F&O Manual | Nifty falls as RBI holds rates steady, VIX suggests volatility may persist

India VIX is suggesting that market volatility may persist.

Benchmark Nifty and Sensex is under selling pressure after the latest MPC meeting decision left key interest rates unchanged, while the measure of volatility – India VIX – surged by 2 percent, indicating a period of heightened volatility.

As of 1 PM, the Sensex was down 550 points or 0.72 percent at 71,635, and the Nifty was down 135 points or 0.62 percent at 21,795. About 1561 shares advanced, 1561 shares declined, and 86 shares unchanged.

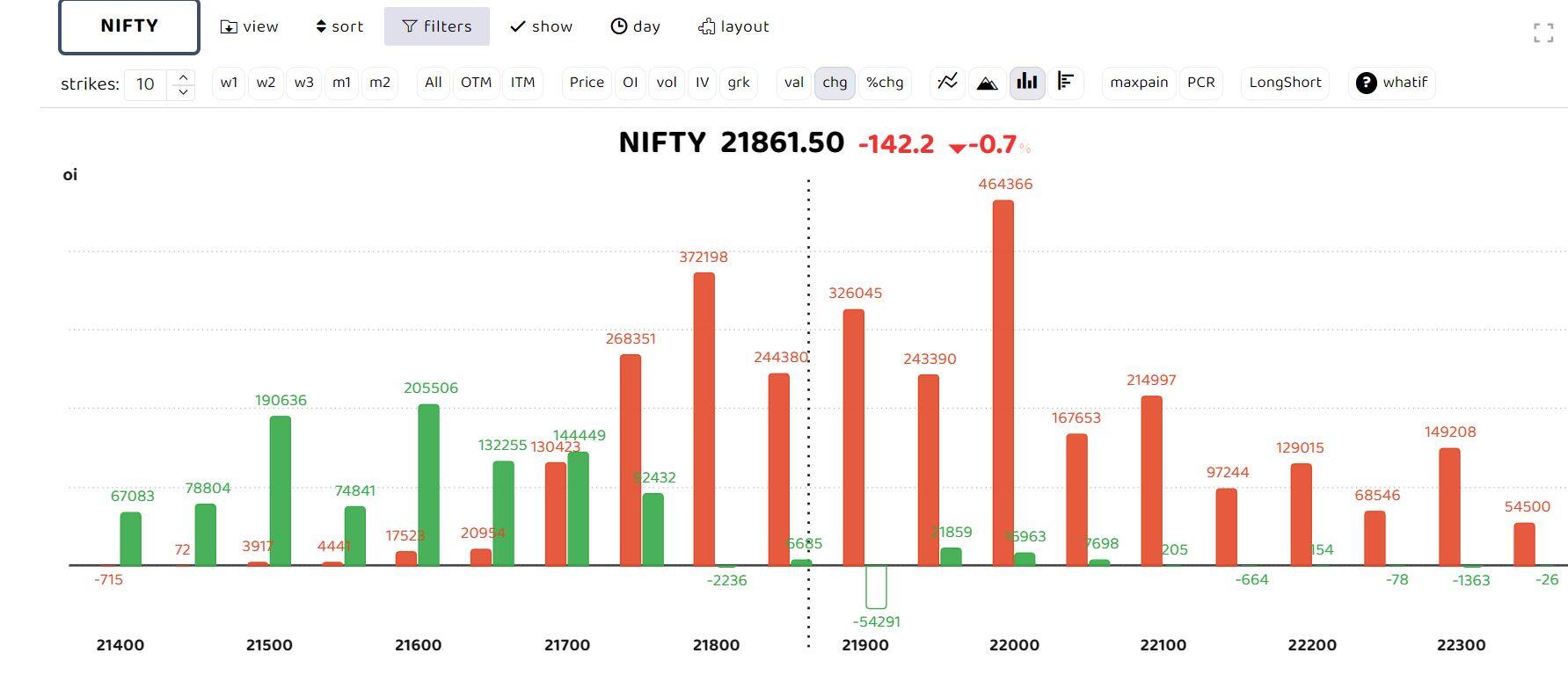

Chart indicate the change in open interest of call writers (red bars), and change in OI of put writers (green bars)

Volatility May Prevail

Options data shows call writers are dominant today. According to ICICI Securities, “the formation of higher high-low signifies elevated buying demand, reinforcing our positive stance and leading us to anticipate Nifty gradually heading towards 22,200 in the coming week. Amidst the progression of the earnings season and global developments, volatility is expected to prevail. Thus, adopting a prudent strategy of accumulating quality stocks on dips is advisable, as we anticipate Nifty to maintain the key support level of 21,400.”

