F&O Manual| Indices trade marginally up; Nifty view negative to below 21,850

At 10:46 hrs IST, the Sensex was down 12.85 points or 0.02 percent at 71,415.58, and the Nifty was down 26.80 points or 0.12 percent at 21,691.20.

The equity benchmark indices were trading marginally up around noon after recovery from the lows of the morning.

India VIX, the fear gauge, was steadily inching towards 16 levels, indicating more volatility ahead. Among sectors, PSU bank, power, metal, auto, capital goods, oil & gas and realty were down 1-2 percent.

At 11:50 am, the Sensex was up 68.36 points or 0.10 percent at 71,497, and the Nifty was up 10 points or 0.05 percent at 21,728.

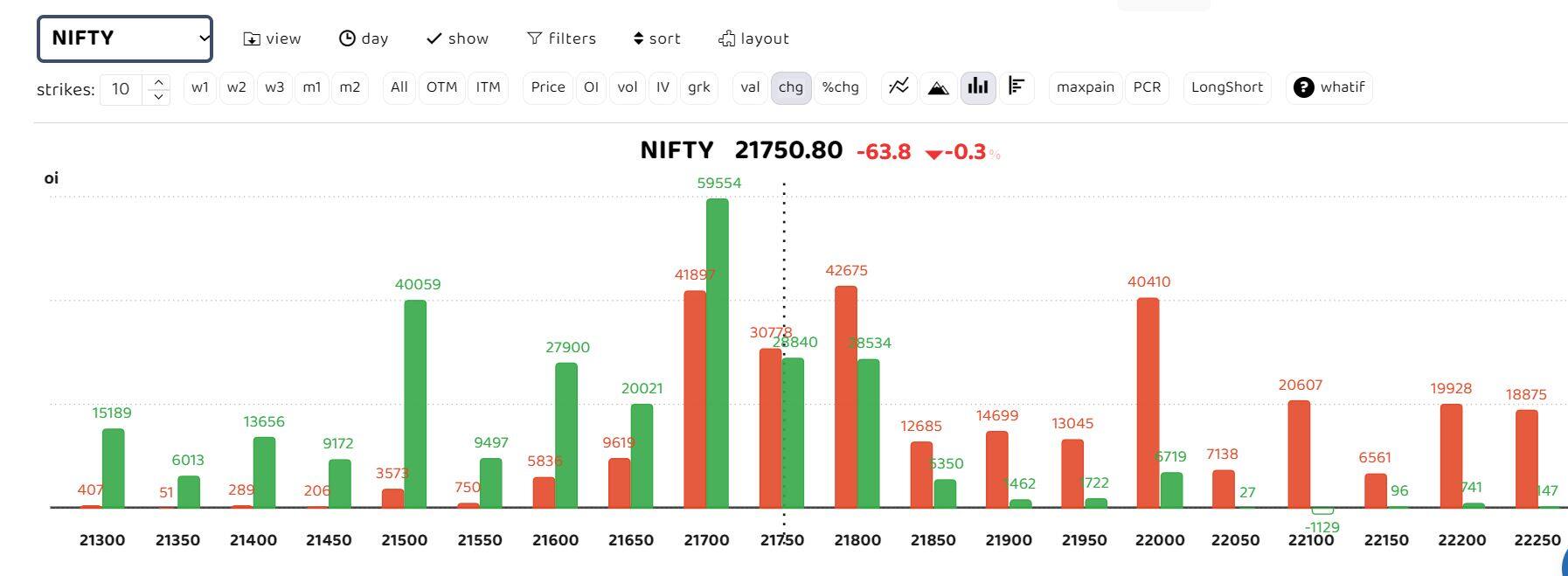

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data reveals that significant straddle positions have been established at 21,700, 217,50, and 21,800 strikes.

According to Akshay Bhagwat, Senior Vice President, Derivatives Research, “21000 put and 22000 call draw the highest OI. 21800 and 22000 strikes in calls, and 21000 in put, have seen significant OI additions, probably on the writing side.

“Volatility Index (VIX) is at 15.58, up 2 percent. The at the money 21,700 straddle pricing for the current week expiry suggests a price range of 21,300-22,100. The day trading view remains negative until below 21,850, with downsides/supports at 21,650-21,500.”

