, Derivatives & Technical Analyst, StoxBox, said, “The overall trend in the Bank Nifty index remains fragile, with a downward inclination. If the index falls below 45,500 mark, the selling pressure may exaggerate, leading to a decline in the direction of 45,000 to 44750 levels. The positive bias is expected to gain momentum only over the key hurdle of 46500 mark.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.