What’s Looking Positive

ICICI Securities also highlighted few positive observations to reinforce their positive bias:

Story continues below Advertisement

– Bank Nifty is establishing a higher base above the 52-week EMA, and the IT index has resumed its upward trend after a 3-week hiatus. The revived momentum is expected to drive the extension in IT shares upwards.

– The current trend is should be seen with an improvement in market breadth, as 70 percent of stocks are currently trading above their 50-day EMA, compared to last week’s figure of 64 percent.

– The bond yield cooloff is expected to give a boost to global equities.

– The benchmark Nifty index took a two-week pause and formed a higher high-low pattern, signaling a rejuvenation of upward momentum. This leads to a revision of the support base to 21,400 on Nifty.

– A 50 percent retracement of the mid-December to January rally (20,508-22,124) has been noted.

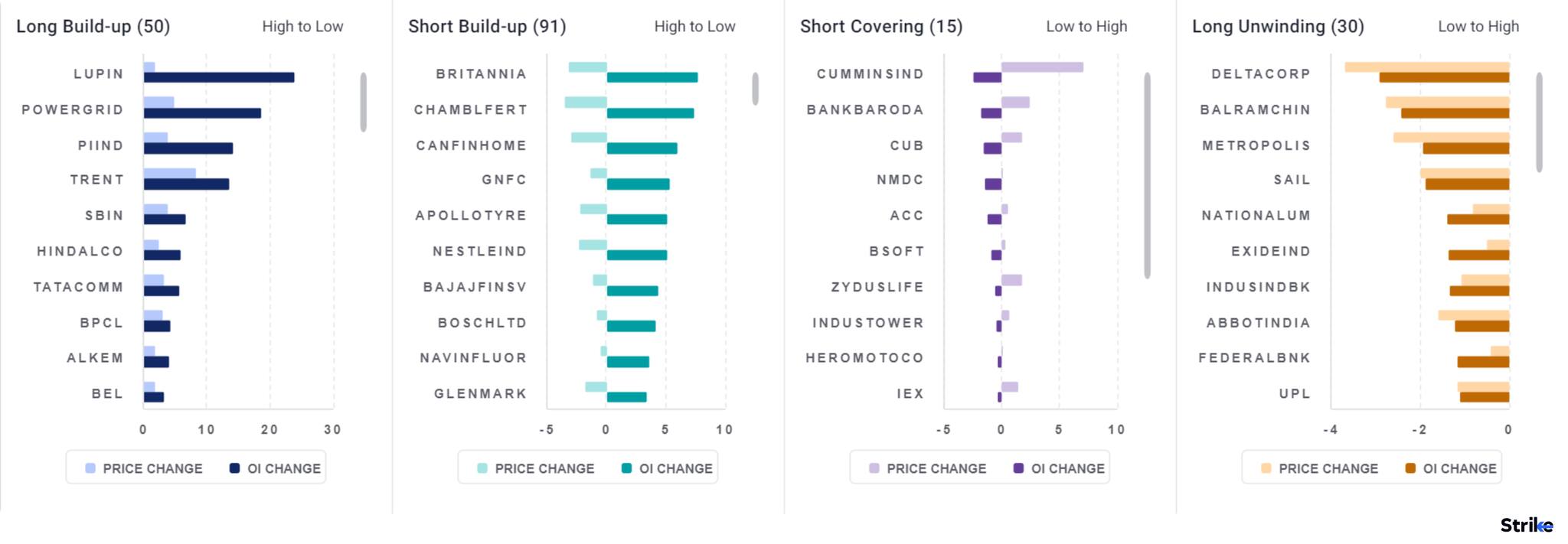

Among individual stocks, long build up is seen in Lupin, Power Grid, PI Industries and Trent. While short build up are observed in 91 stocks which includes Britannia, GNFC and Apollo Tyres.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.