Story continues below Advertisement

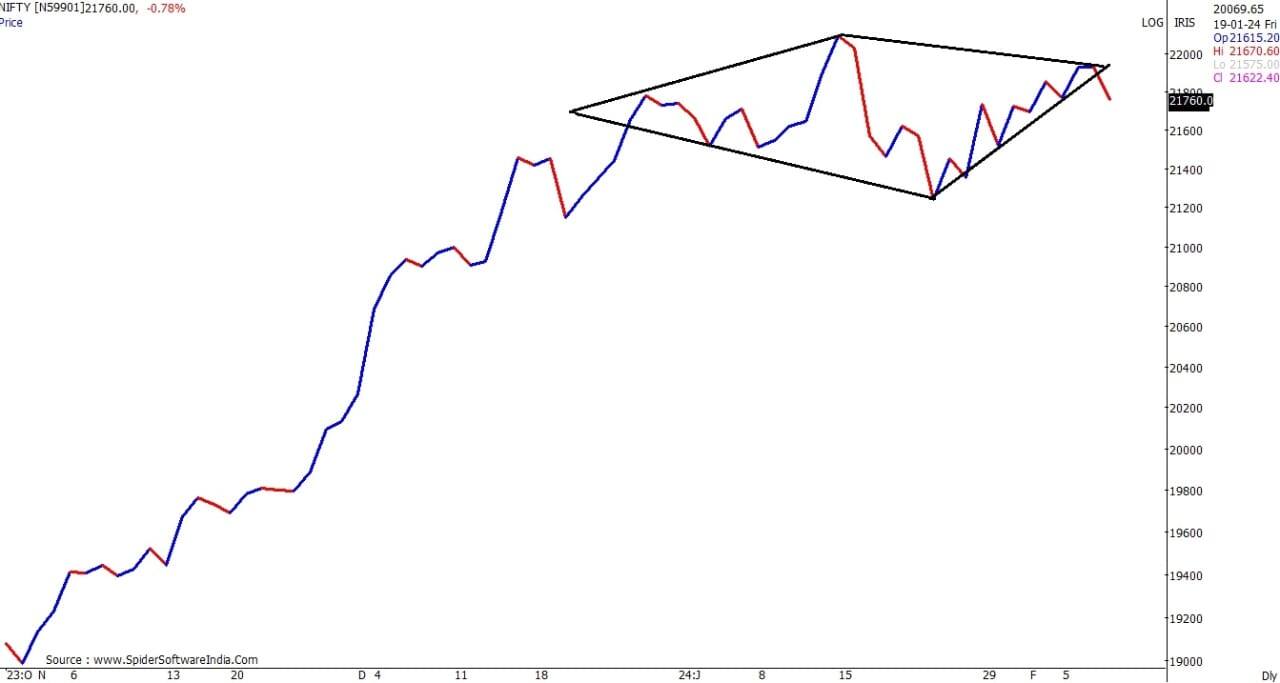

Technical chart of Nifty showing diamond pattern |Source: Emkay Global

Technical chart of Nifty showing diamond pattern |Source: Emkay Global

Nifty short-term structure

The index formed diamond pattern with breach on the lower side. It has key support at 21,670, said Kapil Shah, Senior technical analyst at Emkay Global. “Bulls will hold their fort above 21,670 level in short term. The index has resistance at 21,850 and 22,000. Moving below 21,670 can lead to further weakness up to 21,450 level, ” Shah said.

Volatility continues

Despite all major events such as the interim budget, the Fed meeting and the RBI Policy announcement out of the way, India VIX is steadily inching towards 16 levels.

“Key levels to watch out would be 14 and 17.50. Both these levels are critical considering them being important Fibonacci Retracement levels of the entire downmove from 33.97 (February 2022 highs) and 8 (May 2023 lows),” Sudeep Shah, head of derivative and technical research at SBI Securities, said.

Till the India VIX sustains above 14, it could inch higher towards 17.75-18 levels, indicating choppy trading moves for the next few sessions. Above 18 the uptrend could continue up to 21 levels, Shah said. From here on, there could be a steady rise in volatility with the general elections approaching closer. One should reduce leverage and regularly keep booking profits at higher levels. “Also, one should reduce exposure in midcaps and small caps where the results are not coming in line with the price moves,” he said.

Bank Nifty

Bank Nifty has resolved its short-term consolidation of the past three day to the downside, Angel One said. The index now looks ready to probe its recent swing low at 44430. “On its daily and hourly chart, the important 20-DEMA now trades convincingly below its 50-DEMA indicating that the momentum and the trend is now aligned to the downside. This may aid in the index probing its recent swing lows,” it said.

Bank Nifty, however, still remains within the larger confines of 46,500-44,400 range. Until it breaks out of this broader trading range, participants should avoid chasing momentum on either side. Instead, they should look to sell the index on rallies, the brokerage said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1469602094-b13b5453a78241329cfc05ad814504ab.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1359589698-6bf3bdcc04c541f98c8045046ecf4d8b.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1129638554-f4d4733322584390944654ebf621b2ca.jpg)