F&O Manual | Indices trade higher; Nifty likely to rebound on hold above 21,900

Among individual stocks, long build-up is observed in Alkem, IPCA Labs, and ONGC, whereas short build-up is noted in CUB, NMDC, and Indigo.

Indian benchmark indices traded higher amid volatility on February 6. According to experts, the Nifty is likely to remain weak as long as it trades below 21,900, with support at 21,650. Above the 21,900 mark, the index has the potential for an extension of its rally, rebounding towards 22,070-22,150 levels.

Among individual stocks, long build-up is seen in Alkem, IPCA Labs, and ONGC, whereas short build-up is noted in CUB, NMDC, and Indigo.

At 12:13pm, the Sensex was up 390.77 points or 0.54 percent to 72,122.19, and the Nifty was up 124.80 points or 0.57 percent to 21,896.50.

About 1,957 shares advanced, 1,248 declined, and 73 stayed unchanged.

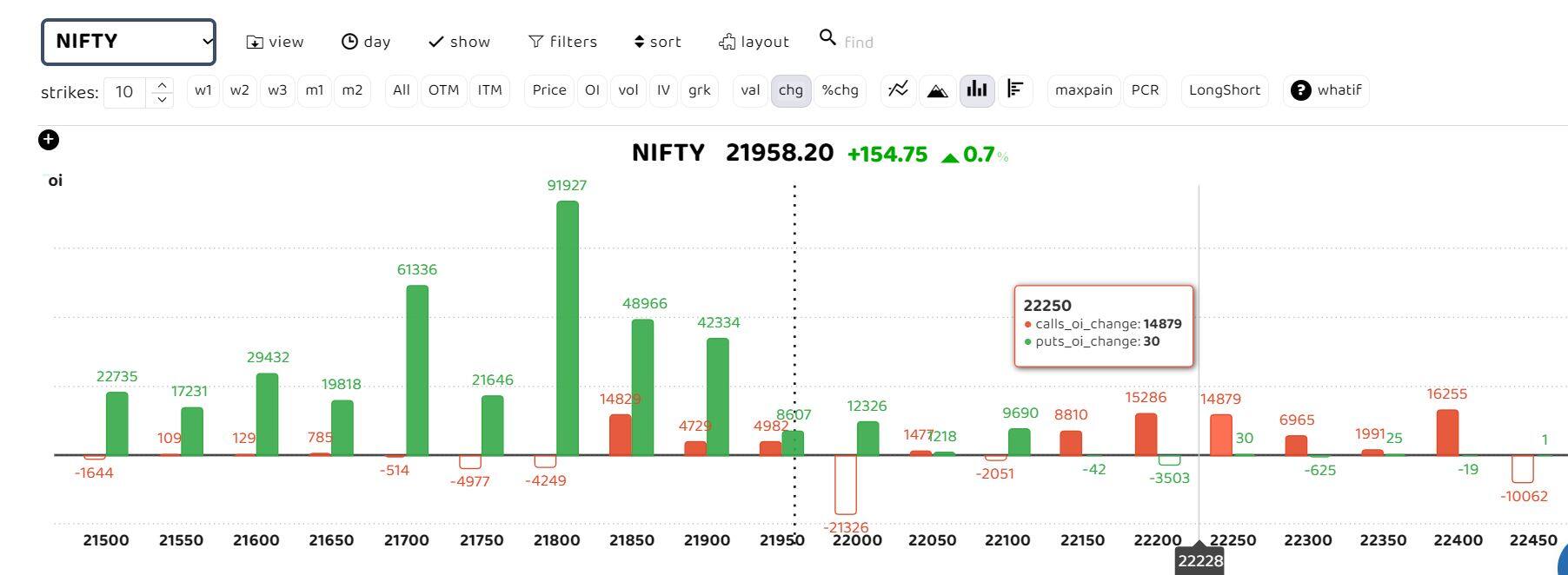

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

“The option chain activity for the February 8 weekly expiry reveals that the 21,000 put and 22,000 call options hold the highest Open Interest (OI). The OI Put-Call Ratio (PCR) stands at 0.89, while the Implied Volatility (IV) is at 15.3, suggesting a preference for call writing,” Rahul Sharma, head of derivative research at JM Financial, said.

“There is significant Open Interest in the 21,800, 21,900, and 22,000 call strikes, indicating a focus on writing bets for the 21,900 and 22,000 calls. Additionally, there was observed unwinding in the 21,600 puts during the last hour sell-off, coinciding with a spike of over 6 percent in the India VIX yesterday,” he said. “The market is viewed as weak as long as the Nifty trades below 21,900, with support seen around 21,650.”

“The resistance is seen at 21,850-21,900, while support is placed at 21,600-21,650 zone, which is a confluence of 10-20 EMA. In case 21,600 is breached, the index could witness a further slide towards the 21,450-21,470 zone. Above 21,900, the Index may see an extension of its rally rebound towards 22,070-22,150 levels,” Sudeep Shah, head of technical and derivative research at SBI Securities, said. “21,450 is a key level from a medium-term perspective derived from the upward sloping trendline joining key swing lows.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Story continues below Advertisement